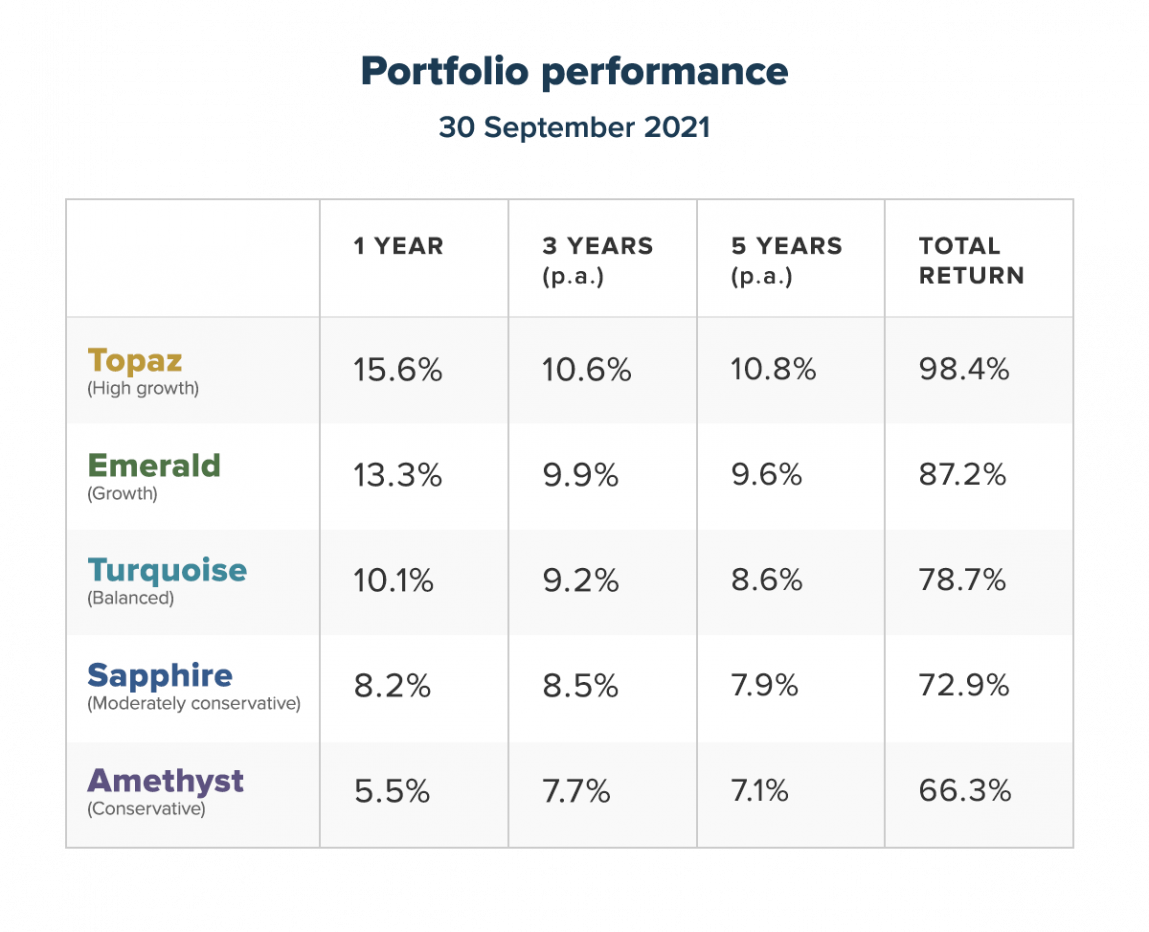

The Stockspot Model Portfolios returned between 5.5% to 15.6% after fees over the last year, while the Stockspot Sustainable Portfolios returned 5.9% to 14.5% after fees over the same period.

Over the five years to 30 September 2021, the Stockspot Model Portfolios have outperformed at least 99% of similar diversified funds, delivering returns of 7.1% to 10.8% p.a. after fees.

Source: Stockspot, Morningstar website comparison group of investment funds across growth, balanced and moderate multi-sector categories to 30 September 2021. Stockspot Amethyst, Turquoise and Topaz portfolios used for comparison.

Preparing for a market dip

Over the last quarter there have been concerns surrounding a Chinese property developer (Evergrande) potentially defaulting on their debts. There are also murmurs of rising inflation, and talks of higher interest rates while winding back central bank stimulus.

Whenever the share market has a dip, investors are peppered with negative news headlines and excuses to sell. You’d think that market falls are uncommon, when in fact they happen all the time.

| Market falls | Historical frequency |

| 5% | 4 times a year |

| 10% | Every 11 months |

| 15% | Every 2 years |

| 20% | Every 4 years |

| 30% | Every decade |

| 40% | Every few decades |

| 50% | 2-3 times per century |

So far in 2021, the Australian share market is down around 6% from its peak. Could it fall further? Absolutely. The average market dip within a year is 13%. However, people who try and pick the bottom of each dip generally do poorly because missing out on the bottom becomes a costly mistake when you have to buy back much higher. This is why it’s safer to simply stay invested through these inevitable dips rather than try and time your exit and entry back into investing.

How to reduce the impact of market falls

Holding defensive assets (such as gold and bonds) in your portfolio is one of the best ways to reduce the impact of share market dips and help you stay confidently invested. For example, the Stockspot portfolios helped protect clients from 50% to 80% of the market falls in March 2020. This is one reason we saw very few clients sell during that volatile period.

You also need to ensure you have the right defensive assets in your portfolio. During the global financial crisis (GFC), government bonds returned 14% while other so-called “defensive assets” such as property and infrastructure fell by over 70%.

During the COVID-19 market falls, government bonds and gold were also able to provide positive returns, while other income assets like high yield bonds, property and infrastructure all fell.

Indexes used: LBMA Gold Price AUD, Bloomberg AusBond Composite 0+ Year Index, JPMorgan EMBI Global Core Index (AUD Hedged), Bloomberg Global High Yield Index (AUD Hedged), Elstree Hybrid Index, S&P/ASX 200 A-REIT Index, S&P/ASX Infrastructure Index, S&P/ASX 300 Index.

Investments promising high incomes are generally not effective as defensive assets because their capital values fall with markets. This is why investing to target income is not an approach we recommend. A better strategy is to adopt a total return approach to investing where the focus is on the combination of capital returns and income.

Remain focused on the long term with emerging markets

Emerging markets haven’t kept up with broader market gains this quarter due to the Chinese government regulatory crackdown on some industries including technology and childcare. In this video we explain why emerging markets still belong in your portfolio.

Stockspot’s chosen emerging markets ETF is diversified across other countries that have performed well so far in 2021 including Taiwan (+24%) and India (+35%).

Final thoughts: Indexing outperforms

Our ninth annual Fat Cat Funds Report once again highlights that low-cost indexed super options outperform around 90% of super funds.

Investing into broadly diversified index ETFs and occasionally rebalancing continues to be the best way to beat most other investors.