In this article we’ll review the Superhero trading product. We have previously reviewed other platforms such as Pearler, eToro, Stake and Sharesies. It’s important to understand exactly what each available trading platform or app does, so you can choose the best investment strategy for you.

- What is Superhero

- How does Superhero provide cheap trading?

- Is trading with Superhero risky?

- How does Superhero work?

- Superhero and Robinhood compared

- Superhero and Stake compared

- Superhero and SelfWealth compared

- Superhero and Stockspot compared

What is Superhero?

Superhero is an online stock broker that launched in Australia on September 7 2020. The platform now also offers a superannuation product. Superhero allows investors to trade Australian and US stocks and ETFs, while their superannuation product invests in ASX listed shares and ETFs.

Superhero offers trading starting at $2 per trade for Australian shares and free trades for ETFs (or 0.01% over $20,000) or US$2 (or 0.01% over $20,000) for US trades. This is compared to Commsec which offers trading for between $5 and $29.95, or SelfWealth that offers trades for $9.50.

The minimum investment required is AUD$10 if you want to invest into Australian shares and USD$10 if you want to invest into U.S. shares with Superhero (however there is a minimum transfer from AUD to USD of A$100).

Investors transferring from AUD into USD in your Superhero wallet will incur a FX transfer fee of 65 basis points (bps). This means US$0.0065 will be added to the rate. That means US$0.65 per A$100 transferred. There is a $100 minimum for currency transfers to or from Australian dollars and U.S. dollars.

Superhero offers Superhero Super with four account types – Diversified, Single Sector, Thematic and Direct.

With Superhero Super you can select one investment option or multiple, however if a member selects multiple investment options they must have a minimum of 25% of their balance allocated across diversified or single sector investment options.

How does Superhero provide cheap trading?

What’s the catch?

In the case of Superhero it all comes down to how your investments are held. With platforms like Commsec, Selfwealth, or an automated investing service like Stockspot, your investments are held legally and beneficially by you on your own Holder Identification Number (HIN) that is registered on CHESS (Clearing House Electronic Subregister System), the computer system of the ASX.

This might all sound like jargon, what it really means is that your money is safe regardless of what happens to the broker.

Superhero is different. The way they’re able to offer cheaper brokerage fees by trading under a single HIN, which means everyone’s investments are held together in an omnibus (combined) account, and then Superhero (or their custodian) keeps a track of who owns what rather than the ASX. This drastically reduces their trading and clearing costs with the stock exchange and they’re able to pass on some of this benefit through lower brokerage.

This is how Superhero describes it:

You consent to, and acknowledge and agree that any Financial Products held on your behalf by Superhero Nominees will be held in an omnibus account, meaning that your Financial Products will be co-mingled in a common pool with other financial products held by Superhero Nominees on behalf of other members in the manner prescribed in, and in accordance with, the Corporations Act, Corporations Regulations, and ASIC Regulatory Guide 133 (Omnibus Account).

Trading under a single HIN isn’t new, there are already other brokers in Australia who operate under this model.

Superhero also offers brokerage-free US stocks and ETFs, but investors still pay a foreign exchange fee to convert AUD to USD.

Is trading with Superhero risky?

Based on historical precedent, it can be riskier to own your investments in an omnibus account rather than on your own individual HIN. As an investor you need to weigh up the benefits of the lower brokerage fee with the risk of having your assets mixed up with others.

You need to trust Superhero (or their custodian) to correctly manage your trading account and allocate your investments.

When establishing Stockspot, we made a decision that direct ownership was a much safer way to go for our clients. Instead of having your account mixed up with others, all investments are held legally and beneficially in your own name on your own HIN.

This can cost a little more, but we believe provides a significant benefit, because investors aren’t exposed to counter-party risk. If something ever happened to Stockspot or one of the external suppliers we work with, it wouldn’t impact your investments because those investments are owned by you and you can simply take them with you.

We took a similar viewpoint with our Stockspot super product, instead of holding investments in a pooled structure, we opted for a more tax-efficient direct investment model.

Superhero super product offers both a pooled investment option, where funds are actively managed by Mercer, and can be combined with other members and a direct investment model (where members can allocate up to 75% of their super).

How does Superhero work?

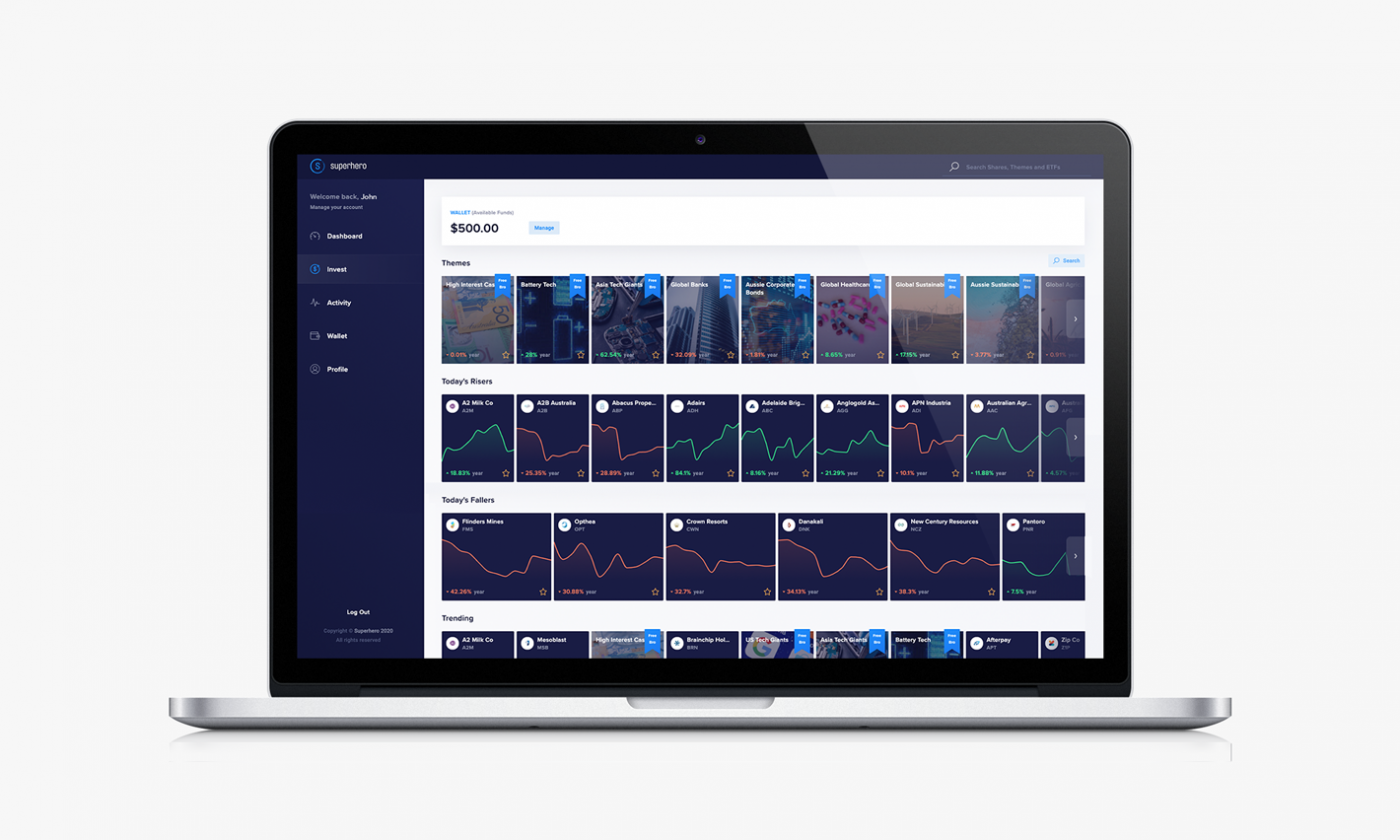

Superhero’s trading platform has an app and desktop version.

| You can fund your account (minimum $10) and can start investing, and you’ll need to choose your ASX listed shares, U.S shares or ETFs to invest in. You can search for stocks within the platform, and can check high level information (eg. opening/closing prices). |

Once you decide on the shares or ETFs you want, you can invest and then start tracking the performance of your investments.

With Superhero, you can only buy U.S. shares, Australian shares and Australian ETFs.

Superhero and Robinhood compared

Upon launch of Superhero, there was a lot of excited chatter comparing the platform to Robinhood. However, Robinhood only operates in the U.S; Australians can’t trade on the platform, despite the rise of day-trading in 2020.

Robinhood offers free brokerage and has enjoyed a meteoric rise. So much so, that other traditional brokers like Schwab, TD Ameritrade and E*TRADE have had to follow with their own zero brokerage offerings.

Robinhood earns revenue in other areas like interest on cash balances, margin loans and selling customer flow (trades) to hedge funds. This model has also been controversial given some of the potential conflicts of interest that arise between Robinhood and it’s customers.

Superhero and Stake compared

Superhero offers trading of Australian shares with brokerage fee starting at $5. Your investments are held on an omnibus account with others. They’ve also recently started offering brokerage-free US shares and ETFs, but you’ll be charged a foreign exchange fee of US$0.65 for every AUD$100 transferred.

Stake AUS charges A$3 per trade (or 0.01% for orders above A$30,000), while Wall Street trading is charged at US$3 per trade (or 0.01% for orders above A$30,000).

Stake Wall Street also charges a FX fee of 55 bps (0.55%) applied when you convert to or from USD.

Read our Stake review and Stake comparison to Stockspot.

Superhero and SelfWealth compared

Superhero offers trading of Australian shares with brokerage costing $2. Your investments are held on an omnibus account with others.

SelfWealth offers trading of Australian shares brokerage costs of AUD$9.50. They also offer trading of US Shares with brokerage fee of USD$9.50. Your investments are held directly in your name on your own individual HIN.

Read our Selfweath review and SelfWealth comparison to Stockspot.

Superhero and Stockspot compared

Superhero and Stockspot comparedThe main difference between Stockspot and Superhero is that Stockspot provides investment advice and an automated investing service. With Stockspot, your personal situation is reviewed, and then you receive a recommendation for the best-suited investment strategy based on your goals and how long you plan to be invested.

Once you settle on your investment strategy, you get a properly diversified portfolio (including Australian shares, global shares, emerging markets, bonds and gold). Stockspot reviews the investment on an ongoing basis and will rebalance your portfolio when necessary.

With Superhero you need to pick all of the investments yourself and review them yourself. If your aim is to regularly buy and sell investments to try and make short term profits, this might be your preferred strategy.

For some people, managing their own investments can be a rewarding hobby. But studies have shown that correct investment selection, the right portfolio allocation and automatic rebalancing can add over 2% p.a. in performance each year. Stockspot manages all of this for you so you can benefit from expertise and automation and you don’t need to worry.

You can see how the Stockspot portfolios have performed here.

For families looking for low-cost investing for kids, Stockspot allows kids to invest for free up to $10,000 (or until age 18), which helps returns compound without being eroded by fees. As you grow your primary account balance, this fee free limit also increases, Stockspots full fees and pricing tiers can be found here.

For investors, Stockspot offers low cost investing options with management starting at just $1 per month for portfolios under $20,000, making it an affordable alternative to brokerage platforms with the added service benefits of investing through an automated and advised platform.

On top of this, Stockspot is not just a brokerage or a pooled fund; it provides a fully managed investment portfolio, including automated diversification, rebalancing, and professional strategy, all held in your own name.

In short, while Superhero suits DIY investors who want to directly trade shares, Stockspot comes out cheaper for kids (with balances under $10,000)* and small portfolios (under $20,000) thanks to its respective fee free allowance and $1/month fee. For investors with balances $20,000 to $199,999 Stockspot charge 0.66% p.a., while balances $200,000 to $1,999,999 would be charged 0.528% and clients with a balance over $2,000,000 would incur an annual management fee of 0.396%.

This fee structure makes Stockspot a low cost investing option for Australians, while also including a full-service portfolio management solution.