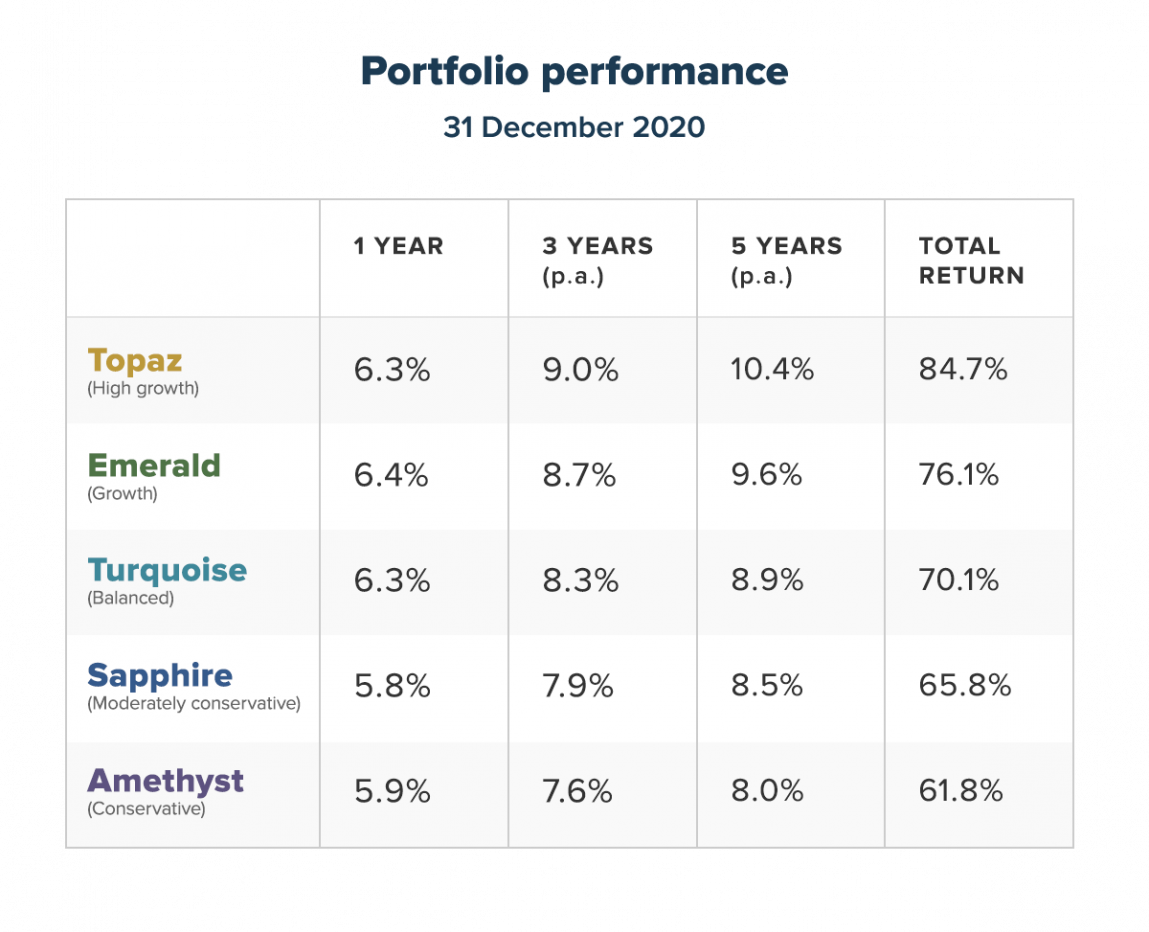

Despite the market turmoil from COVID-19, the Stockspot Portfolios remained resilient and had their seventh consecutive calendar year of positive returns. The Stockspot diversified portfolios returned between 5.8% (conservative) to 6.3% (high growth) in 2020.

The portfolios have now delivered 5 year returns of between 8% p.a. and 10.4% p.a. which is 3% to 4% p.a. higher than equivalent funds.

The Stockspot portfolios outperformed 100% of similar diversified funds over 5 years.1

1Source: Stockspot, Morningstar website comparison group of investment funds across growth, balanced and moderate multi-sector categories to 31 December 2020. Stockspot Amethyst, Turquoise and Topaz portfolios used for comparison.

2020 market records and volatility

There were a number of memorable market records set in 2020:

- We saw the biggest daily share market fall since the 1987 crash on 16th March 2020 with the Australian share market down 9.5%

- The price of oil went negative, briefly dropping to a low of -$US37 a barrel

- Australia experienced its first economic recession in almost 30 years

- The Reserve Bank of Australia dropped interest rates to a record low of 0.10%.

No one could have predicted the events that unfolded in 2020. Not even the experts could see a pandemic causing an economic recession, proving the challenges of market forecasts and predictions.

After the March 2020 fall, we saw an extraordinary response from governments and central banks around the world to help reduce the economic and financial impact of COVID-19. The enormous quantum of monetary and fiscal stimulus, combined with zero to negative real interest rates around the developed world helped support a sharp recovery in all asset prices.

Stockspot achieves positive returns in 2020

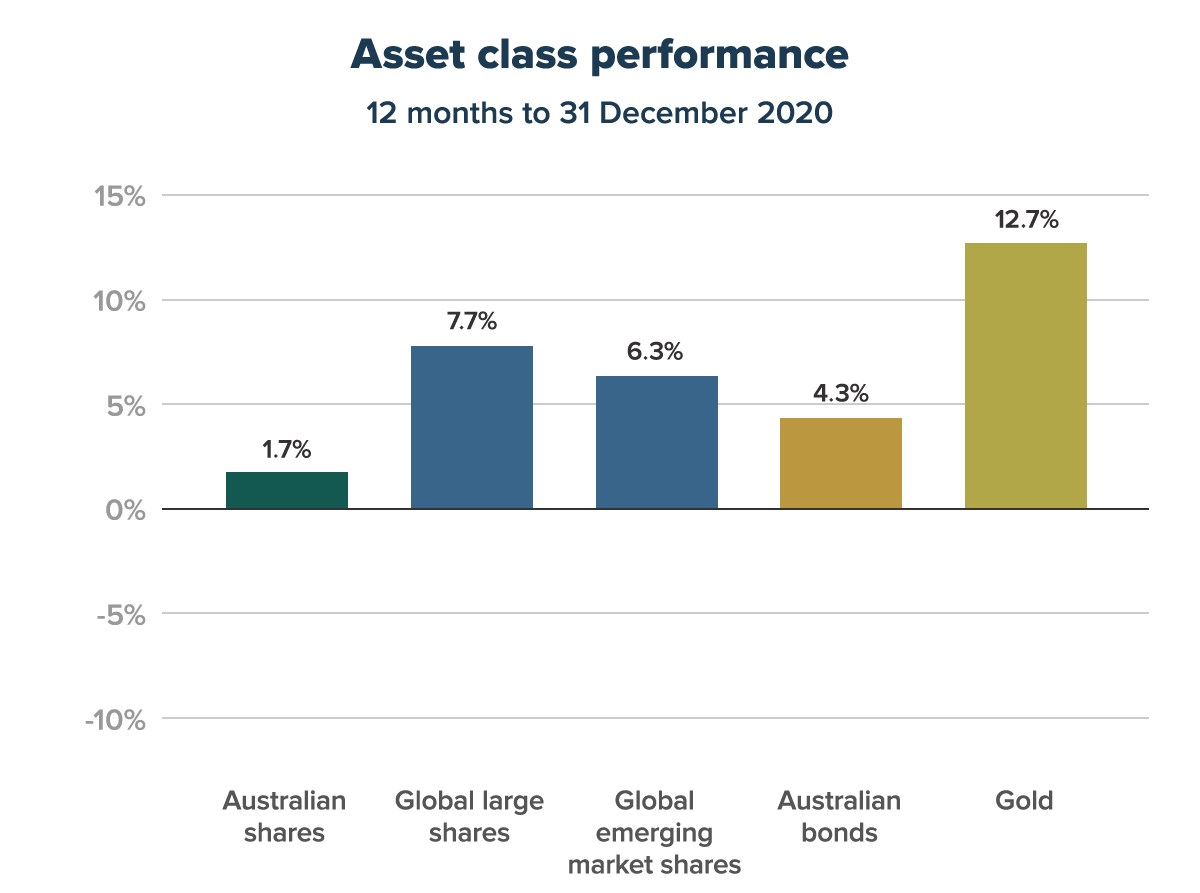

All asset classes in the Stockspot Portfolios achieved positive returns in 2020. Gold was the best performing asset class for the year, driven by lower real interest rates and the expansion of global money supply.

The Australian share market ended the year up almost 2%, but was beaten by emerging markets and global developed markets, up 6.3% and 7.7% respectively.

The 3 R’s of investing in volatile markets: Readiness, Restraint and Rebalancing

Readiness is all about preparing rather than predicting. The Stockspot Portfolios are built to handle different market scenarios, which is why clients have defensive assets like gold and bonds in their portfolios. Increasing our allocation to defensive assets in 2017 helped protect clients from 50% to 80% of the market falls in March 2020 and the gold allocation has generated much of the outperformance compared to similar funds.

Restraint is one of the hardest psychological challenges that investors face. When the share market fell almost 40% in March, one of the sharpest declines in history, some investors felt that they should hit the sell button. The good news is the majority of Stockspot clients resisted the urge to follow the herd mentality, restraining from making changes to their portfolio and instead used it as a good buying opportunity. Those who remained disciplined, sticking with their long term strategy benefited from the sharp recovery in asset prices.

Rebalancing is the final ingredient in the recipe that can help boost returns in challenging environments. During the market turbulence of March, we automatically rebalanced client portfolios and bought more shares to take advantage of low prices. Australian shares then rose by 42% before we rebalanced again in November to harvest some gains and reset portfolios back to their target investment mix. Automated rebalancing helped to remove emotion which was particularly difficult at the end of March when buying shares didn’t ‘feel’ like the right thing to do.

Why owning low cost index ETFs is a winning strategy

Not all sectors and shares were able to produce positive returns in 2020. The impact of COVID-19 meant that energy, utilities, and travel shares suffered with negative returns.

The surest way to avoid picking shares that underperform the market is to own low cost exchange traded funds (ETFs) that track the entire market. This guarantees you own the winning sectors and companies driving the market returns.

This year most of the share market returns were driven by four sectors:

- Technology (through the acceleration of digital adoption and e-commerce);

- Consumer (lockdowns forced many to spend more time at home);

- Healthcare (for obvious reasons); and

- Materials (due to the reflationary bound in commodity prices).

Another year that low cost ETFs outperform

The high market volatility seen during the COVID-19 crisis was an excellent opportunity for active stock pickers to show their skill. However, the results of annual studies such as S&P SPIVA show that the majority active funds failed to capture this opportunity.

It’s no wonder the government is also putting a greater focus on super fund performance net of fees.

Research has consistently shown that buying and holding a broad mix of diversified investments over the long term will leave you in a better position than trying to pick shares or pay an expensive active fund manager to do so. It is this process that has enabled our portfolios to return 8% p.a. to 10.4% p.a. (after fees) over the last five years to 31 December 2020.

In addition to a strong year of returns in 2020, we introduced our Sustainable Portfolios, and published our annual research on ETFs and Superannuation Funds.

We look forward to helping you achieve your financial goals in 2021 and beyond.

Read our earlier performance investment updates from 2020: