Humans crave certainty and answers. If we’re curious about the weather, we check an app on our phone. When we feel unwell, we want our doctor to diagnose the problem and prescribe a remedy. Investors are in the same boat, seeking guidance on what to buy/sell and when.

The problem is, when we don’t receive a conclusive response to a question in areas outside our circle of competence, we often feel angst or agitation.

The coronavirus pandemic highlighted this angst. When share markets fell by 35% there was mixed behaviour amongst investors when there were too many unknown questions about the virus. Some investors panicked and sold everything. Others did nothing or rebalanced their portfolios, and accepted that there was absolutely no way to know what we don’t know.

The latter behaviour is known as intellectual humility, and it’s about being consciously aware of our cognitive limitations, and being able to admit that some of our beliefs or opinions may be incorrect.

“Real knowledge is to know the extent of one’s ignorance.”

Confucius

Knowing what you don’t know

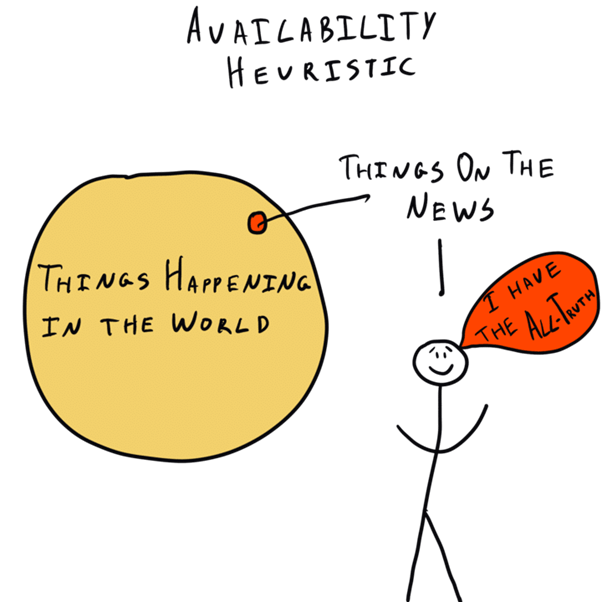

People take the information they have and make the best story they can. Most investors fail to consider the information they don’t have, don’t know or haven’t come across yet. Often there are known unknowns and unknown unknowns. Investors often become too confident in their own beliefs based on the limited information they have. This leads to big investment mistakes when they act on their limited information to buy or sell, thinking that they’re smarter than the market. It’s a bias known as the availability heuristic.

Investors also like to believe simple cause-and-effect explanations rather than accepting that many market moves are complex or caused by information they simply don’t have.

The imperfections of market commentary

It can be tough for investors (experienced or otherwise) to adopt intellectual humility given the strong desire to have an “outlook” for what’s to come. The satisfaction we get from opinions that comfort our angst can sometimes lead to confirmation bias. It is much easier to accept this than the effort needed to critically analyse a situation. However, most of the time market forecasts are complete guess work. This is especially true when there are too many unknowns.

Some market commentators exude confidence, regardless of their actual knowledge. This is known as the paradox of expertise. Market commentators have started posing as world class epidemiologists, trying to predict the shape of the economic recovery using a soup of alphabet letters – V, U, W, L. Some are even using global brand logos such as the ‘Nike Swoosh’ to describe the recovery pattern.

We don’t like accepting that the future is uncertain and unpredictable, as we yearn for an informative answer. So how can we tune out the noise and prepare for the unknown?

Ignore market forecasting and embrace uncertainty

Instead of trying to predict the shape of the recovery, investors would be much better off acknowledging the gaps in their knowledge. The fact remains that there’s simply no playbook telling us how things will unfold. Instead of predicting which shape the recovery will take, prepare for all types of shapes.

Admitting that you don’t know what the future holds allows you to set yourself up for it.

Rather than asking ‘how can I make the most money?’, it’s often better to ask “how can I ensure my portfolio is resilient so that it can weather storms and crashes?”

Prepare for the worst through diversifying your portfolio

The key to ensuring portfolio resilience is proper diversification. It’s this, rather than wild predictions, that will help provide returns in all market environments. Having a diversified portfolio that contains a mix of asset classes can act as blind spot enablers. For example, growth assets (such as shares) will shine if there is a sharp and sudden recovery, while defensive exposures (such as bonds and gold) will help cushion portfolios if the downturn is deep and prolonged.

People fear volatility, but by admitting what they don’t know, well-prepared and disciplined investors can surf the waves – instead of going under. After all, volatility is par for the course when it comes to investing.

2020 is looking similar to the 2008 global financial crisis (GFC) in terms of the level of share market price movements, but some have forgotten about this event from 12 years ago. When faced with volatility, regardless of if it was caused by an economic or medical event, our mind takes shortcuts and recalls what happened most recently (known as recency bias).

During the GFC, it was also tempting to react based on market fluctuations or panicky headlines. Many investors moved to cash at just the wrong time. After 2008, the share market ended up going through one of longest bull markets in history. Patient investors who accepted the uncertainty of the market and held on to their assets were rewarded while those who had moved to cash lost out.

The behaviour of patient investors during the GFC is a classic example of intellectual humility. Those who accepted there was no way to know what would come next ended up winning. Those who tried to predict further crashes made costly mistakes.

Preparation, not prediction, is the key to success

Many believe there is a disconnect between share markets and economic reality. How can the U.S. share market be at an all-time high when the country recorded their worst economic result in modern history? When COVID-19 hit earlier this year, echoes of the Great Depression in the 1930’s frightened investors, but many underestimated the power of government response.

Ultimately, investing is the intersection of economics and psychology. Share markets are forward looking, based on expectations, and react when there are surprises. It’s a counter-intuitive outcome as share markets essentially ‘price in’ the future.

Current investor sentiment believes that economies will reopen, unemployment will fall, and normality will return. It’s all perception – and it could all change tomorrow. We can’t say with a high degree of certainty that there will be a COVID-19 cure this year or next year, nor do we know where share markets will head.

If we exercise intellectual humility, we can then recognise our own limits by admitting what we don’t know, which allows us to prepare instead of predicting.

Sure if you have some informational ‘edge’, you can have a swing as many day traders do. However, the only way to do better as an investor is to know what you don’t know.

“Knowing what you don’t know is much more useful in life and business than being brilliant.”

Charlie Munger

If we prepare ourselves properly, then we set ourselves up for success. After all, isn’t ‘luck’ simply a happy meeting of preparation and opportunity?