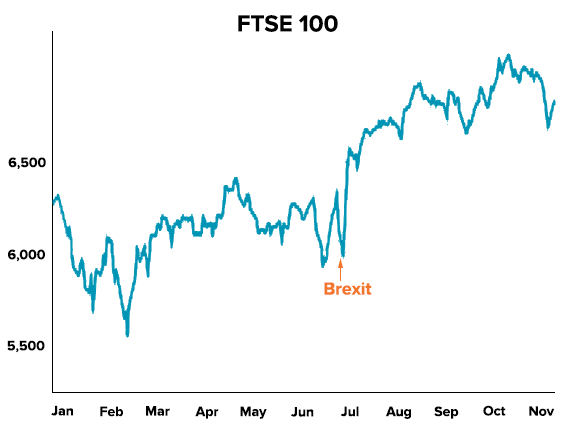

Does this feel like deja vu? After the market reaction to Brexit earlier this year, the US election result seems like we’ve been down this road before.

Unexpected political result causes wild market movements

Before you make any investment decisions based on politics, it’s worth considering what it actually means for your investments over the long-run. The answer, which may surprise you, it’s actually very little.

Market commentators and your emotions may lead you to believe the different policy positions (and personalities) of the candidates will lead to different market returns.

However, history repeatedly shows us markets will overreact in the short term and pay no attention after that. In fact, investment markets often move in the opposite direction to what you would expect due to currency movements or because everyone is already positioned one way.

Take Brexit as a perfect recent example. After the surprise Brexit result, which was considered by many ‘investment experts’ to be a disaster for the UK economy, British shares rose 25% over the next 3 months.

Very few commentators warned of that! People who sold on the result day have missed out on significant returns as exporting companies have risen sharply and never returned to their low prices on the day Brexit occurred.

Rather than react to the Brexit news by selling, we encouraged clients to sit tight and where possible, invest more.

Equally, despite the hype and any short term market reaction in the US, decades of historical data analysed by Vanguard shows that presidential elections typically don’t have any long-term effect on market performance.

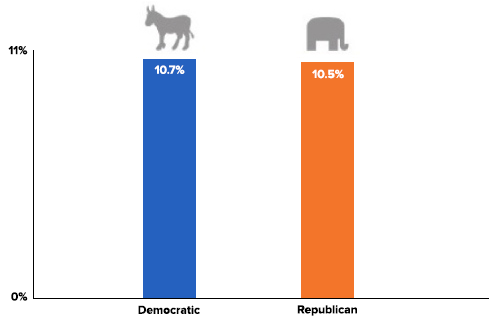

Markets do the same under Democrats and Republicans

Vanguard research going back to 1853 shows that share market returns in the US are virtually identical no matter which party controls the White House.

Source: Vanguard. Global Financial Data, 1853-1926; Morningstar and Ibbotson thereafter through 2015. Returns are nominal.

It’s worth noting that financial and political news that might be negative for one company or asset can equally be very positive for other companies or assets. In the short term, the market often gets this cause and effect drastically wrong so reacting to emotion or paying attention short-term market ‘noise’ really makes no sense.

What you can do

Rather than react to the latest political or market headlines, you should remain focussed on the few investment strategies that are within your control and proven to build long term wealth.

-

Set your investment goals, invest regularly and take a long term view. Nobody can predict short term movements and those who try are more likely to enter and exit markets at the wrong times because of behavioural biases.

-

Accept that nobody knows where markets will be tomorrow or next week. Don’t think you can outsmart the millions of analysts, stockbrokers and market traders trying to beat each other. When those people panic you can take advantage of market falls by dollar cost averaging. Stockspot’s automated rebalancing will help you buy low and sell high when investments move far from their target portfolio weights. As Bruce Lee would say: Be like water.

-

Ensure your portfolio is well diversified across asset classes and regions. We wrote an article about how gold helps your portfolio as well as the benefit of bonds. The benefits of these 2 assets is clear during periods of short term market volatility. Gold tends to move in the opposite direction of shares which helps reduce the risk of our portfolios when markets fall. Our portfolios include these 2 assets to help absorb volatile markets.

-

Keep investment costs as low as possible. Low cost ETFs give you access to long term market returns without paying high fees to active fund managers who, as a group, tend to do worse than the market after their costs and fees are paid!

Find out how Stockspot makes it easy to grow your wealth and invest in your future.