Financial freedom is the most important factor in our ability to achieve our lifestyle goals and lead our life the way we should reasonably expect to. Yet, this is no longer guaranteed for future generations.

According to the 2016 HILDA Report, future generations of young people in Australia are, for the first time, set to be worse off than their parents.

To help understand parents’ views on their children’s financial future, Stockspot has partnered with Galaxy Research to produce the Future Affordability Report. We looked into parents’ concerns about young people’s finances, the cost of housing and living, and what do they think the fallout will be in later life for their children and themselves.

Bank of Mum and Dad set to shut up shop

What we found is families from across Australia of all ages and incomes are deeply concerned about the future financial freedom of their children.

The vast majority of parents (81%) said they’re unwilling or would be too financially strained to support their children financially into their adult life. Very few parents (17%) committed to help their children financially in the future. Suggesting future generations will not be able to rely on the so called “Bank of Mum and Dad”.

Sadly families who most want to help their children have the least ability to do so. Unemployed parents are twice as likely to want to provide financial help but half as likely to be able to do so. Whereas families with incomes over $100,000 are two and a half times more likely to be able to offer financial assistance, but are less willing.

Housing affordability is a big concern

We found that 9 in 10 parents are worried about housing affordability and how it will affect the financial future of their children. The majority of parents (74%) fear the prospect of children living at home well into adulthood and being lumped with a “generation never leave home”.

Despite widespread opposition towards supporting their kids in later life, most families (71%) have $30,000 or less available to lend for a deposit on a first home. With median house prices in Australia well over $580,000, young people will be saving for a long time to scrape together a mortgage deposit.

One of the most worrying statistics to emerge is that one in 5 parents admit they could not lend a cent to their children to help with the first home.

What does this mean for parents?

The results paint a picture of a nation of parents who are not immune to the daily headlines around housing affordability, increasing cost of living alongside macro- economic issues.

Parents want to enjoy their own lives when their children reach adulthood. They fear their children will rely on them well into adulthood and that it will impact their life.

Interestingly, parents are even concerned about how affordability may impact their grandchildren. The majority expressed worry their children won’t be able to provide decent opportunities to their own offspring.

Investing early and starting today

Saving early and taking advantage of compound returns is one action parents can take to help give their child a good financial head-start.

A majority of parents we surveyed would put money in a bank account if they were to start a savings strategy, but far fewer would set up higher growth investment portfolio for their kids.

Parents and their children are missing out on the benefits of higher long term compound returns that an investment account can offer. History shows that investing in a low-fee, diversified investment portfolio that you can set-and-forget over 20 years has achieved higher returns than a saving account. Provided you have a long-term view, this even includes volatile periods like the Global Financial Crisis.

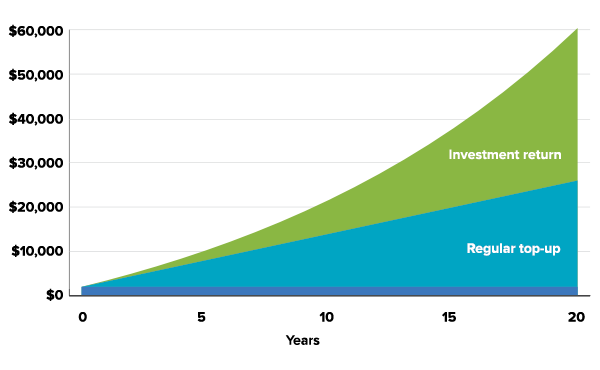

Investment compounding

An initial investment of $2,000 and regular top-ups of $100 a month at an an average after-tax return of 7% per year would result in $60,000 at the end of 20 years. Compare that to today’s average bank interest rate of less than 2% which would achieve only about $32,500.

Technology has made saving and investing easier than at any other point in history. Financial technology companies like Stockspot allow parents to access a low-cost diversified investment strategy to save up for their kids without the need to constantly watch markets.

We acknowledge that for many families money is tight, but the simple act of putting a small amount of money when possible can make an incredible difference to a child’s future independence.

See the full findings at www.stockspot.com.au/future.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.