Work-out more and the fitter you become. Study harder and you can get better grades. People apply the same logic to investing. If you watch and listen to as much market news as possible you can get ahead of everyone else.

There is no shortage of share market newsletters, tipsters and TV commentators to help give you an ‘edge’ over the millions of other investors out there.

Since 1995 all the people reading, researching, charting, analysing, scouring the market for opportunities and actively trading have lost out to those investors who have done absolutely nothing. In fact those so called ‘lazy investors’ made triple the returns of their active counterparts.

You’re feeling a bit sceptical now right?

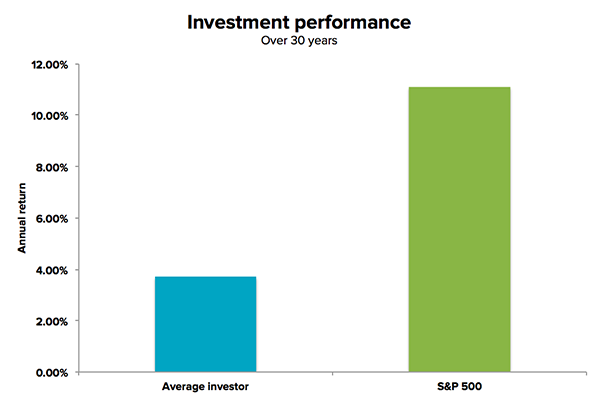

Over the past 30 years, the average share market investor in the US earned a return of just 3.7% per year compared to an annual return of 11.1% for the market.1

In other words, people who read, research and keep up with markets give away most of their returns in costs and bad decisions. The ‘lazy’ investors who bought the market and forgot they even invested tripled the returns of everyone else.

Investing is one of the few areas of life where the less you do, the better the results.

Why is it so difficult for most people to be lazy?

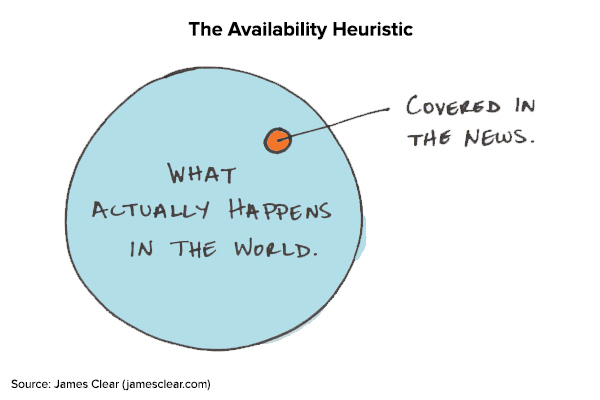

We’ve written before on why you won’t beat the market (but many still try), but here we’ll focus on one reason people can’t resist the temptation to trade – people make too many investment decisions that are influenced by the limited information they have.

To borrow from the great psychologist on behavioural economics Daniel Kahneman: “What we see is all there is.” (WWSIATI)

What does this mean?

People take the information they have and make the best story they can. Most investors fail to consider the information they don’t have, don’t know or haven’t come across yet. Investors become too confident in their own beliefs based on the limited information they have. This leads to big investment mistakes when they act on their limited information to buy or sell, thinking that they’re smarter than the market.

Investors also like to believe simple cause-and-effect explanations rather than accepting that many market moves are complex or caused by information they simply don’t have.

For example, if there is a high GDP number out and the Australian market rises 1% at the start of that day, this is likely to lead to a new headline to the effect of ‘Market rises on confidence Australian economy is strong’. If later that same day the market has now fallen 1%, the new headline is likely to read ‘Market falls on fears economy is overheating’.

Clearly the same explanation can’t explain both why the market rose and fell. The writers are experiencing the WWSIATI effect. They’re retro-fitting something that already happened (the market move) with an important event they know happened on the day (GDP data).

This happens all the time and we don’t think twice about it. How often do you hear the business expert’s explanation of what caused a stock or market to go up or down and assume they know what happened? Do you ask yourself if that explanation is the whole picture or just a tiny piece in a giant puzzle?

A GDP announcement could certainly have some impact on the market on any given day but so could hundreds of other factors like the Australian dollar, bond markets, buyers, shorters and sellers.

Was it really the data that caused the market move or a combination of many of these factors? Or perhaps the reason the market moved was completely unrelated? The reality is that nobody really knows.

We don’t know what we don’t know

It’s tough to admit to ourselves that we don’t know why something happened because we have limited information. It’s also tough to admit that markets are complex with many moving parts. That’s why there’s an irresistible temptation to link market moves to salient events even though the relationship may be weak or not exist at all.

Markets are a lot more complex than cause-and-effect but people love simple stories. The danger is that simple stories give investors the false impression that they know more than they do – it leads investors to act (incorrectly) on that information. Most buying and selling is by people who think they know much more than they do.

This is why ‘active’ investors end up with 3.7% per year and ‘lazy’ investors earn 11.1%.

Next time you’re tempted to make an active investment decision like timing the market, first ask yourself ‘What information am I missing’? Chances are the story you have is only a tiny piece of the overall puzzle.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

1DALBAR’s 22nd Annual Quantitative Analysis of Investor Behavior