Too often though, investment lessons come with a large price tag and cause financial distress for individuals and families when they are made with vital savings.

Many common mistakes can be avoided by having a basic appreciation of risk, return, the importance of time in the market and understanding some of the behavioural biases likely to get in the way of smart investment decisions.

1. Short-term thinking

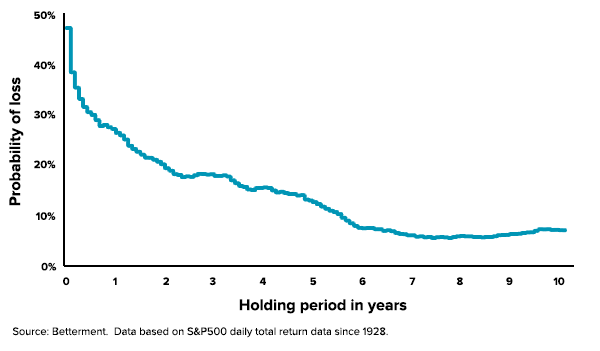

Investing requires patience for one simple reason – your chances of a positive return are directly related to how long you invest for. Invest for a day and you’re essentially flipping a coin – with even worse odds once you factor in transaction costs.

Invest for one year and your chances of being profitable are closer to 70%. After six years you have a 9 in 10 chance of being profitable holding a portfolio that consist of a wide range of shares.

Many people make the mistake of fixating on short time periods of a few days, weeks or months and forget that they really should be focusing on the long-term trend.

Checking your investments too often can lead to this and make it tempting to change strategy if profits don’t come quickly. However jumping in and out of investments is fraught with danger because you’re likely to be buying and selling at exactly the wrong time.

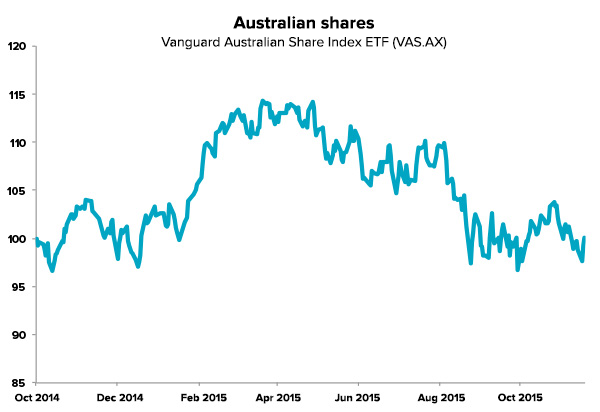

Using Australian shares as an example, the performance of the Vanguard Australian Share ETF (VAS.AX) that forms part of the Stockspot portfolios has been volatile in 2015, with periods of gains and losses.

In April, it was up close to 15% for the calendar year but by October, had fallen almost 20% from its April highs to be down 5% for the year. It’s currently even for 2015.

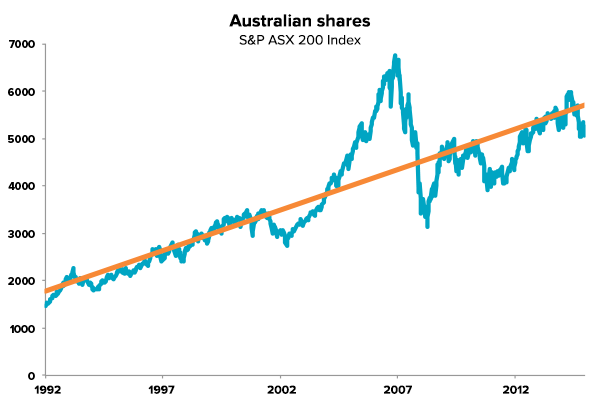

However, if you zoom out and look at the performance of Australian shares over the long term since 1992, you can see that there is an upward trend despite many peaks and troughs along the way. The 20% fall from April to October this year is only a small blip on the long term chart.

Knowing exactly where the market is tracking compared to the trend-line is impossible, which is why it’s important to have an appropriate investment horizon to be able to ride the trend. Anything less than a couple of years is not a sensible strategy since there’s not enough time to have a fair chance of a positive return.

2. Trying to time the market

Related to short-term thinking is the temptation to try and time when to enter and exit the market. Buying an investment low and selling high may sound easy, but in reality even most experts can’t get it right.

Worse, the natural tendency to panic during market dips and buy after markets have risen can mean you actually end up buying and selling investments at the worst time in the cycle.

Markets can also be ‘overvalued’ or ‘undervalued’ for long periods of time and avoiding investing altogether during times when investments seem ‘cheap’ or ‘expensive’ can mean missing out on long periods of good returns.

A better strategy to smooth the short-term troughs and peaks of the market is to invest regularly or ‘dollar cost average’. This also improves your chances of locking onto the long-term trend and not being as exposed to short-term market movements.

3. Thinking recent trends will continue

Market returns, like coin-tossing outcomes, are independent of previous results. In other words, after tossing two ‘heads’ in a row you still have exactly a 50% chance of getting ‘heads’ on your next toss. The same logic can be applied to investing because one year’s performance has no bearing on the next year’s returns.

Also similar to coin-tossing, investment returns tend to revert to a long-term averages over time. Toss a coin 100 times and you’ll end up with something close to 50 heads and 50 tails. Similarly if you pick 50 random years on the Australian share market and average the returns you’ll end up with a figure near 10% per year.

Therefore chasing markets after periods of higher returns because you think they will continue is a strategy destined to disappoint when returns revert to long-term averages. Over the period of 2003-2007 the Australian share market had a period of higher than average returns. This has now been followed by 8 years of lower than average returns.

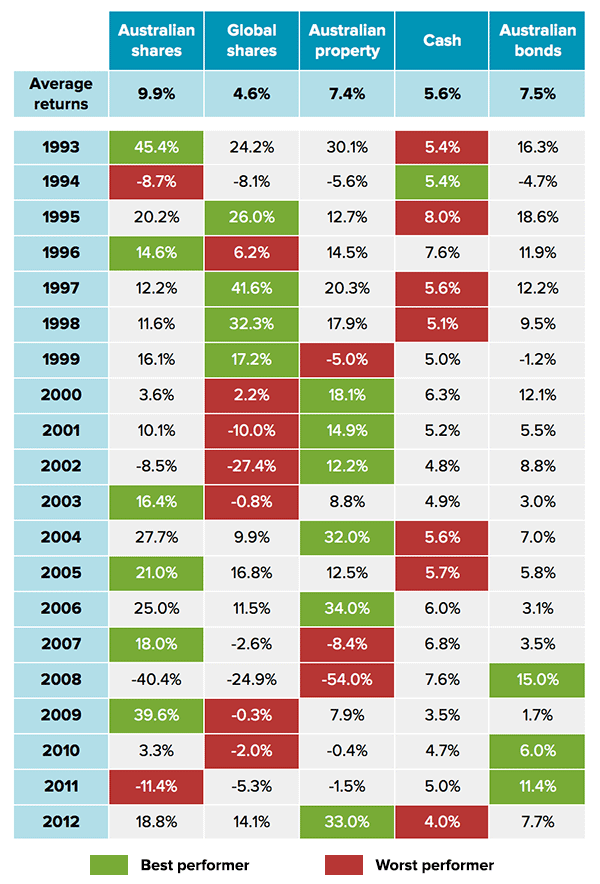

As the table below shows, the worst performing asset in one year often becomes the best performer in the next and vice versa. Therefore trying to predict the best and worst performing asset class based on previous performance is a strategy that’s bound to cause you frustration and cost you money over the long term.

Instead of trying to pick short-term winners, we spread our clients portfolios across many assets to help reduce risk and balance out assets having inevitable bad years with other investments doing well.

4. Following financial commentators

There is no shortage of share market newsletters, tipsters and financial commentators to get your daily dose of financial wisdom. Unfortunately, with all of the noise they make, it can be tempting to get caught up in the stories and start tinkering with your investment strategy too often.

Remember that most financial businesses like brokers make money when you act on their buy and sell recommendations and few of them profit if you simply set-and-forget for the long term.

Financial news is biased towards ‘noisy’ commentators recommending that you should buy or sell – this is because recommending a long-term, buy and hold strategy simply isn’t newsworthy.

Despite what many think, financial experts also get their calls wrong as often as they get them right. As the Australian Financial Review demonstrated, not a single bank economist correctly predicted the RBA’s interest rate decision in the first 3 board meetings this year. Even flipping coins would have had a better success rate!

Investing is one of the few areas of life where the less you do, the better the results. You don’t need to stay up to date with the latest market news to succeed – you just need patience.

5. Not diversifying enough

Investment Trends research data found that the average self directed investor in Australia holds shares in just 18 companies with a large portion to a few stocks, namely the big four banks since they now represent almost 40% of the ASX 300.

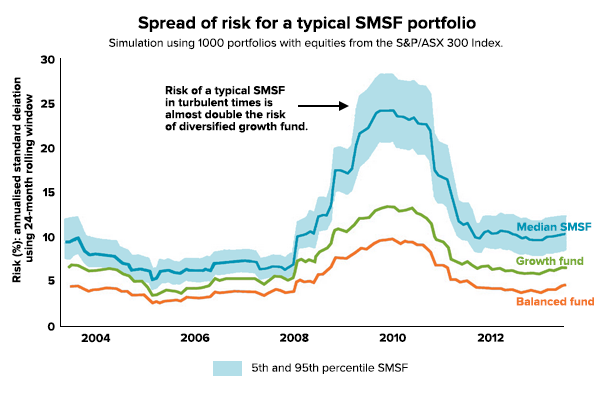

Having such a large part of your portfolio exposed to just a few stocks means you’re taking a lot more risk than you need to be. Vanguard estimates that the average self directed portfolio contains about double the risk of a typical managed fund with a growth strategy largely due to this high exposure to just a few companies, particularly the banks.

Source: Vanguard, Bloomberg and FactSet

It’s crucial to appreciate the links and relationships between different investments in your portfolio. These correlations could cause a much larger risk during periods of market turmoil and can be avoided (without sacrificing returns) through greater diversification across different industries, assets and countries.

6. Paying unnecessary fees and costs

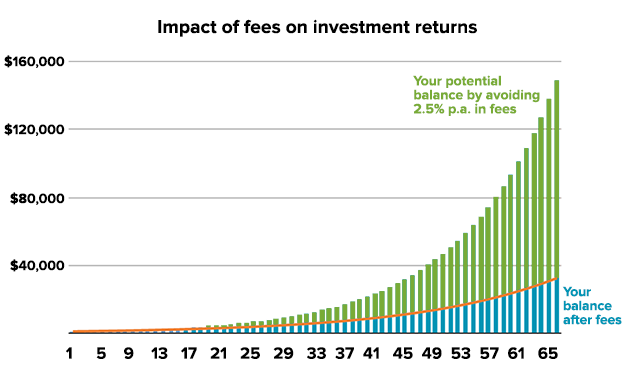

Paying a few percent each year in fees to a fund manager or few thousand dollars for a share market software subscription may not sound like much, but it could easily end up making you poorer by hundreds of thousands of dollars.

To illustrate, if you invest $1,000 over 65 years in a portfolio returning 8% per year you would end up with $148,780. By paying just 2.5% per year in costs (e.g. brokerage, subscriptions, fund manager fees), your final balance would be reduced by 75% to $32,465. That’s 3x your total profit paid to the financial industry in fees over your life!

Our Fat Cat Funds Report found that an average 30 year old could lose almost a quarter of their superannuation in fees by being in a high-fee ‘Fat Cat Fund’. After your mix of assets, fees are the second most important factor in determining your long-term returns.

It can be tempting to pay a newsletter or magazine subscription, fund manager or software provider to help you get an ‘edge’ over the market and achieve better results but it’s unlikely that your returns will be boosted by enough to justify the extra cost.

When investing, paying more doesn’t mean better after-fee returns so keeping your costs under control will help your investment returns compound faster.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.