For the latest performance update

Stockspot performance update: December 2019

We’re pleased to provide our 3½ year performance update and explain some portfolio changes we’re making to reduce risk and keep the Stockspot portfolios in line with client goals.

This update will cover:

-

Portfolio performance

-

Our approach to reviewing the asset allocations

-

Changes to the portfolios and why we’re making them

Performance update

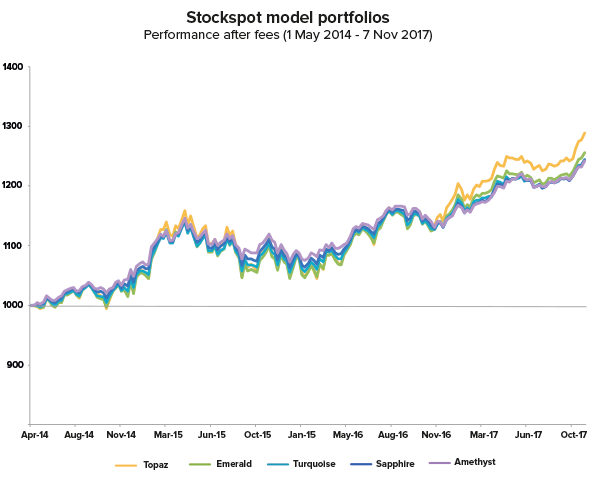

Since we launched in May 2014, the Stockspot model portfolios have returned 6.5% to 8.1% p.a. with realised risk (volatility) of 5.0% to 8.6% p.a. That compares to the Australian share market which has delivered an annual return of 8% with much higher risk of 13% over the same period.

Simply put, the Stockspot portfolios have generated their returns with 30% to 60% less risk than a broad portfolio of Australian shares. When Australian shares fell, our investment strategies had much shallower dips because of their allocation to bonds and gold.

Importance of having high quality returns

Having high quality returns (known in finance speak as the Sharpe ratio) is much more important than just aiming for high returns as that usually requires high risk. Preserving your money is as important as generating a return which is why we’re so focused on minimising unneeded risk.

(Standard deviation – lower is better) |

(Sharpe Ratio – higher is better) |

||

| Topaz | |||

| Emerald | |||

| Turquoise | |||

| Sapphire | |||

| Amethyst |

Annualised return after fees (1 May 2014 to 7 Nov 2017). See how we calculate returns.

Over the same period, a diversified portfolio of Australian shares had a Sharpe Ratio of 0.48. In other words, all of our portfolios generated much higher quality returns. Less risk meant that clients didn’t panic when markets dipped and were more confident to stay the course.

The past 3½ years have been characterised by relatively stable markets and low returns by historical standards. Our allocation to global shares has helped boost returns as Australian shares have lagged the rest of the world.

Global developed shares have returned 15% p.a, emerging market shares 13% p.a. and Australian shares 8% p.a. The lower performance of Australian shares over this period is a normal part of markets and likely to reverse during the cycle.

The portfolios have shown resilience during periods of market stress including Brexit and the US election result – both times recovering quickly to new highs. Bonds and gold provided a cushion during these periods of market jitters while still returning 4% – 5% p.a.

Why we make portfolio changes infrequently

While we continually review the portfolios for rebalancing opportunities, we aim to make changes to the portfolio target weights infrequently. There is a good reason for this…

Over the long run, making fewer changes to your portfolio leads to better outcomes because it means reducing capital gains and improving after-tax returns. Most people (including professionals) make asset allocation changes too often which harms after-tax returns. We don’t make regular ‘tactical’ bets on assets because it’s proven to be no more effective than picking stocks.

A recent study by Finalytiq showed that 94% of simple ‘no brainer’ portfolios outperformed more complicated investment strategies. Looking at over 300 ‘growth’ multi-asset managed funds over the 3 years to 30 June 2017 we found that our Topaz strategy outperformed 74% of them after fees.

Moral of the story – stick to simplicity and focus on the 3 aspects of investing you can control: costs, risk and your investor behaviour.

Our approach to reviewing the portfolios

We combine carefully selected low-cost ETFs with disciplined risk management and rebalancing to give clients the best long-term results. Equally important is our job to ensure clients have the confidence to stay the course during periods of market turbulence.

We regularly review the investments (ETFs) in our portfolios and the allocations to each asset in light of market conditions, risk, expected returns and correlation characteristics. We don’t make changes often but when we do it is to ensure our investment strategies reflect current market conditions including the relationship between different assets – known as correlation.

We’ve recently reviewed our investment strategies and are making some changes to reduce risk.

Portfolio review – what’s staying the same

We are not adding any new ETFs to our model portfolios at this stage. Having 5 assets allows us to give clients the best possible combination of returns, risk and costs, and our research has found that there’s little diversification benefit of adding more assets.

We also believe the 5 ETFs in our model portfolios are still the most suitable in each category. Our 2017 ETF Report supports having VAS, IAF, IEM, IOO and GOLD in our portfolios when compared to other ETFs in their categories.

It’s worth noting we don’t always select the ETF with the lowest fees because sometimes other factors are equally important like size, liquidity or sector diversification.

For example, our global share ETF (IOO) has outperformed its closest comparable ETF (VGS) by 2.2% over the past year due to having a larger allocation to the technology and healthcare sectors. Our preference remains IOO over VGS since these sectors are under-represented in the Australian share ETF (VAS) and therefore provide extra diversification benefits.

Portfolio review – what’s changing

Historically Australian shares and bonds have had an inverse relationship (moved in opposite directions), however recently both assets have been moving in the same direction. To best reflect these conditions, we’re updating the weights of some assets within the portfolios as well as with some Stockspot Themes.

The major changes are:

Increased allocation to defensive assets, particularly gold

The increased allocation to gold is driven by the current relationship between Australian shares and bonds. Bonds may not be as effective cushioning market volatility in the current global low interest rate environment. Gold has the dual benefit of protecting against market volatility and currency debasement.

Our modelling suggests it’s the right time for an increased allocation to gold in the portfolios. Despite returning only 5% per year for the last 3½ years, it had played a significant role in reducing risk and improving the quality of returns. Gold is a form of portfolio insurance and here’s why gold is an important part of our portfolios.

“If you don’t own gold…there is no sensible reason other than you don’t know history or you don’t know the economics of it”

Ray Dalio

Reduced allocation to developed market shares and some increases towards emerging markets shares

We are reducing our allocation to shares in all portfolios because of the high correlation between global markets at present. When all markets move in tandem, diversification benefits are reduced so it’s prudent to reduce risk in this way.

There is a strong temptation to add to investments that have done well in the past and US shares / tech stocks fit into this category today. However, markets work in cycles and investments that do well for a period always revert back to average. Here’s why there may be low returns from the US going forward.

Growth vs defensive assets

Our portfolios are becoming more defensive across the board.

| Topaz | ||||

|---|---|---|---|---|

| Emerald | ||||

| Turquoise | ||||

| Sapphire | ||||

| Amethyst | ||||

Australian vs international shares

Historically the optimal allocation to Australian shares is around 55% (vs 45% global) to maximise the quality of your portfolio returns. Our model portfolios currently have a 52-70% allocation to Australia. With Stockspot Themes clients can increase their overseas exposure up to 60%.

A higher global allocation might be tempting at the moment (while global markets are performing well), the opposite can also be true when global markets fall. In the current environment we’re limiting global exposure to 60% as a higher allocation will lead to undue risk.

| Topaz | ||||

|---|---|---|---|---|

| Emerald | ||||

| Turquoise | ||||

| Sapphire | ||||

| Amethyst | ||||

What does it mean for clients?

These changes will impact clients differently based on the timing of when you’ve invested, your current allocation to each investment and the rebalancing setting you’ve chosen.

We’ll reach out to clients individually if there’s anything you need to do – otherwise your portfolio will be rebalanced automatically by us at the most appropriate time.

In some cases this will be immediate and in others we will use future top-ups and upcoming distributions to bring your portfolio in line with its new target weights to minimise the impact of realising capital returns.