Buy the dip (often shortened to BTD) is a phrase commonly used by both professional and retail investors.

Internet chat rooms and forums often discuss this topic when there has been a sharemarket fall.

Memes and jokes encourage investors to consider buying the dip when markets are down, based on a view that sharemarkets have always recovered from temporary falls.

In this article we discuss why markets have fallen recently and whether it’s a good time to become a dip buyer.

Why have sharemarkets fallen?

Global and emerging sharemarkets have had a rough start to 2022.

Global technology shares have fallen in anticipation of higher interest rates.

Many large technology companies like Netflix, Zoom and Robinhood are down 75% to 90% from their 2021 highs.

Emerging market shares have also dropped due to the ongoing Russia-Ukraine war and weaker Chinese growth.

Australian shares outperforming

It’s not all bad news though. Despite a 9% dip from recent highs, Australian shares, which are in all Stockspot portfolios, are up 1.8% in 2022. Globally, Australia has one of the better performing sharemarkets in 2022.

This is due to their high exposure to banks and resource shares, which benefit from higher inflation, interest rates and commodity prices. Gold is the other asset in the Stockspot portfolios that has risen so far in 2022, up 6.2% to the end of April.

Thanks to this allocation of Australian shares and gold, the Stockspot portfolios have achieved returns of up to +5.5% over 12 months to the end of April. These are lower returns compared to a year ago. However, comparatively, many growth focused global share funds are down 25% or more over that same period.

| Global fund name | 1 Year return to 30 April 2022 |

| Nikko AM ARK Global Disruptive Innovation Fund | -55.8% |

| Perpetual Global Innovation Share Fund | -35.8% |

| Baillie Gifford Long Term Global Growth Fund – Class A | -32.5% |

| Premium China Fund | -30.5% |

| Baillie Gifford Global Stewardship Fund – Class A | -29.4% |

| Ophir Global High Conviction Fund | -29.0% |

| Platinum International Healthcare Fund | -27.6% |

| Forager International Shares Fund | -26.9% |

| Mirae Asset Asia Great Consumer Equity Fund – Class A | -25.1% |

| Lakehouse Global Growth Fund | -24.5% |

Why Stockspot has a high allocation to indexed Australian shares

Our portfolios have a large allocation to indexed Australian shares compared to their size in the world. Stockspot portfolios hold between 18.6% to 47.3% in Australian shares via the Vanguard Australian Shares Index ETF.

The main reason for this is maximise returns for clients, relative to the amount of risk taken. Australian shares don’t have the additional currency risk of investing in global shares.

They also have the tax benefit of franking credits which can add between 0.5% to 1.0% in additional returns each year.

Should you buy the dip?

Markets often rise or fall further than you would expect over the short-term. Stockspot doesn’t try to guess the absolute best time to buy. Instead we generally recommend that clients dollar cost average over time.

We’ve recently been asked by a lot of clients who have cash parked on the sidelines whether it’s time to ‘buy the dip’.

Here are two reasons why theVanguard Australian Shares Index ETF (VAS), which is held in all Stockspot portfolios, may continue to perform well in 2022 despite interest rate worries, the European conflict and falls in global technology shares.

- Australian shares are fairly valued compared to history

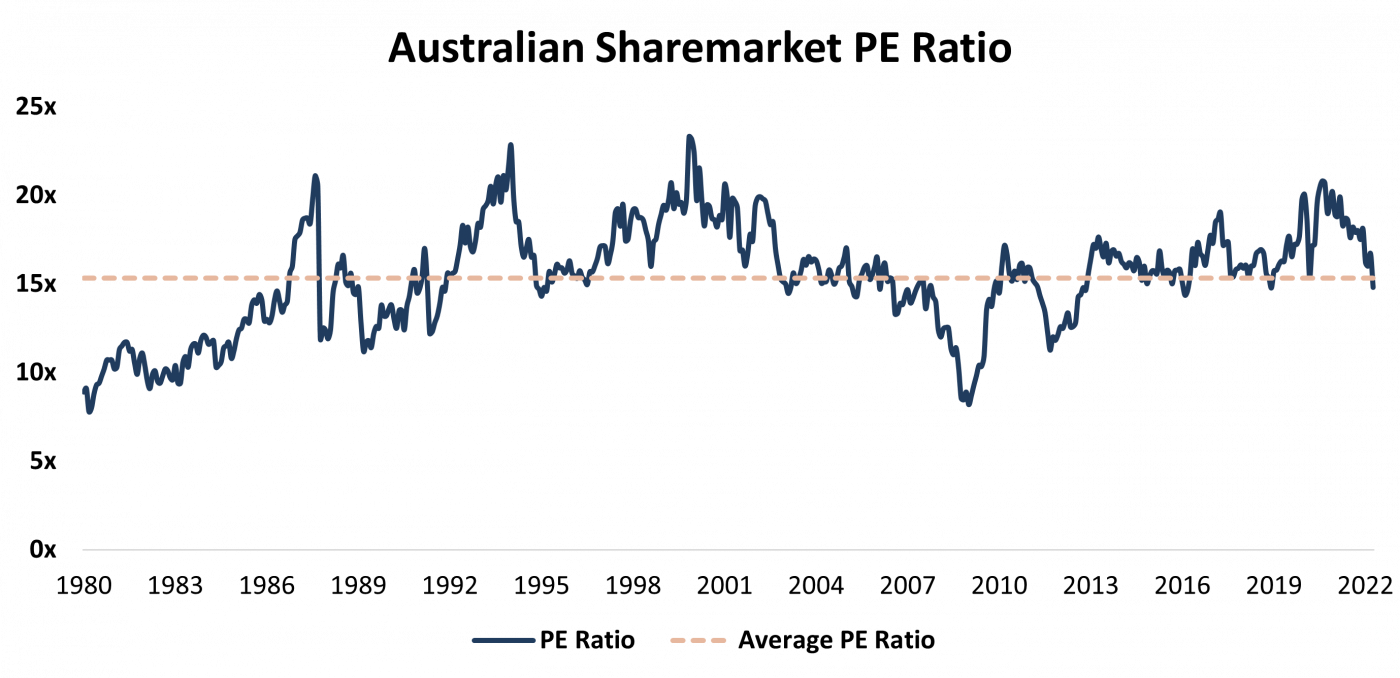

Compared to history, the Australian sharemarket looks quite ‘normally’ priced at the moment based on its ‘earnings multiple’. The market price/earnings multiple (also known as its P/E ratio) measures the market index divided by market earnings. It’s a quick and easy way to see how much people are prepared to pay for earnings.

A higher P/E means people are willing to pay more for earnings. That could be because they’re confident in those earnings growing or simply because other alternative investments (like cash or term deposits) don’t offer much of a return.

The Australian market, measured by the S&P ASX/300 is currently near its long term historical average of 14.8x earnings. By comparison at the peak of the tech boom in 2000 shares were trading as high as 23x earnings. That would translate into a sharemarket that’s 50% higher than today! By this measure, Australian shares have room to grow especially if they are considered defensive compared to other markets like the U.S. which are dominated with high P/E tech companies.

2. Australian shares are fairly valued compared to other assets

Compared to the income returns of other investments available to Australian investors, Australian shares still look fairly attractive.

- Despite rising interest rate expectations, cash, term deposits and Australian government bonds still only give you a return of 0.5%-2.5% p.a.

- Residential property rental yields in major Australian cities aren’t much better at 2.7% p.a. according to SQM Research.

- Most global sharemarkets are only paying 1-2% in dividend income.

The Australian sharemarket has an attractive dividend yield of 4% which increases to close to 5% with franking credits.

In fact, the extra dividend return received from investing in Australian indexed shares compared to the RBA interest rate hasn’t looked better for the last 20 years.

This might be another reason Australian shares have outperformed global markets in 2022.

Is it a good time to buy the dip for long-term investors?

For those looking to invest for the long run we advise to avoid the social media gossip and meme chatter. Speculation and daytrading is not something we recommend at Stockspot.

The current sell-off in markets offers an opportunity to invest at reasonable prices. Shares and bonds may continue to be volatile. However, provided your investing horizon is at least a few years, buying the dip and using diversified low-cost ETFs is a sensible strategy to build wealth.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.