It would be great if everyone started saving money early to take advantage of compound returns but it’s easy to see how people fall behind.

The typical financial lifecycle involves saving up for a house deposit, having children, and all of the expenses that come along with raising a family. Meanwhile for many people in their 50s and 60s, compulsory superannuation didn’t kick in until much later in life…

Plenty of parents reach the empty nest phase of their life once the kids are out of the house and slowly realise they are completely unready for retirement.

The average superannuation balance for someone who is 50-54 in Australia is $142,644. That falls a long way short of the amount needed to generate a comfortable income in retirement.

How much is enough for retirement?

Industry veteran Jeremy Cooper estimates that a couple requires at least $1 million in pre-retirement super to even generate the equivalent of an age pension of $33,717 per year.1 A comfortable retirement in today’s low interest rate environment could therefore require $2 million or more depending on how you plan to live.

Compare that to the average super balance for a household aged 60 to 64 today which is $355,000.2 That will barely get you $230 a week to spend which is well short of what many people need.

Some Australians have been fortunate to build up equity in their own home when they can draw down on retirement if needed, however many have missed the housing boom or not been as lucky.

If you want to live a similar lifestyle in retirement without relying on the age pension, the bad news is you’re going to have to save a lot in a short space of time!

The good news?

Even if your super balance is well below $1 million to $2 million you still have time to do it. Here’s what’s working in your favour:

-

If you had kids, they should have moved out of the house and be putting less pressure on your finances (although our Future Affordability Report shows many kids are staying home later). Generally speaking this means you should be able to move the majority of the money you were spending on them into retirement savings.

-

Your earnings are high relative to when you were younger.

-

There are catch-up concessional superannuation provisions you can take advantage of. People with super balances of less than $500,000 will be able to access their unused contributions cap space to make extra contributions to their super.

-

It’s easier than you think to save up a decent amount of money in 10 to 15 years.

Little by little

Turning saving into a regular habit is the biggest barrier for most people in their 50s and 60s to reach a comfortable retirement. However the urgency that you get from being closer to retirement age can provide a big nudge!

Let’s take a look at an example. Say you’re a couple earning $100,000 a year and have nothing saved for retirement at age 50. Not the perfect situation but all is not lost if you’re able to ratchet up your savings.

If you’re able to save 15% to 35% of your income and see a 3% rise in salary every year (based on long-term average) here’s how your ending balances would look after 10 years of saving:

| Savings after 10 Years | |||

| Savings rate | 4% returns |

6% returns |

7% returns |

| 15% | $204,491 | $223,465 | $244,502 |

| 25% | $340,819 | $372,442 | $407,504 |

| 35% | $477,147 | $521,419 | $570,506 |

Here’s what things look like if you work a little longer and build up your savings for 15 years:

| Savings after 15 Years | |||

| Savings rate | 4% returns |

6% returns |

7% returns |

| 15% | $364,464 | $419,295 | $484,260 |

| 25% | $607,440 | $698,825 | $807,100 |

| 35% | $850,416 | $978,355 | $1,129,941 |

Did you expect to be able to save so much in so little time?

A few things may surprise you from this example.

How much you’re able to save will have a much larger impact on your savings than your investment returns. Doubling your investment returns resulted in a much smaller boost to your savings than a doubling of your savings rate. For example, 8% returns at a 15% savings rate will give you a smaller balance after 10 years ($244,502) than 4% returns at a 25% savings rate ($340,819).

Trying to achieve higher returns by taking more risk not only is unnecessary for older people, but it’s also dangerous. When you’re over 50, negative market events can have a lot more impact on your final balance because of when you need the money. This is known as sequencing risk.

For instance if you’re entirely invested in bank shares and Telstra and their share prices fall, you have fewer years for your portfolio to recover. For this reason we encourage our older clients to invest in more conservative investment strategies and focus their attention on getting the right asset mix, keeping their investment fees low and having the discipline to save consistently.

Your savings power may even surprise you

Saving more money is something you have control over, unlike market returns. This is where you should focus your attention, especially since you don’t have decades for compounding returns to work their magic.

Delaying your retirement also has a large impact in a number of different ways. First, it gives you more time for your super balance to grow. What may be less obvious is that it also helps by deferring spending down your super.

If you spend the typical 5% of your super each year in retirement, holding off on retirement not only adds value to your superannuation balance but reduces the impact of that 5% drawdown each year.

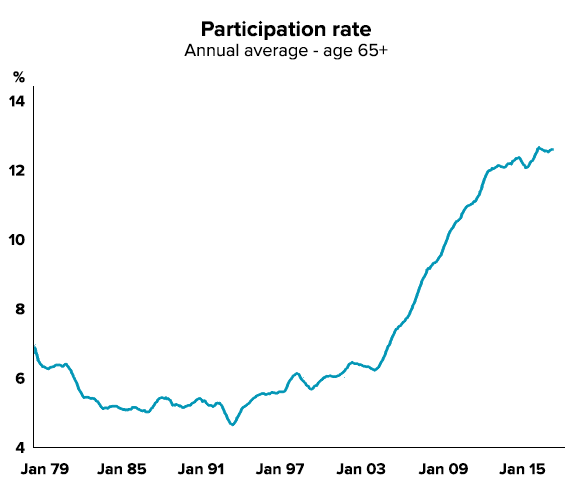

This might be why ABS data shows that Australians are staying in the workforce longer to make up for lost time and give themselves more to spend in retirement. The percentage of 65+ year olds in the workforce today has more than doubled since 2003.

Source: ABS, CommSec

Getting a late start on retirement savings can be a scary prospect, but it’s a position many baby boomers find themselves in today. Some simple solutions include:

-

Sort out your household budget and ideally help the kids become self sufficient

-

Take advantage of superannuation catch-up provisions and find a good accountant

-

Get the investment basics right: broad diversification, low fees and ignore short term market news

-

Increase your savings rate (which you can control) instead of your investment performance (which is out of your hands)

-

Stay in the workforce a few years longer

Focusing on these small changes you can make will give you a better chance of having the retirement lifestyle you want.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

1 http://www.smh.com.au/business/the-economy/superannuation-alert-1-million-isnt-enough-to-retire-in-comfort-20150419-1modsc.html

2 https://www.superannuation.asn.au/ArticleDocuments/359/ASFA_Super-account-balances_Dec2015.pdf.aspx