Before you start investing with Stockspot

If you’re on this page, it’s likely you’re ready to start investing with Stockspot. If you’ve read our overview of How Stockspot Works, this page will take you through how to get started and answer a few commonly asked questions by our new customers.

Visit our robo-advice page if you want more information on how robo-advice blends the best of technology with smart human advice.

Visit our Performance and Portfolio page if you want more information on investment returns and the type of investment portfolios we offer.

Wait…what are ETFs again?

Stockspot uses ETFs as the basis of how we invest. Instead of investing in one or two companies on the stock market, an ETF (Exchange Traded Fund) tracks the broader market or an index like the top 200 Australian companies or the largest 100 companies in the world.

Imagine an ETF as a basket that contains slices of lots of different shares. When you invest in an ETF you invest in that basket of shares.

ETFs give you exposure to many different markets and assets across the world, and this gives you a well-balanced portfolio. You don’t need to engage in risky stock-picking, and you don’t need to time the market.

We build our portfolios from ETFs comprised of underlying investments in over 1,400 shares and bonds from Australia and the rest of the world. We select ETFs that complement each other. This smooths out the short-term ups and down in the market and improve your return path.

How do I get started with Stockspot?

There are four basic steps to getting a Stockspot investment portfolio up and running:

Step 1 – Create Your Account

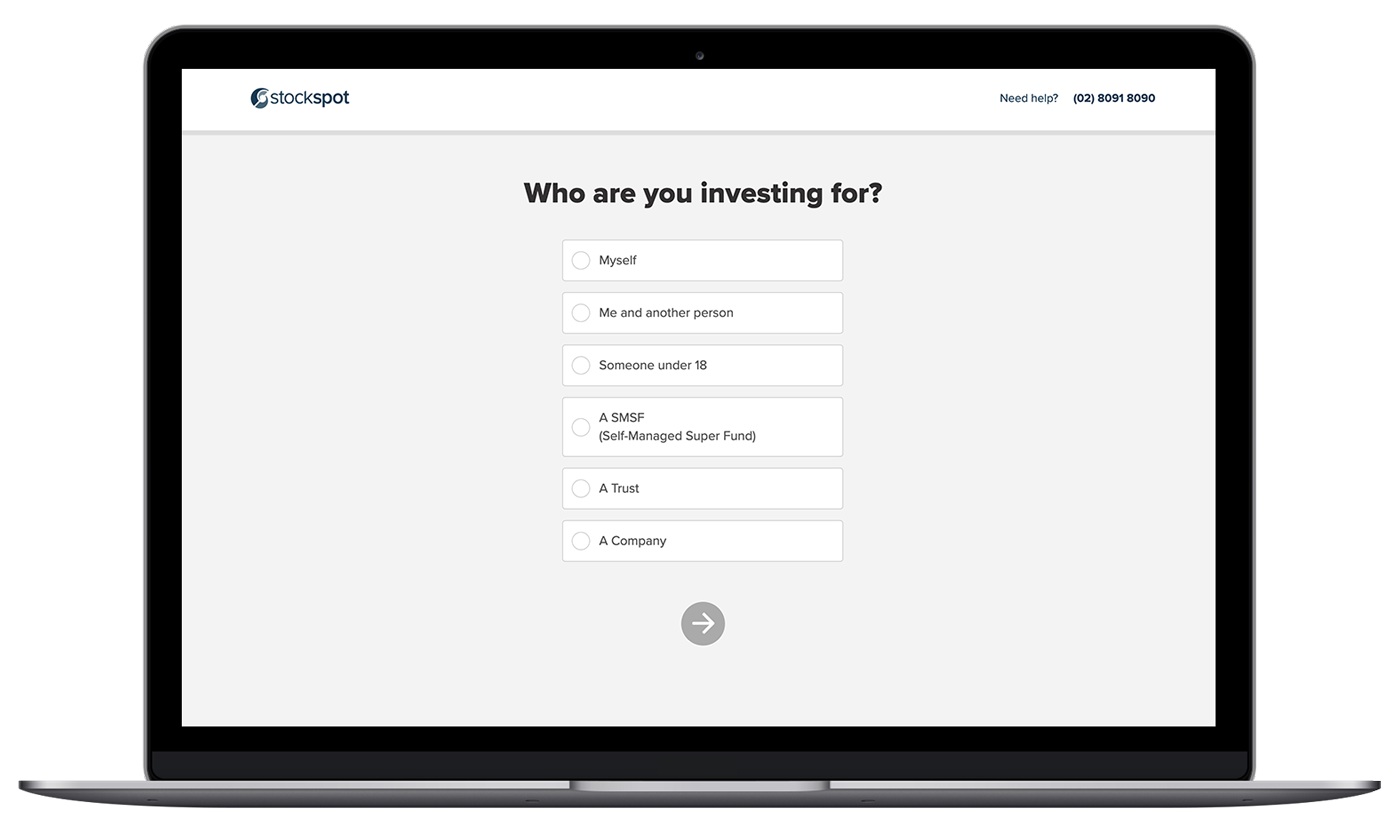

When you click ‘Get Started’, you’ll be walked through a simple questionnaire where we’ll ask you:

- Your financial goals. Are you saving for a house, retirement, or trying to grow your wealth?

- How long you plan to invest for (don’t worry, you can change this later)

- Your investment experience

- Your cashflow needs (will you need to withdraw cash from your investment account?)

- Your risk capacity (your ability both from a financial and emotional perspective to withstand the ups and downs of the market).

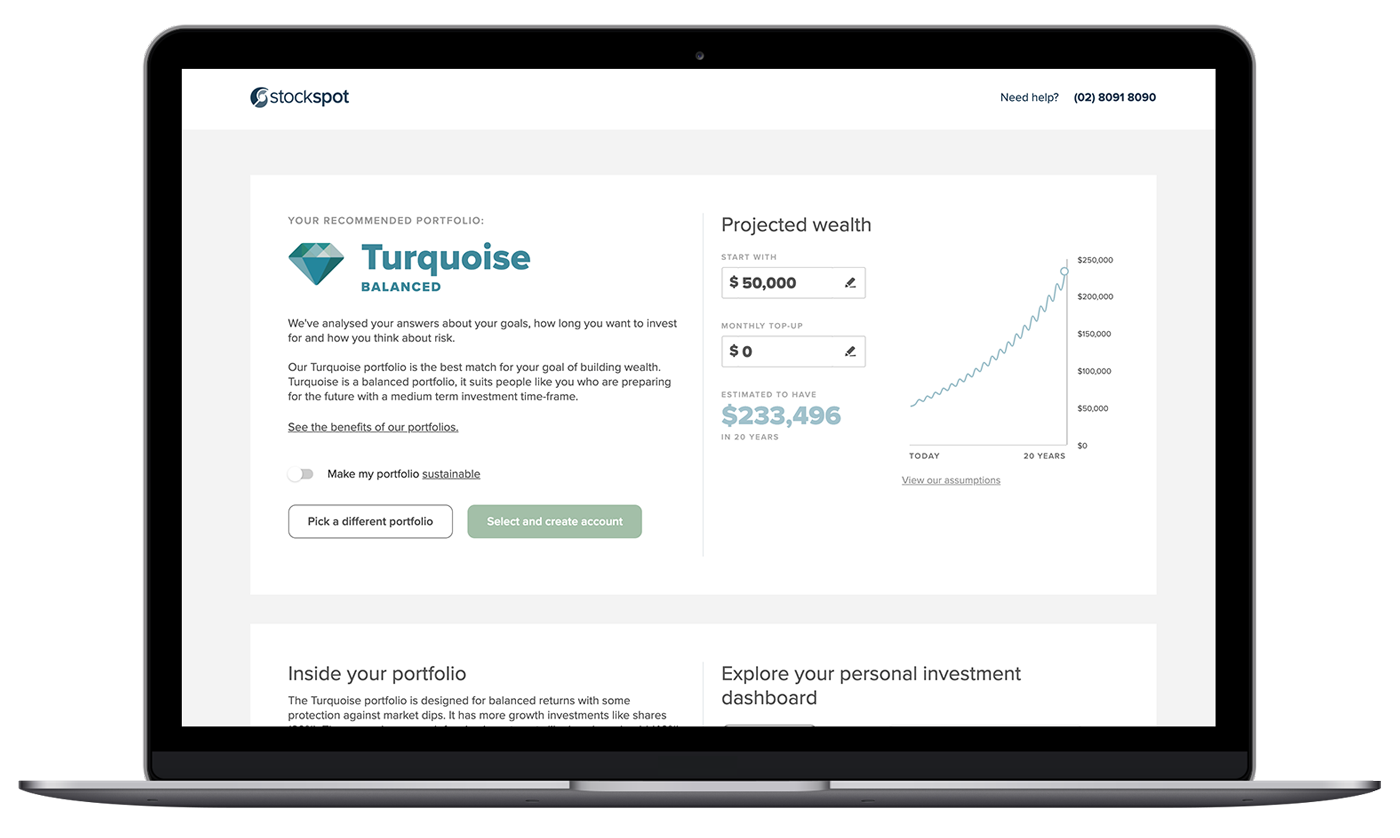

Step 2 – Receive a custom investment strategy

After you answer our questions, we use our smart algorithms to advise you on whether you should invest, and what type of investment strategy you should consider.

Learn more about investment profiles and investment strategies.

We recommend a strategy with the right mix of growth and defensive assets to match your personal situation and goals. All of our investment strategies aim to give clients the best possible of returns while minimising risk.

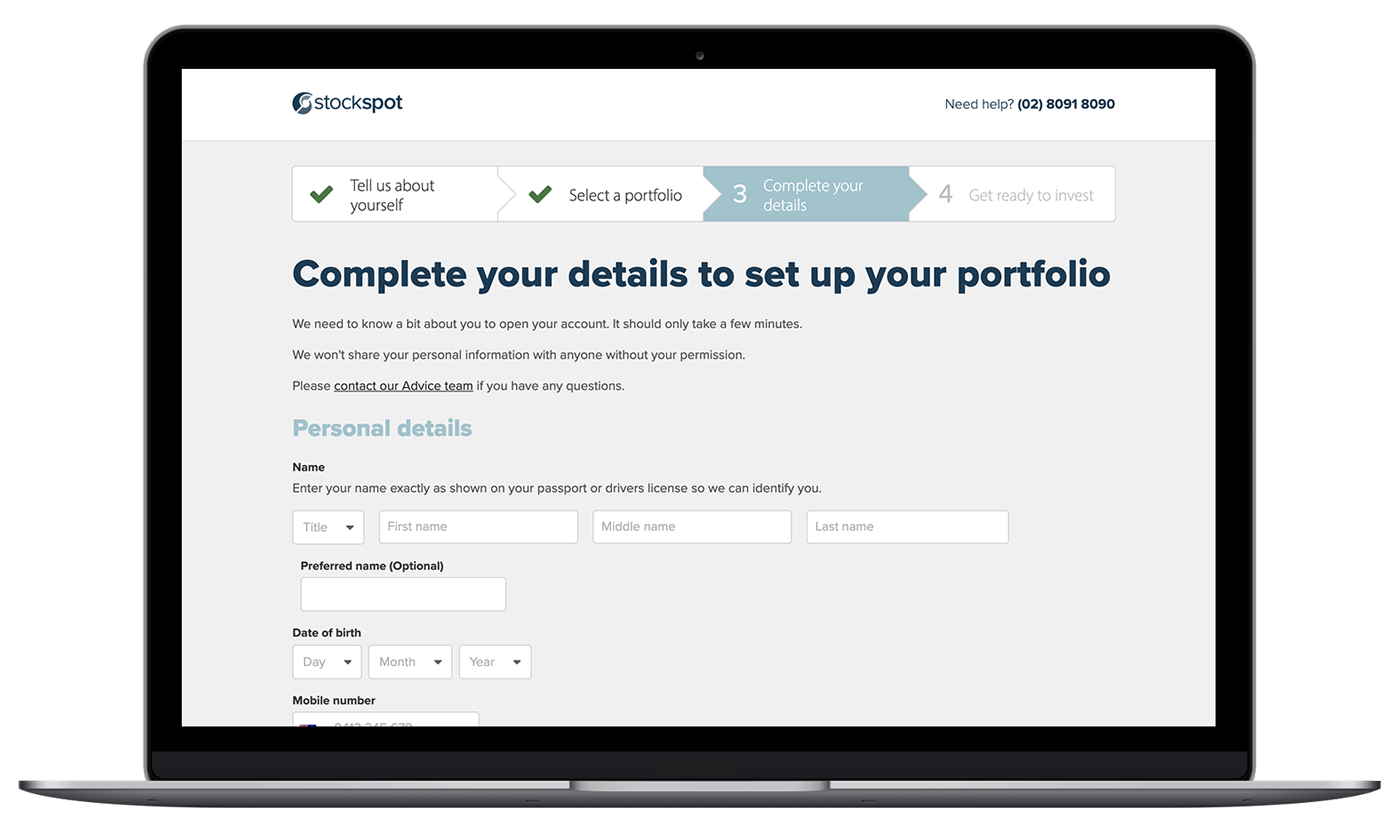

Step 3 – Complete the sign-up process and online ID check

After we recommend a strategy, you either choose that strategy, or you might opt for another one. Select your strategy, and we’ll then direct you to complete an online ID check. The ID check is required by law. After that, you’ll electronically sign your investment agreements (MDA).

Step 4 – Open your account and start investing

When you invest with Stockspot, you’ll have a dedicated cash account and investment account that are both in your name. This means that your investments are safely owned by you.

You confirm the opening of the accounts and make your first investment by making a deposit into the cash account.

To start investing, your account will need a minimum $1,000 investment, but you can start depositing money as soon as you open the account and keep topping up until you reach $1,000. Alternatively, you can deposit $1,000 or above and we’ll start investing for you straight away, and send you a confirmation email.

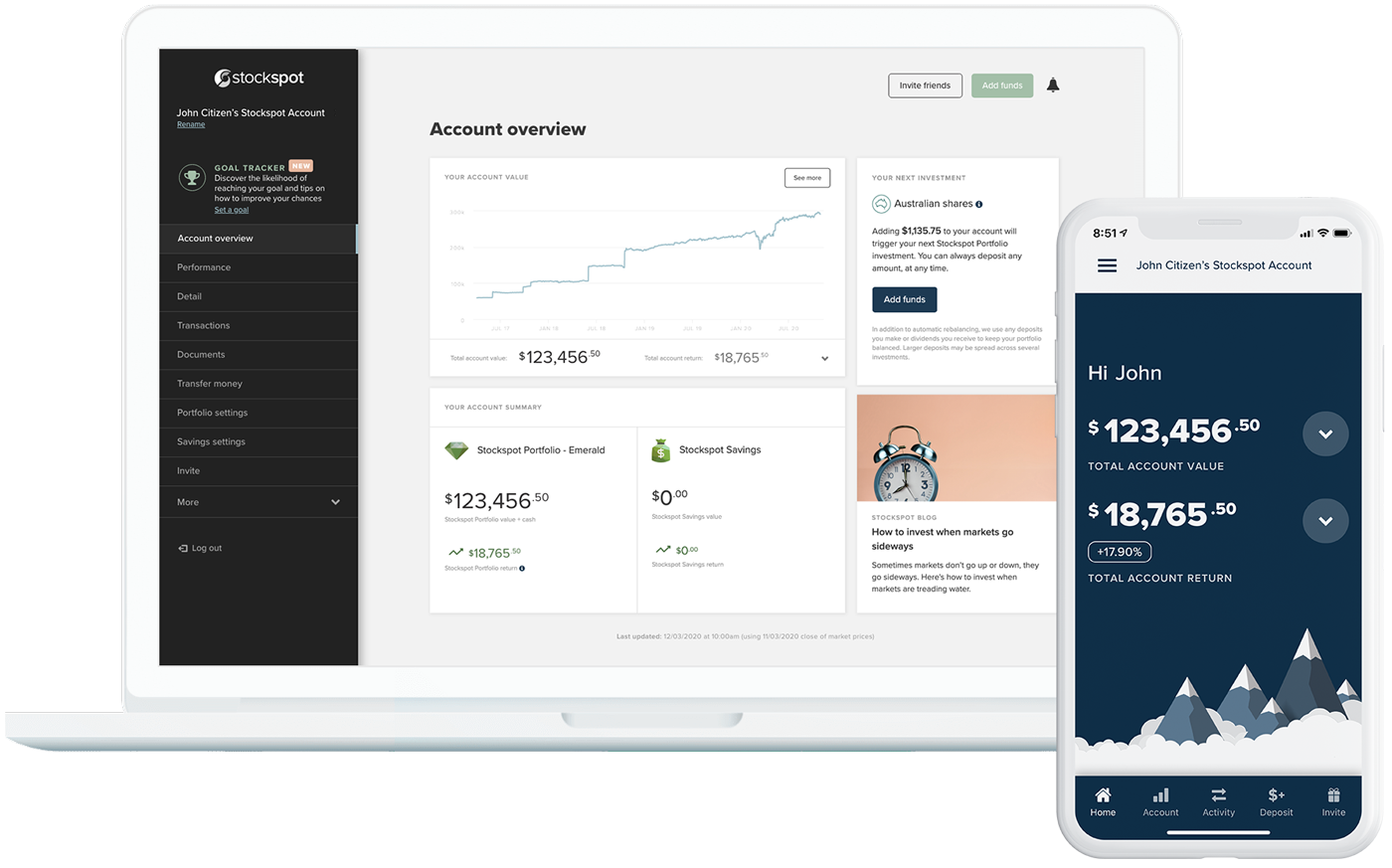

Step 5 – Log in to the investment dashboard

Once you’ve started investing, you can view your investment dashboard anytime. This where you can monitor your portfolio to see the performance of your investments, keep track of your investment goals and add to your investments.

You can use the Dashboard to tell us about changes in your life (ie buying home / changed investing time horizon) that may affect your investment strategy. We review your investment strategy and make relevant changes to your portfolio if needed.

You can also view your Stockspot portfolio via our iOS and Android apps. They are a quick and easy way to view your portfolio without logging into the dashboard.

Step 6 – Top up regularly

Topping up regularly is the secret sauce of investing. You can easily add to your investment account whenever you want. We’ll invest for you at each increment of $500 (for portfolios less than $200,000). You might want to set up a regular deposit, or deposit cash whenever you can.

All the instructions to deposit money easily are within your investment dashboard.

Can I have more control over what I invest in?

Yes, for higher balance accounts, we offer customisation through Stockspot Themes. Themes allow you to personalise your portfolio even further. Interested in technology, emerging markets, or want more dividends in your portfolio? Stockspot Themes allows for personalisation, without the stress of doing it on your own.

Ready to get started?

If you have more questions, feel free to contact us. We’re here to help.

If you’re ready to create your Stockspot account and begin growing your wealth, the best time to start is right now.