All Stockspot portfolios and their underlying assets performed strongly in the first quarter of 2023.

Gold (ASX:GOLD) led with a rise of 9.8% followed by global large shares (ASX:IOO) returning 9.0%.

Australian shares (ASX: VAS), Australian bonds (ASX: IAF) and emerging market shares (ASX: IEM) were all up between 3.3% to 4.4% for the quarter.

| ASX Code | Asset Class | 3-month return | 12-month return |

| VAS | Australian shares | 3.3% | -0.6% |

| IAF | Australian bonds | 4.4% | -0.1% |

| IOO | Global developed market shares | 9.0% | 1.6% |

| IEM | Emerging market shares | 3.9% | -1.8% |

| GOLD | Gold | 9.8% | 14.2% |

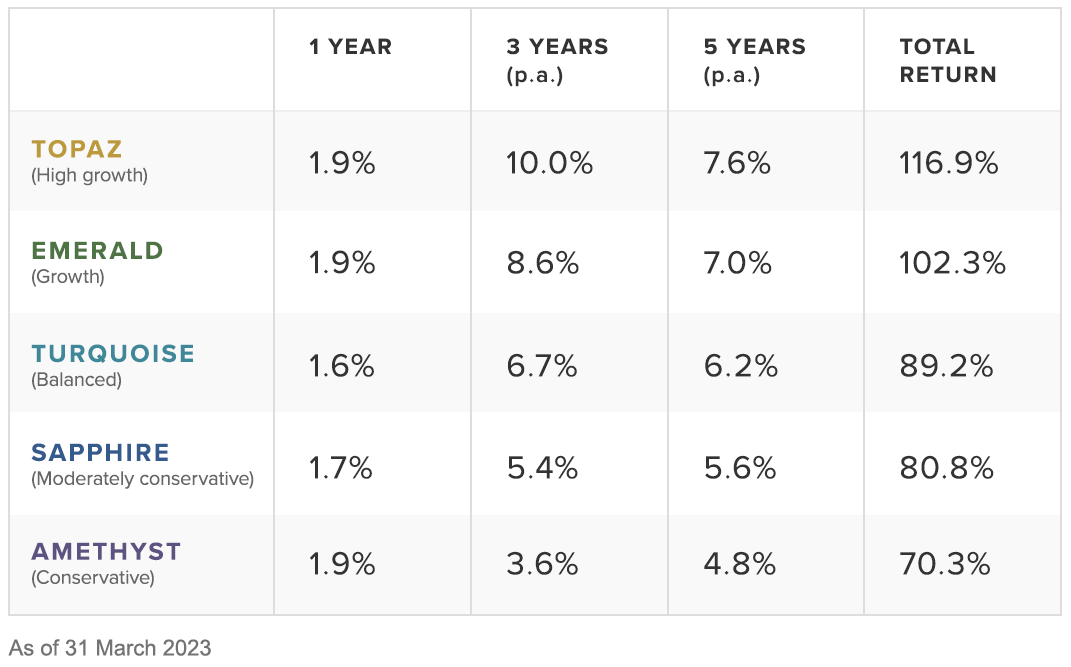

The Stockspot Model Portfolios returned 1.6% to 1.9% after fees over the 12 months to 31 March 2023, while the Stockspot Sustainable Portfolios also returned 1.6% to 1.9% after fees.

Bank collapses help bonds and tech shares

The past quarter saw a strong rebound in some of the assets and sectors that performed poorly in 2022. The technology-heavy Nasdaq index in the U.S. rose 18% for the quarter to be down 12% over 12 months.

Investors have been betting that the current rate hiking cycle in Australia and the U.S. may be close to pausing, and now foresee rate cuts as early as this year. This change in sentiment around interest rates was driven by the volatility in the financial sector following the collapse of several regional banks in the U.S. and forced acquisition of Credit Suisse by UBS.

Investors have interpreted these financial collapses as a positive for the share market and bond market since they could make central banks less inclined to continue raising interest rates.

In Australia, the RBA recently paused on further rate hikes after 10 successive hikes which took the overnight rate from 0.10% to 3.60%. In a recent interview, the RBA governor Philip Lowe said “The Reserve Bank board is prepared to have a slightly slower return of inflation to target than other central banks”. Despite inflation running at 6.8% – more than double the RBA target rate of 2-3% – this acceptance of higher inflation helped Australian bonds rise by 3.5% this quarter as investors now expect fewer rate hikes.

At 3.60% the Australian cash rate is now well behind that in the U.S. (4.75%) and New Zealand (5.25%). It will be interesting to see whether the RBA is right to have paused earlier than other central banks, or if this pause ultimately makes it harder to get inflation back under control.

Lower interest rates are a boon for high growth sectors like technology, although falling rates could signal a recession and we haven’t seen investors cut their expectations of corporate earnings yet.

Stockspot has a modest allocation to the technology sector in our portfolios. We continue to caution investors tempted to chase recent performance by adding an above-index weight to tech shares and ETFs to their portfolios. The tech sector had wonderful performance from 2011 to 2021 but now faces the dual risk of persistent (secular) higher inflation and an earnings recession caused by higher interest rates. The technology sector makes up around 10.6% of our overall growth portfolios compared to 21% of the global share market. On the other hand, our portfolios have a higher allocation to the basic materials sectors (resources and gold) to help insulate against inflation.

Why is gold an attractive investment at the moment?

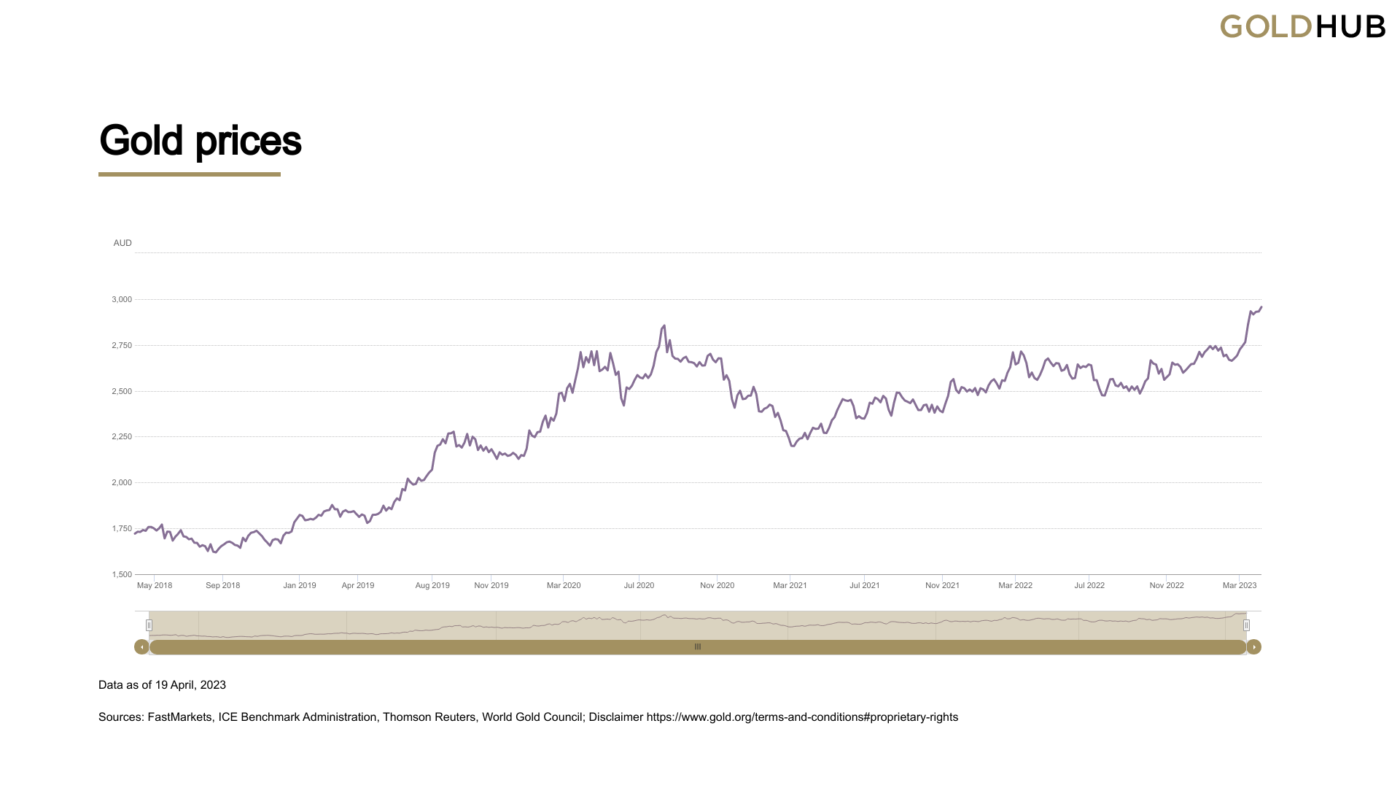

Gold was another beneficiary of higher bond prices (i.e. lower yields) over the quarter. In Australian dollar terms gold reached an all-time high of AUD $3,000/oz. In the current climate of inflation and interest rate uncertainty, gold continues to be a critical part of all of our portfolios. Gold is the strongest-performing asset in our portfolios over 12 months with a return of 14%.

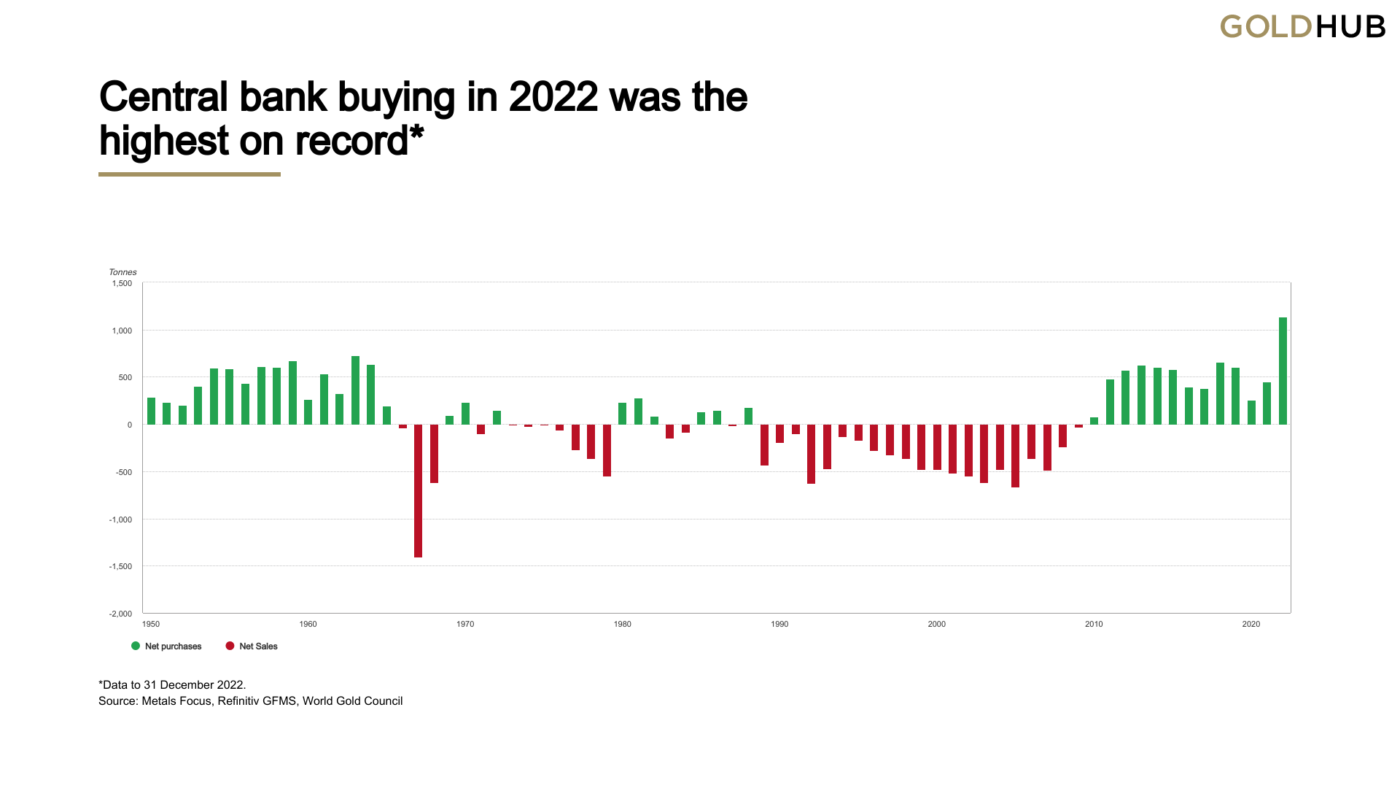

Gold has benefitted from high inflation and enjoyed strong central bank buying around the world. Central banks added 1,136 tonnes of gold worth some $70 billion to their stockpiles in 2022, the most of any year in records going back to 1950.

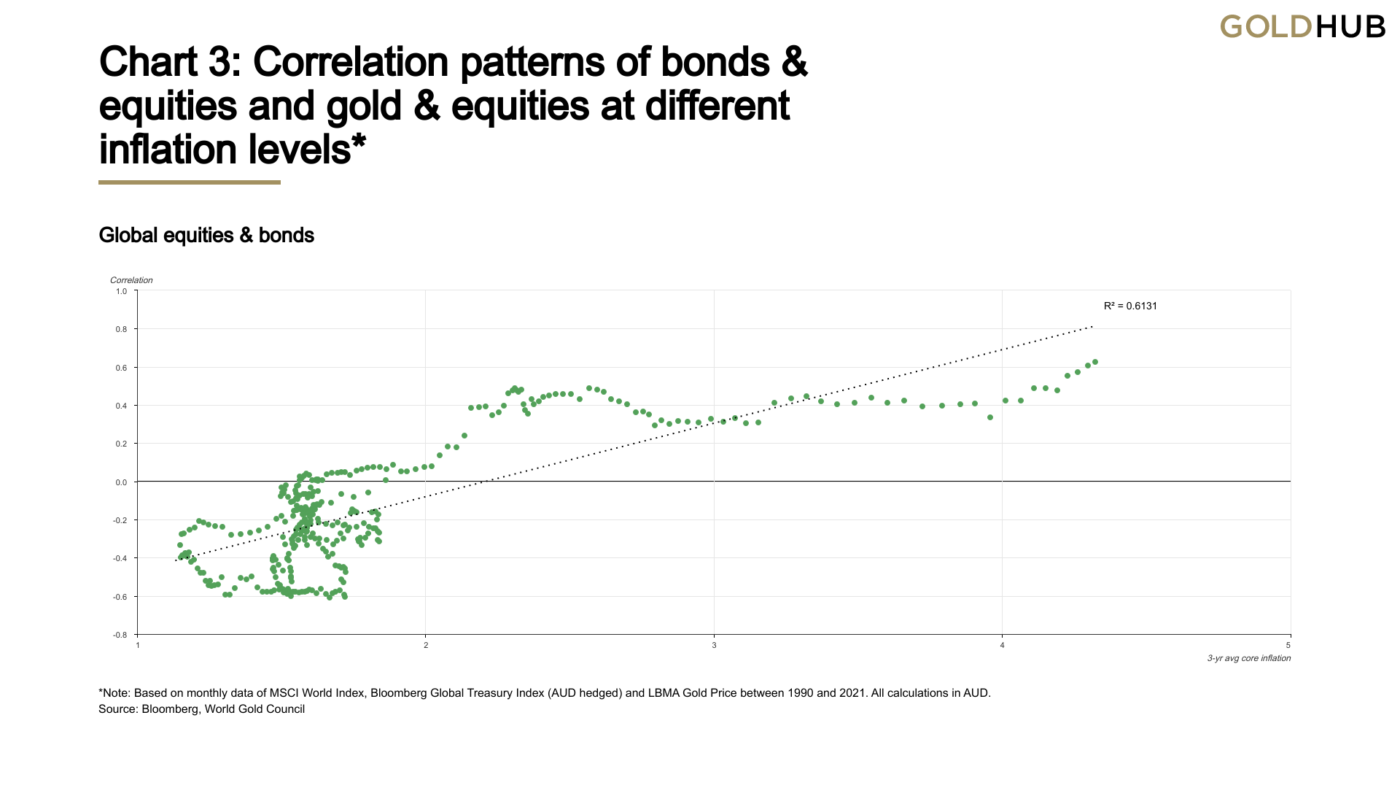

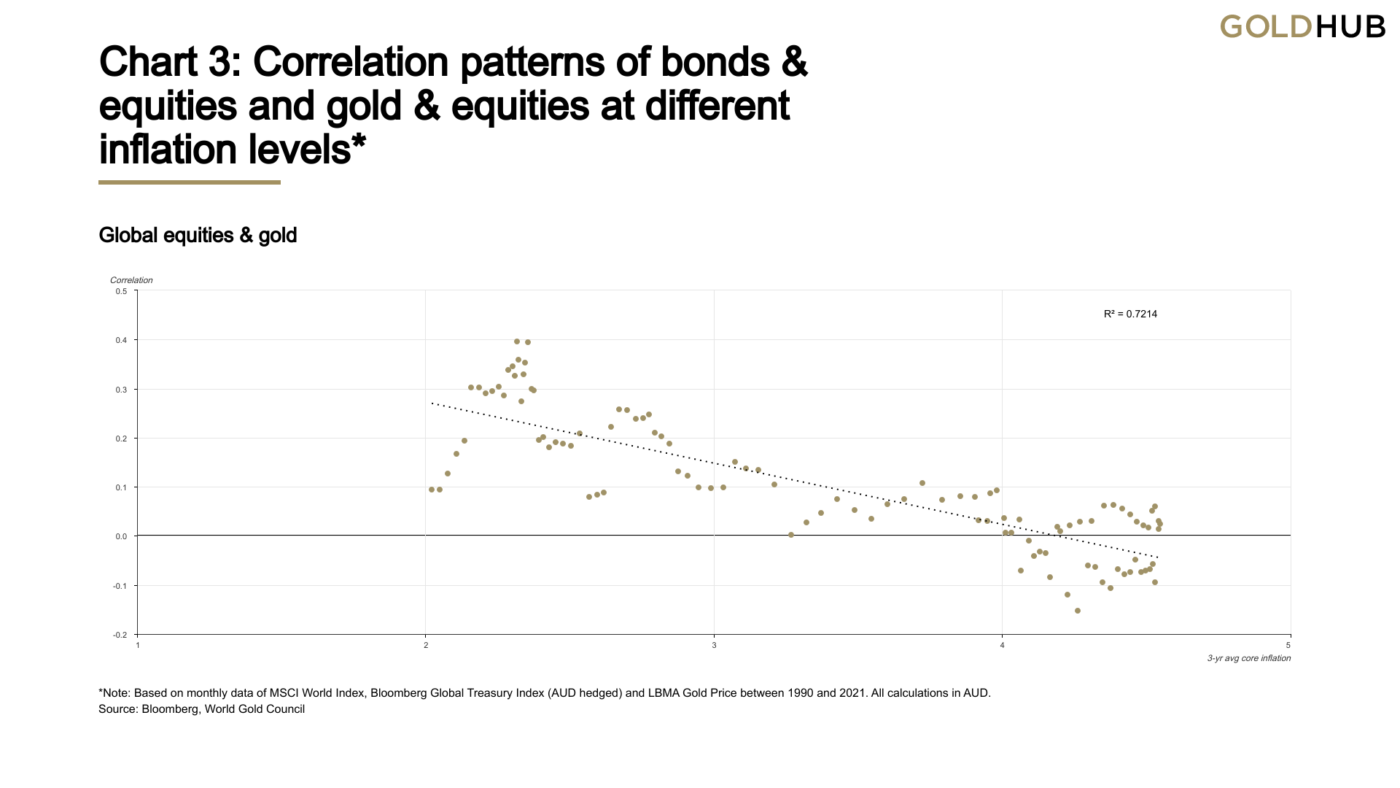

The following two charts from the World Gold Council show why gold is getting more attention from investors. When inflation is higher, bonds tend to move in the same direction as shares so don’t provide much protection. On the other hand, gold tends to move in the opposite direction to shares. Thus, gold has historically provided strong diversification benefits in periods of higher inflation.

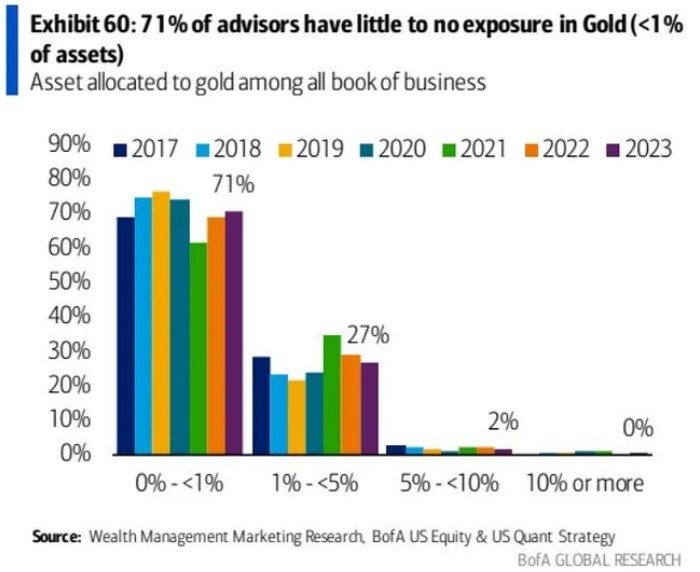

A recent survey of wealth managers by Bank of America Merrill Lynch found that 71% don’t have any allocation to gold while less than 1% have an allocation of 10% or more. At Stockspot we have a 14.8% allocation to gold which places us firmly in that 1%.

We believe our higher allocation to gold is prudent for our clients, particularly in a world of higher inflation. If inflation remains elevated and bonds don’t provide much insulation from share market volatility over the coming years, we would expect other asset managers to follow us and increase their allocation to gold.