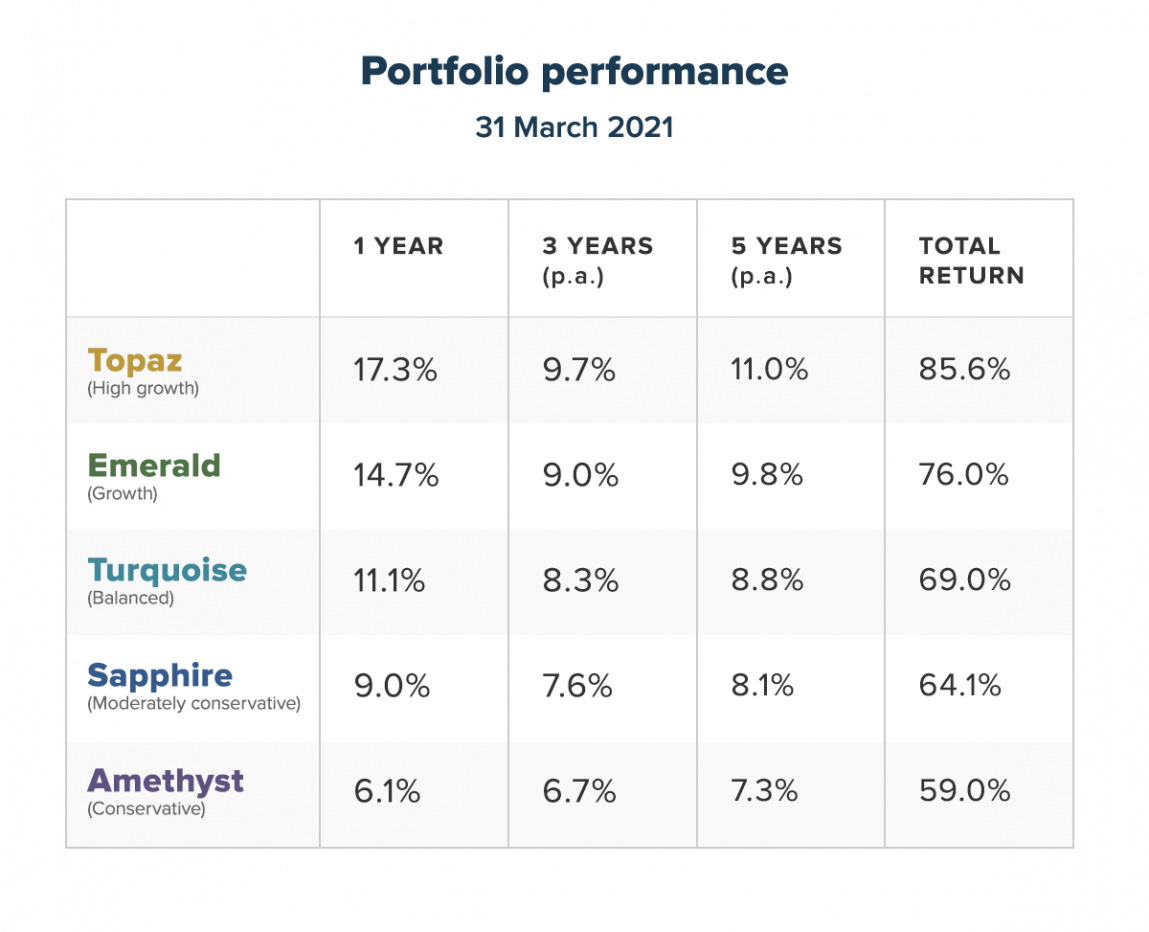

Twelve months since the start of the COVID-19 pandemic, markets have staged a strong recovery. Stockspot Portfolios returned 6.1% to 17.3% after fees over the 12 months to 31 March 2021, and 5 year returns of between 7.3% p.a. and 11% p.a. after fees.

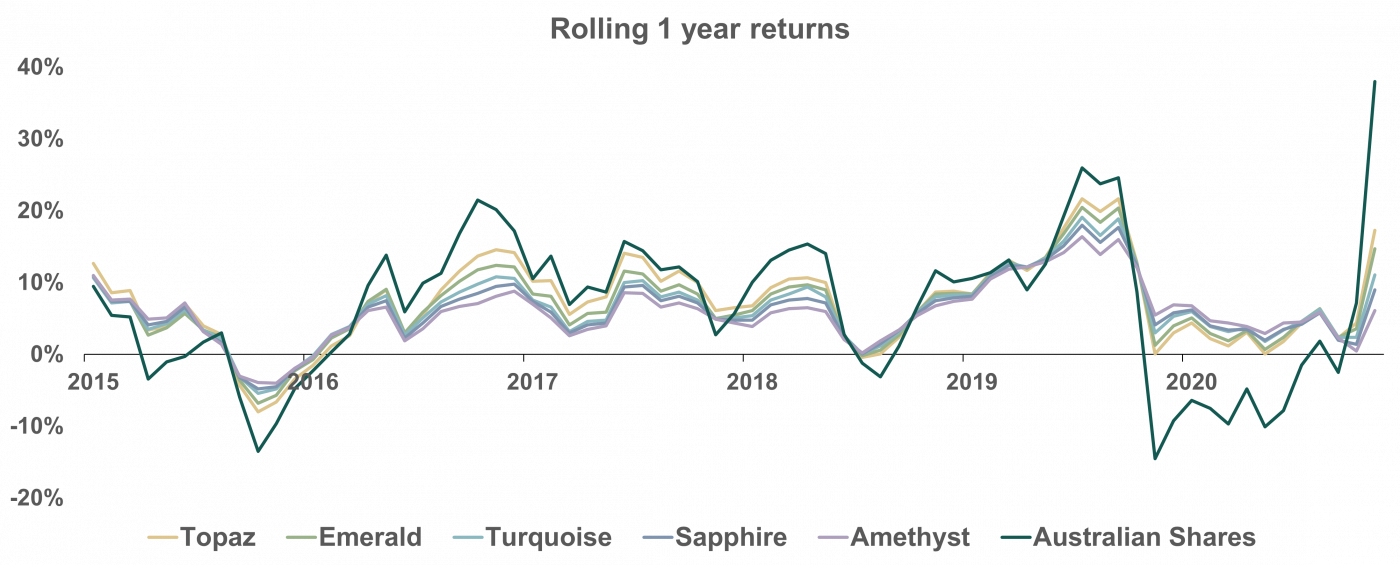

Despite the share market correction, all of the Stockspot Portfolios continued to have positive 12 month returns each month in 2020.

The past year was a good reminder that diversifying into defensive asset classes like government bonds and gold can help to reduce the impact of share market falls and help with positive returns.

The Stockspot Portfolios are an example of this strategy and our properly diversified portfolios have enjoyed positive 12 month returns 92% of the time since inception. This compares to Australian shares which have only had positive returns for 72% during the same period.

Our portfolios have also outperformed 98-100% of similar funds over the long term.

1Source: Stockspot, Morningstar website comparison group of investment funds across growth, balanced and moderate multi-sector categories to 31 March 2021. Stockspot Amethyst, Turquoise and Topaz portfolios used for comparison.

Successful investors stay invested

In 2020, the biggest fear for investors was COVID-19 and its impact on the global economy. Recently, investors have shifted their concern to the potential inflationary impact of government stimulus packages.

If the last year in markets has taught nothing else, it’s that successful investing is usually due to ignoring market commentators and simply staying invested. Markets are quick to factor in bad news, so by the time you move to cash, it’s almost always too late.

History shows that remaining invested and using market volatility as an opportunity to rebalance is a far superior strategy for building long term wealth.

After fear comes greed

Over the last few months there has been a rise in market hype and speculation. Daytrading app Robinhood was the most downloaded app in the U.S, and investments like Bitcoin, NFTs, and GameStop have seen large returns and attracted the interest of traders.

In every market boom, the siren song of speculative trading opportunities is hard to resist. As prices rise rapidly, it can seem like everyone else is making more money than you. I remember this feeling when I was cutting my teeth in markets in 1999 – just before the tech crash of 2000.

Having a small part of your portfolio reserved for more risky bets is common, but my advice would be to resist the urge to increase the size of your speculative positions as markets build towards a crescendo.

Any investment opportunity that offers the potential for higher returns always comes with higher risk – even if that risk isn’t obvious yet. Taking too much risk during a boom will usually end up reversing years of hard work.

While others are riding the daytrading rollercoaster in 2021, focus on sticking to your investing plan: have a disciplined approach to asset allocation based on your risk profile, keep costs (like brokerage) low, and automate your investment decisions to remove emotion.

This approach will allow you to avoid the pitfalls of market fear and greed.