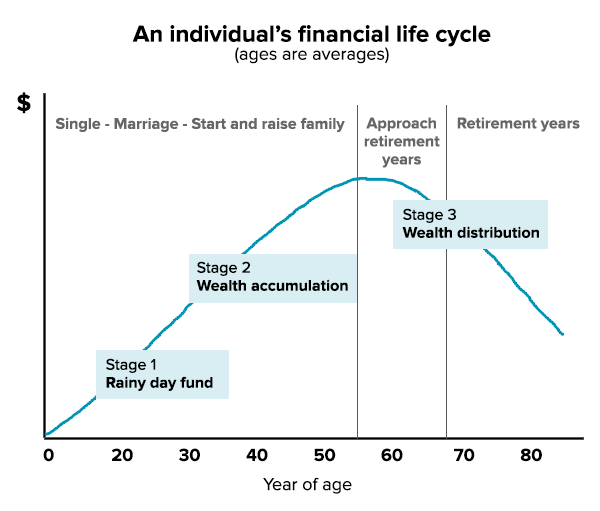

Everyone’s financial priorities change over time. The typical path starts with building some basic savings, then accumulating wealth in your working years and then spending it in retirement.

By comparing the goals and aspirations of different generations of Stockspot clients we’ve discovered interesting insights on the reasons why each invests.

Millennials (Ages 25-39)

According to the ABS, Millennials are Australia’s largest demographic at 21.5% of the population and are expected to earn 2 out of every 3 dollars by 2030.1

Unfortunately, high levels of education and tech savviness haven’t yet translated into higher earnings or home ownership.

High house prices in the major cities mean many young Australians have deferred or given up on the idea of home-ownership as their primary way of building wealth. However being blocked out of the property market has also led to millennials to quickly figure out how to take advantage of other ways of investing enabled by technology.

Almost two thirds of millennials (67%) investing with Stockspot are focused on growing wealth for the future, whilst another 22% say future plans include buying a home or starting a family soon. With time on their side, millennials are most likely to target higher returns with 30% choosing the Stockspot Topaz (aggressive growth) portfolio. We see that millennials are also more likely monitor their investments regularly via our mobile app.

Although millennials have the smallest size portfolios on average, they invest the highest percentage of their total available assets with Stockspot. Many of our millennial clients have a savings buffer which they keep in cash and then invest the rest as a way to save up more quickly and have easy access to funds when they need them.

The 2017 ASX Investor Study reveals the the proportion of 18 to 24 year olds investing has increased dramatically from 10% to 20% and 25 to 34 year old investors has grown from 24% to 39% in the past 5 years.2

According to the 2023 ASX Investor Study, “20% of investors are embracing the convenience of Exchange Traded Funds (ETFs) – up from 15% in 2020.”

The report also found that “ETFs are one of the most affordable ways to enter the investment market and diversify holdings.

“As a result they have been a common choice for new investors with 14% of on-exchange investors selecting them as their first investment. They were also the second most common investment traded, with 11% of investors trading ETFs in the past 12 months.”

The report went on to say that “investors who start with ETFs tend to be younger (a median age of 28), and start with smaller portfolios (a median of $46,500).

“Investors who hold ETFs were most likely to be seeking diversification opportunities, looking for a balance between risk and return, aiming to maximise their capital growth or secure a sustainable income stream. They appeal to both high value investors and SMSF owners.”

Most common reason for investing: Building wealth / saving for a house

Most popular portfolio: Stockspot Topaz (high growth)

Generation X (Ages 40-54)

Those in generation X tend to have built up some wealth and have enough work experience to earn higher incomes, but also have more financial pressures. The increasing age of first home ownership and children are major expenses for many in generation X. Over 20% of our generation X clients are dealing with these commitments and another 10% are preparing for them.

With the cost of raising a child skyrocketing to over $400,000 it’s no wonder parents are focused on financial commitments in this part of their life.

More than half of our generation X clients (59%) are focused on growing their wealth. As this group covers accumulation and the beginnings of the preservation stage, the most common portfolio is the growth option (Stockspot Emerald) with 31% of clients.

They need to find a balance between building up a large nest egg and keeping funds accessible for living costs before retirement. We are also seeing a growing number of SMSF trustees invest with us who are in their late 30s and 40s.

Most common reason for investing: Building wealth / working through financial commitments

Most popular portfolio: Stockspot Emerald (growth)

Baby boomers (Ages 55-74)

Australia’s baby boomers have benefitted from decades of economic growth and increasing house prices. Although rising life expectancies and the pressure to help older as well as younger relatives can affect finances. They know they need to protect the wealth built up over the years by outpacing inflation and diversify with investments outside the family home.

Baby boomer’s life stages contrast with younger generations, as just under one quarter (24%) are still focused on building wealth. Almost another quarter (24%) of Stockspot clients in this age bracket are already retired and 27% are planning for retirement.

The balanced portfolio (Turquoise) is the most popular choice at 37% of our Baby Boomer clients. Our data data also shows that baby boomers are more comfortable with market volatility than younger clients – probably because they have more experience investing over the long run. This is counter to the common perception that younger investors have a higher tolerance for market movements.

This age group has the highest percentage of SMSFs.

Most common reason for investing: Planning for retirement

Most popular portfolio: Stockspot Turquoise (balanced)

Generation gap

Our data reinforces that older investors are keen on dividends shares and millennials are more likely to invest with a social conscience.

| Most popular Stockspot Themes – by generation | ||

| Millennials | Generation X | Baby boomers |

| US shares | US shares | US shares |

| Global (non-US) shares | Asian large companies | Australian dividend shares |

| Australian socially responsible shares | Australian dividend shares | Asian large companies |

These outcomes reveal that age-related factors impact each generations investing preferences.

Regardless of which generation you belong to, having the right investment mix that matches your profile and life stage is key to giving you the best chance of success in meeting your goals.

Knowing your current situation and future plans helps us recommend the best investment strategy and keep you on the right path.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

1 Macquarie Bank ‘Australian Macro Strategy: Millennials – more to invest in than avocados’, June 2017

2 2017 ASX Australian Investor Study