Investments tend to give you a return in two ways.

First of all there is the capital return. This is the price of the investment rising over time. Capital return is difficult to predict and fast to change because prices are just a reflection of what people are prepared to pay at any point in time. Investing for capital gains is sometimes known as growth investing because the aim is for the price of your investment to grow from the initial price.

The other way of earning a return is through income from interest or dividends. Income tends to be more steady and reliable than capital returns or growth. For example, income from a term deposit is predictable, and income from shares can be based on company earnings, past dividends, and dividend payout policies.

How does income investing work?

Income investing involves building a portfolio with a specific income goal in mind. For example, if you’re retired and need to withdraw 4% of your portfolio next year you might look for an investment strategy that will deliver a 4% income return.

This strategy allows you to simply withdraw the necessary income and leave the rest of your portfolio untouched. Income investing is also popular with people growing their wealth since income can be re-invested to create larger future income.

Why is investing for income popular in Australia?

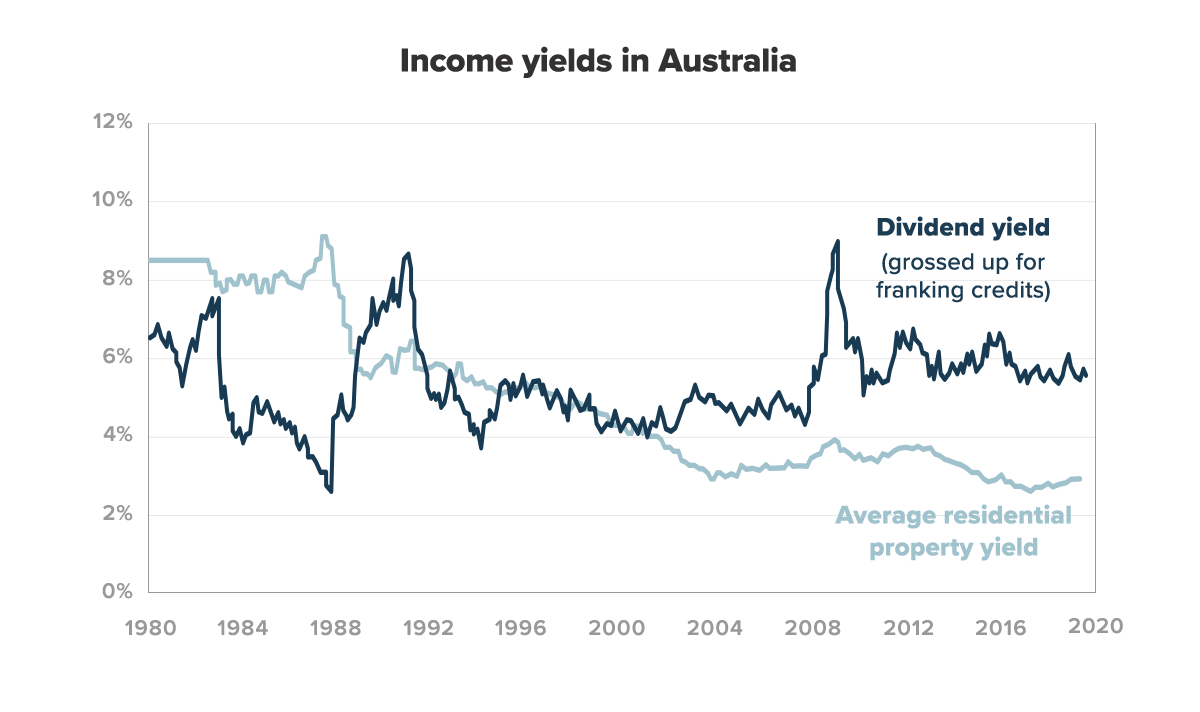

Australia has higher interest rates and dividend yields compared to the rest of the world, and this has historically meant that Australians have been lucky to have a range of different high-income investments to choose from.

Term deposits, bank shares, hybrids, and even property and infrastructure shares have been popular income investments. Additionally, the tax benefits of our franked dividend system in Australia also makes investing for income a viable option.

Why is income investing getting harder?

As interest rates have fallen in Australia, it’s become harder to target higher levels of portfolio income. Safe ways of generating income like term deposits now only pay 1% (compared to 3% a few years ago). This means you’re forced to put more money into higher-risk income investments in order to meet an income goal for your overall portfolio.

For example, in 2015, if you wanted to earn an income return of 4%, you could have put half your money in a term deposit paying 3% and have your money into the ASX 200 shares paying 5%.

In 2020, term deposits only pay 1%, and the ASX 200 has a dividend yield of 3%. If you put half of your money into each of these investments, you’d only earn an income return of 2%.

To meet an income goal of 4% you might be tempted to forget the stable, yet low returns of term deposits and instead invest in shares or alternative investments that have a dividend yield of at least 4%.

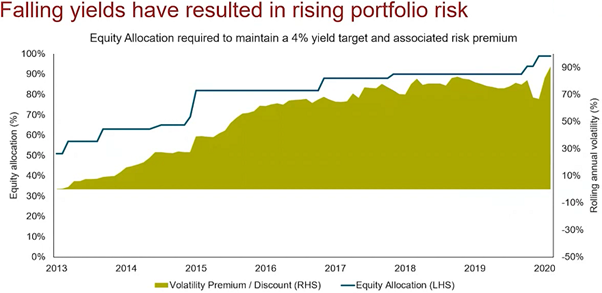

The chart below from Vanguard shows what percentage of your portfolio you needed to have in growth assets (like shares) compared to defensive assets (like cash and government bonds) to earn a 4% income return. In the example below, the percentage of growth assets increased from 50% to 100% since 2015.

What’s risky about just investing for income?

Following the example in the chart above, transitioning from a portfolio of 50% safe term deposits and 50% shares (2015) to a portfolio of 100% shares (2020) means you’d be taking double the risk in order to try and achieve the same income. The problem with this strategy is that shares and other ‘high income’ investments are a lot more volatile than defensive assets like cash, term deposits and government bonds, and that means your portfolio is much more likely to move up and down.

The other problem are the losses you’ll experience when markets fall.

The table below shows the losses you’d have suffered during the share market fall of 2020 if all of your money was in one of these ‘high-income’ investments.

| Asset | Annual income return | COVID-19 capital return (drawdown) |

| High Yield Bonds | 4.3% | -31.6% |

| Emerging Market Debt | 7.2% | -28.5% |

| Listed Property | 3.8% | -48.4% |

| Listed Infrastructure | 3.9% | -35.7% |

| High Yield Shares | 4.9% | -35.5% |

As you can see, a typical ‘high income’ investment won’t necessarily protect your money when share markets fall. During 2020, some income investors suffered capital losses of 30-50%.

An alternative approach: focus on total returns

For Stockspot clients who want to draw down income from their portfolio regularly, we don’t recommend an ‘income focused’ approach. Instead, we focus on a total return portfolio, and construct a personalised portfolio with the right balance of return and risk.

In other words, we suggest sacrificing some income to maintain the right level of risk in your portfolio rather than sacrificing risk to maintain the same level of income.

If you need a 4% income return to sustain your spending but your portfolio only generates 2% in dividends and interest, it’s possible to sell down 2% of your portfolio to make up the difference.

Since capital gains will be positive most years, this approach won’t harm your investment balance over the long-term. Most importantly, this is a much lower risk strategy compared to only investing in high income assets which are prone to capital losses and poor diversification.

What is a total return portfolio?

A total return portfolio takes into account both capital return (the price of the investment rising over time) and income returns.

While an typical income investment portfolio will mostly include growth investments, a total return portfolio matches your investment horizon with your capacity for risk by combining the following investments:

- Historically high-income investments with low capital returns (like Australian shares).

- Historically low-income assets with high capital returns (like Global shares).

- Low-income defensive assets that cushion your portfolio against share market falls (like gold).

A total return approach in practice

While Stockspot portfolios have generally earned less income compared to a portfolio that only has Australian shares, our portfolios successfully protected our clients against 50%-80% of share market falls in 2020.

This meant that the overall result (total returns) combining both income and capital returns was better than a portfolio that was only geared for income.

Learn more about the performance of Stockspot Portfolios.