Why would I borrow to invest?

Borrowing money to invest (also known as gearing or leveraging) gives you the ability to invest more money than you currently have saved.

The basic idea is you can benefit if the value of what you’ve invested in rises more than the interest you pay on the borrowed money.

People usually consider borrowing to invest for a couple of reasons:

-

To access the increase in the value of an investment over time without needing to pay for it entirely upfront, i.e. a house.

-

To access tax benefits. Sometimes you can get a tax deduction for interest payments on the loaned amount when the interest is more than any income earned. This is known as negative gearing.

What is gearing and leverage?

Gearing or leveraging refers to investing borrowed money. If the price of what you invest in rises, profits are magnified. However, if the price falls, your losses are also amplified. Your loan balance needs to be paid back regardless of whether the investment rises or falls in value which is why gearing or leverage adds an extra risk to investing.

What is negative gearing?

Negative gearing refers to borrowing money to invest where the income from the investment is less than the interest and expenses. This is common in property investing because rental income is often less than mortgage interest and other expenses.

Negative gearing means you are making a loss on the cost of owning an investment. If your investment is negatively geared and costing you money you will need another source of income to fund the extra expenses.

Obviously nobody wants to buy property to lose money but over the long run. Negative gearing can work if the money you make from the capital growth is greater than the loss you make on income along the way.

Negative gearing is a popular tax minimisation strategy because in some cases the shortfall can be used to reduce your taxable income.

For this reason, negative gearing can cause distortions in the pricing of assets like property because there is essentially a ‘tax bribe’ to make a loss. This encourages people to pay more than they would if the tax benefit wasn’t available, which is one of the common criticisms of negative gearing as a tax policy.

Can shares be negatively geared?

Yes, if you borrow money to invest in shares, your investment will be negatively geared if the dividends from the shares are less than the interest on the loan. The common type of loan used for investing in shares or ETFs (exchange traded funds) is known as a margin loan.

What is a margin loan?

A margin loan is similar to a mortgage. However if the value of your shares fall you may be required to stump up more cash so that your overall gearing doesn’t go above a certain level. This is known as a margin call. If you are unable to top-up your account when you get a margin call, your investments may be sold.

Negative gearing with shares is also a common tax minimisation strategy because the shortfall can be used to reduce taxable income. This needs to be weighed up against the extra risks that come with borrowing to invest.

Cons of borrowing to invest in property or shares

The biggest danger of borrowing to invest is obvious. If the investment return is negative, you still owe the loan balance and interest repayments. This amplifies any losses you make and may lead to a situation where you owe more than you actually own.

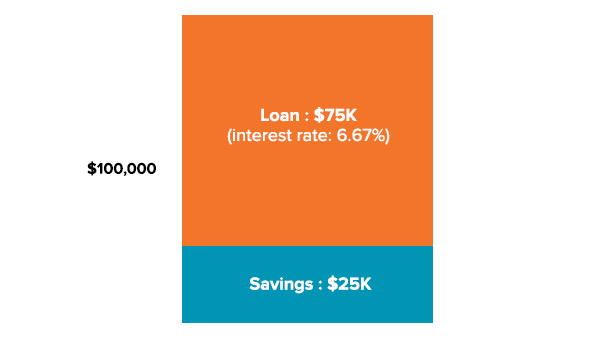

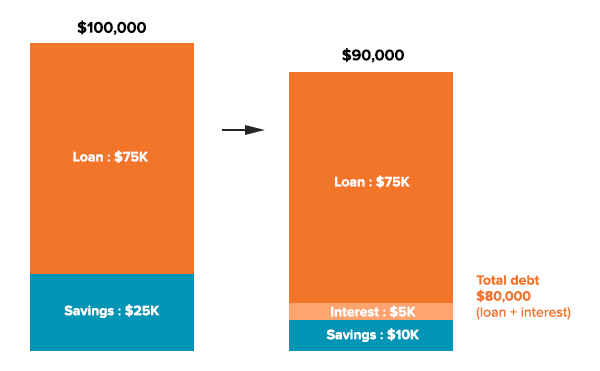

Let’s say you have $25,000 in savings and wish to borrow an additional $75,000 so that you can invest $100,000.

If the market has a bad year and the return is -10%, you would end up with a capital loss of $10,000 and a further $5,000 in interest owed.

If you were forced to sell and pay back the loan after a year you would be left with just $10,000 or a 60% loss on your initial $25,000. That’s leverage!

Leverage can work in both directions. Over the short run, investments can go up or down by significant amounts, therefore when borrowing you need to be comfortable investing for the long term, otherwise your chances of making a large loss or completely wiping out your savings are high.

Borrowing to invest as a way of amplifying short term returns is usually a bad idea because markets (share markets and property markets) are very unpredictable.

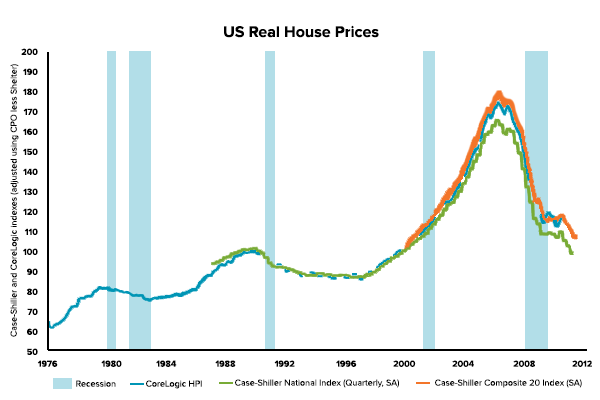

For example, between 2007-2012, the US property market fell 33.8%. This means that many people with gearing had all of their home equity wiped out and may spend years paying interest on their loan to get back to where they were.

Share market falls can be even more severe. Between 2000 and 2002 the US tech index (NASDAQ) fell over 80%, and in the late 1920s to 1930s the US Dow Jones Index fell by a whopping 96%.

Since nobody knows when markets could have a fall like these, leverage adds the risk of completely wiping you out. This is why we don’t recommend it. If you’re only investing money you have, at least you have the opportunity to buy and take advantage of lower prices when markets fall.

Other risks to consider when borrowing to invest include your ability to service the loan:

- Interest rate risk. When interest rates are low you might be comfortable paying interest on the loan. If interest rates rise you may not be able to cover the loan payments which could force you to sell the investment.

- Income risk. If you lose your job you may be unable to pay the interest on the loan.

What to consider before borrowing to invest

1. Time horizon

Is your investment horizon at least 5-10 years? It’s important to remember that past performance is not a good indicator of future returns and there’s always risk associated with investing in any asset class. The best performing investment for one year may be the worst performer of the next, so keeping a long-term perspective is vital.

2. Reliable income

Do you have a plan B for covering the interest expenses on the loan if you lose your job. Do you have a rainy day fund to cover any unexpected expenses?

3. Extra savings

If you’re borrowing to invest in shares you may get a ‘margin call’ if those investments fall in value. This means you need to provide more capital so your overall gearing doesn’t increase beyond a certain level.

4. Tax

Are you on a high marginal tax rate so you can benefit by claiming the difference between investment income and interest off your income (i.e. negative gearing)? Even though negative gearing can provide a tax benefit, it may not be the right decision to invest in negatively geared investments. This is due to the interest that will put you behind and you rely on the value of the investment increasing.

5. Emotions

Do you have the staying power to stick with the plan and stay invested even if the market fell 30% in a year? If a 30% market fall is going to make you lose sleep at night, borrowing to invest is not for you or you should consider borrowing less.

In summary…

In this video, Stockspot founder and CEO Chris Brycki shares why he believes you don’t need to borrow to be a successful investor

Even if you can tick all of these boxes, we think borrowing to invest may not be the best option if you don’t need to take that extra risk to reach your goals.

Renting and investing rather than buying a house is one way to grow your wealth without needing to borrow more than you have.

You really don’t need leverage in this world much. If you’re smart, you’re going to make a lot of money without borrowing.

Warren Buffett

If you’re intent on borrowing to invest, more than anything make sure you’re timeframe is long enough to withstand market falls and that you’re not going to be a ‘forced seller’ in that situation.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.