I had the pleasure of presenting at the ASX Investor Days this month – its been a great chance to meet investors from around the country. From students investing for the first time to octogenarians with decades of experience behind them.

These were the 5 most common question I got after my presentation…

Q. Markets seem expensive so I’ve been sitting on cash for the last few years. Should I invest now or wait to buy lower?

Markets are difficult to time, even for the experts. They can stay expensive (or cheap) for a long time. Meanwhile procrastination will harm your ability to enjoy any investing returns. If you’re worried about short term market movements consider dollar cost averaging.

Investing into markets gradually and regularly will help you minimise both kinds of possible regret:

1) the regret of buying just before a market fall

2) the regret of not being invested at all and missing out on returns as markets rise.

Learn more at When is a good time to invest

Q. Why should I rebalance my portfolio? Aren’t you supposed to hold onto your winners?

It’s great that some of the investments in your portfolio have posted better returns than others. However as ‘winning’ assets become a larger part of your portfolio, they also make your portfolio more risky. Assets that are today’s winners can just as quickly become tomorrow’s losers.

Portfolio rebalancing is about making sure your portfolio doesn’t become too risky over time. Harvesting profits from assets that have done well and grown bigger than they started, and investing that money into other assets that haven’t performed as well.

Many people struggle with rebalancing because it requires keeping a close eye on markets and doing the opposite to your instincts – to not chase what’s hot. That’s why we automate rebalancing for clients – to remove the emotional biases that can get in the way of smart portfolio management.

Note that rebalancing in this way works for whole asset classes and not for individual securities. Individual shares can go to zero so rebalancing into losing shares is a sure-fire way to lose money.

This is one of the reasons we recommend owning entire asset classes via index ETFs rather than picking shares. Index ETFs regularly rebalance out of falling shares to protect your capital.

Learn more at How rebalancing works

Q. XYZ share seems cheap. What do you think?

Most people think the shares they own are cheap or undervalued. In fact I’ve never seen anyone say they try to buy ‘overvalued’ shares!

But prices reflect the collective wisdom of every buyer and seller in a market including the thousands of professionals looking for opportunities every day.

I’ve never seen anyone say they try to buy ‘overvalued’ shares!

The chance you know something that no one else does is low. Even if you do have some extra knowledge, your ‘undervalued’ share could stay ‘undervalued’ for years or even decades because others mightn’t agree.

Prices of shares are rarely perfect (stock pickers would call this trading at intrinsic value), but the market is still hard to beat because prices can stay imperfect for a very long time.

The good news is you don’t need to try and beat the market. By simply owning the market via an index ETF you can benefit from the collective research and wisdom of everyone.

Learn more at Why you won’t beat the market (but many still try)

Q. How can I generate X% yield in my portfolio?

Something I’ve noticed is that Aussies seem to have an unhealthy obsession with income.

There’s no free ride with investing so where you’re earning higher income than the interest you earn on cash in the bank, you’re always going to be taking on higher capital risk. Income focused portfolios e.g. high dividend shares like banks and Telstra, hybrids and high-yield debt are riskier than a diversified portfolio. What you get in one hand (income) you could just as easily lose from the other (capital).

My advice is to always to focus on your total return (income + capital growth) rather than just your income or dividend yield.

Today a well diversified portfolio of Australian and global shares and bonds should be able to give you income of 2-3% p.a. plus capital growth of 3-6% p.a. (total return of 5-9% p.a.) The capital growth component of returns will vary year to year but that’s just the nature of investing.

When you only focus on boosting income it comes at the expense of growing (and preserving) your capital. Even if you’re at pension stage you shouldn’t be afraid to draw down from income and from capital growth.

Trying to ‘juice up’ the dividends in your portfolio is riskier than you may think which is why we don’t recommend yield chasing strategies to our clients.

Learn more at The dangers of dividends

Q. Why do I need bonds in my portfolio when I have cash?

They may sound similar but there are actually some big differences between cash and bonds. When you deposit cash at the bank you’re taking almost zero risk.

Because of that you’ll only earn a low return in the form of interest, which will fall if interest rates are cut.

Bonds (also known as fixed income) are a different beast.

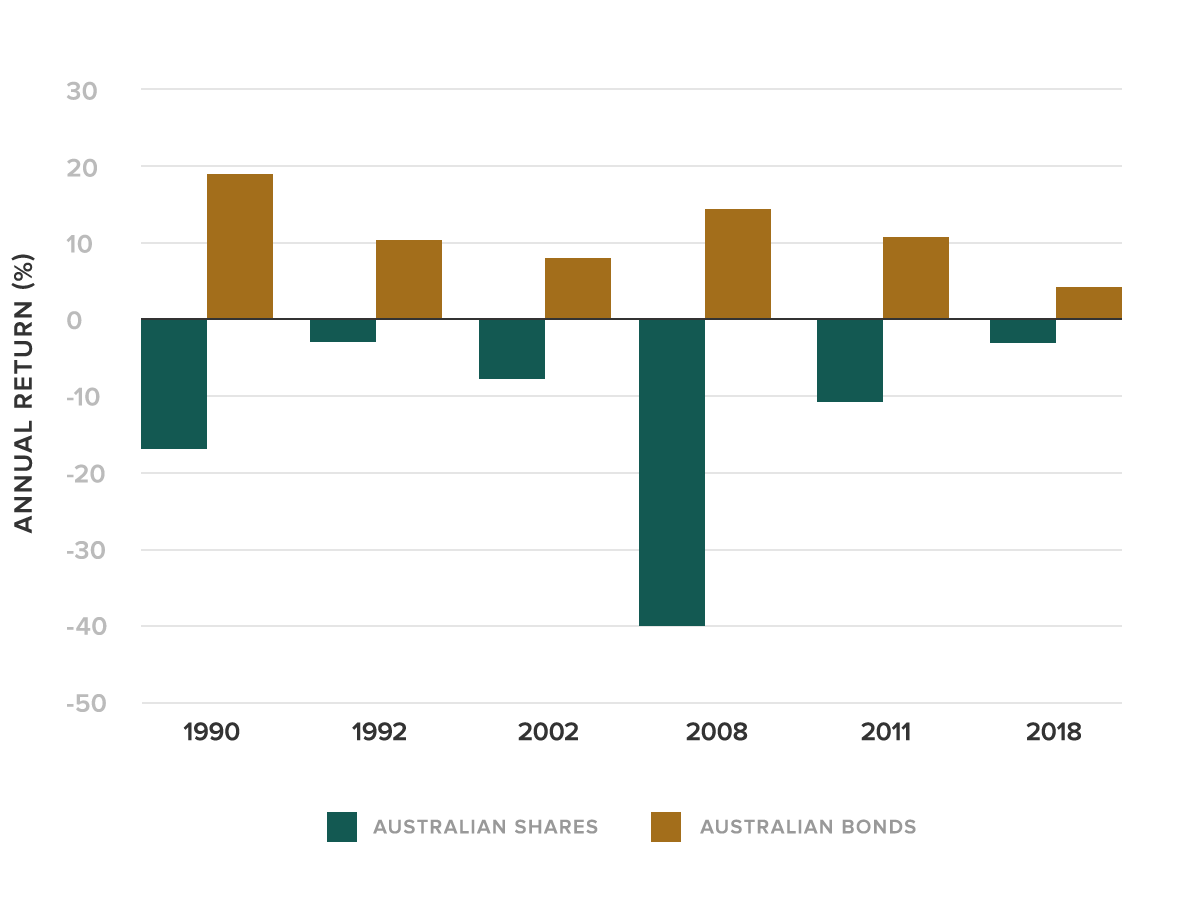

As interest rates fall, bond prices rise in value because their fixed coupon payments become more valuable. Bonds have historically been a much better cushion for falling share markets than cash and also earned higher long term returns.

Over the last 30 years, Australian shares have had a negative year 6 times and on each of those occasions bonds have risen. That’s why we recommend clients have an allocation to high quality investment grade bonds in their portfolio rather than cash.

Learn more at The role of shares, bonds and gold in your portfolio