Over the last 15 years, exchange traded funds (ETFs) have rocketed in popularity in Australia and around the world as more investors recognise their benefits. Overall, the combination of lower costs, better performance, increased accessibility and tax efficiency has made index ETFs an increasingly popular choice for individual investors, SMSFs and financial advisers.

There is still some confusion between managed funds and ETFs because, although they are both investment structures, they have different characteristics.

ETFs tend to be passively managed with low fees and listed on a stock exchange. Managed funds tend to be actively managed, have higher fees and can either be unlisted or managed on a stock exchange.

In this article we compare some of the key differences between ETFs and managed funds in Australia to help answer the common question: Should I invest in ETFs or managed funds?

- What are ETFs and Managed Funds

- Fees: ETFs vs Managed Funds

- Performance: ETFs vs Managed Funds

- Instant diversification: How ETFs and Managed Funds Compare

- Transparency and Liquidity: Understanding ETFs and Managed Funds

- Convenience and Ease of Investment: ETFs vs Managed Funds

- Tax Implications: ETFs vs Managed Funds

What are ETFs and Managed Funds

A simple analogy of the difference between an ETF and managed fund is when you want to watch a movie. You can visit a video rental store, like Video Ezy, where a person will help you pick a movie based on your interests (managed fund), or you can subscribe to Netflix where there is a wide variety of different films available to watch instantly.

ETFs are a type of investment that provide direct exposure to a wide range of companies and asset classes. ETFs cover investments such as Australian shares, global shares, bonds or metals. Most ETFs track a market index (ie. a section of the stock market), rather than taking bets on individual companies. ETFs are sometimes referred to as index funds.

Over a 20 year period, the ETF industry has grown, and there is now approximately $130 billion held in ETFs in Australia. The Stockspot Annual ETF Report summarises where growth has come from and includes some forecasts on future growth.

A managed fund is a type of investment structure that pools money from multiple investors to purchase a diversified portfolio of assets, such as stocks, bonds, and real estate. The fund is managed by a professional fund manager who makes investment decisions on behalf of the investors.

Managed funds can offer access to a range of assets that may be difficult for individual investors to purchase on their own. The value of the fund is based on the performance of the underlying assets. Investors receive a share of the profits or losses based on the amount they have invested.

Managed funds in Australia can be actively managed, meaning the fund manager makes frequent investment decisions, or passively managed, meaning they aim to track the performance of a specific market index.

Another similar group of products to managed funds are Listed Investment Companies or LICs. In this article we discuss some of the differences between ETFs and LICs.

Fees: ETFs vs Managed Funds

The main reason for the difference in fees is the type of management involved. Using our movie analogy again, you will always pay more for a person to guide your movie selection process as opposed to doing it yourself.

Managed funds are actively managed by professional fund managers who use their expertise to select individual shares (or bonds or other assets) to try and beat the market. This level of active management requires a lot of effort, expertise and big teams of analysts, traders and researchers who occupy expensive real estate in Martin Place and Collins St. As a result, managed funds typically have higher fees to cover these costs. Stockspot research has found that a typical managed fund investing in Australian shares charges 1.32% p.a.

On the other hand, index ETFs are passively managed and simply aim to track the performance of a specific market index, such as the S&P ASX/200. The lack of active management means that index ETFs have lower fees as there are fewer costs associated with running the fund. A typical ETF tracking Australian shares charges 0.10% p.a. One of the reasons ETFs generally perform better than managed funds is their lower fees as it’s difficult for managed funds to add enough value to cover this cost.

Another factor that contributes to the difference in fees is the structure of the investment. Managed funds typically come with additional costs such as overheads (rent and staff) and transaction costs (like brokerage). ETFs, on the other hand, are structured as exchange-traded securities and have lower overhead costs.

Performance: ETFs vs Managed Funds

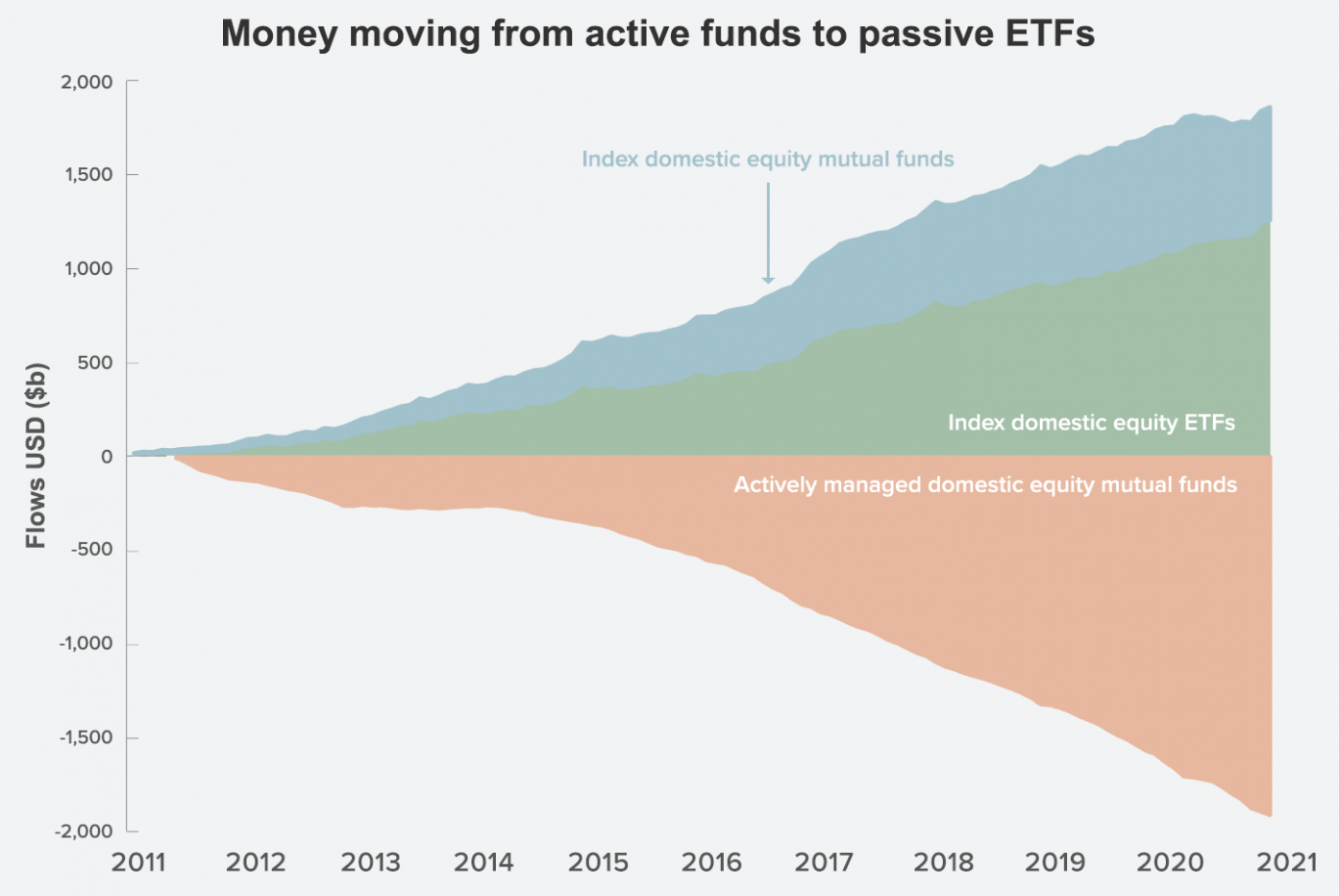

In recent years, many managed funds have struggled to keep pace with the broader market, and as a result, investors are seeking out lower-cost, passively managed ETFs that are designed to track the market, rather than beat it. Stockspot research found that approximately 74% of managed funds underperformed an equivalent Australian shares ETF over five years. This echoes research by others, including the S&P, who have found that very few managed funds have been able to beat the market index over the long run, mainly due to the impact of their higher fees compounding over time.

S&P research shows that fewer than 20% of managed funds beat their benchmarks over 20 years.

In this article we discuss why we avoid managed funds for our clients and include some well known examples.

While most ETFs track a market index, a recent area for growth has been Active ETFs. Stockspot has also compared Active and Index ETFs in this article.

Instant diversification: How ETFs and Managed Funds Compare

Managed funds and ETFs have different investment objectives, with managed funds often targeting specific investment objectives, such as growth or income, while ETFs are designed to track specific markets. This difference can be confusing for investors who are not familiar with the investment objectives of each type of investment. For example some managed funds have an investment objective to beat inflation by a certain percentage per year, to outperform cash or to beat the overall market benchmark.

Using the video store analogy, this would be like if the video store owner had a particular interest in Baz Luhrmann films to help you pick the best ones to watch.

Depending on the type of managed fund or ETF you’re investing, diversification can be similar. In broad markets like Australian shares, ETFs tend to be more diversified since managed funds tend to have a certain style of investing that means they have less exposure to some sectors of the market.

Transparency and Liquidity: Understanding ETFs and Managed Funds

Managed funds are typically less liquid than ETFs because investors are only able to buy or sell units in the fund at specific times, such as at the end of the trading day. ETFs, on the other hand, are typically more liquid than managed funds because investors are able to buy or sell ETFs throughout the trading day, just like they would with individual shares.

Using our video store analogy, this is like needing to return the movie by a certain time.

Managed funds can be less transparent than ETFs because they do not have to disclose the specific shares or bonds that they hold on a daily basis. This lack of transparency can make it difficult for investors to know exactly what they are investing in or how it’s likely to perform in different markets.

ETFs are generally more transparent than managed funds because they track specific indices and are required to disclose the specific shares or bonds that they hold on a daily basis. This level of transparency makes it easier for investors to understand exactly what they are investing in.

Convenience and Ease of Investment: ETFs vs Managed Funds

Managed funds can be less convenient for some investors because they typically require a minimum investment amount, and there may be restrictions on how often you can buy or sell units in the fund. For example some funds only allow you to redeem (sell) quarterly. Additionally, you may need to go through a financial adviser or platform (like Panorama, Hub24 or Netwealth) to invest in a managed fund. Where managed funds are available to retail investors the application process is often cumbersome and based on paper forms and require minimums that are often $25,000 to $100,000.

ETFs are generally more convenient for investors because they can be bought and sold just like individual shares on the ASX or Cboe. This means that you can buy or sell an ETF at any time during the trading day, and you typically don’t need to go through a financial adviser to invest in ETFs. There may also be lower minimum investment amounts for ETFs compared to managed funds. For example, Stockspot’s minimum investment amount is $500 for those investing less than $50,000.

Tax Implications: ETFs vs Managed Funds

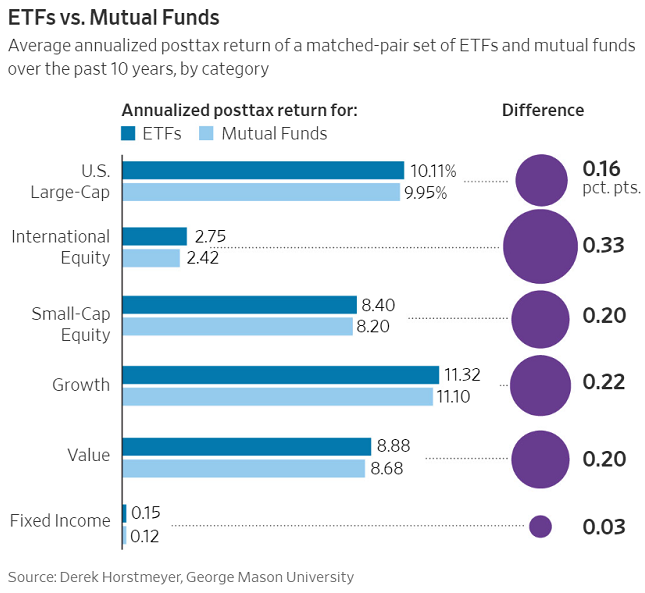

Managed funds can be less tax-efficient than ETFs because they are often actively managed, which means that the fund manager is constantly buying and selling different shares and bonds. This higher level of turnover can result in more frequent capital gains, which are taxed as income. U.S. research has shown that ETFs have post-tax returns that are better by 0.16% to 0.33% per year, depending on the share category.

ETFs are generally more tax-efficient than managed funds because they are passively managed and simply aim to track the performance of a specific market index. This means that there is typically less turnover of holdings, resulting in fewer capital gains and lower tax liabilities for investors.

ETFs also have an advantage because of in-kind redemptions. When an ETF buys or sells securities within its portfolio, it does so through in-kind redemptions. This means that the ETF will exchange securities for cash instead of selling them in the open market. In-kind redemptions are typically more tax-efficient than selling securities in the open market, as they don’t trigger capital gains taxes.

Both managed funds and ETFs are able to pass on franking credits. You can learn more about how ETFs are taxed and franking credits here.

Overall, ETFs are considered to be more tax efficient because of their lower turnover of holdings and in-kind redemptions. However, it’s important to note that tax rules can change and the specific tax implications of each ETF can vary, so it’s important for investors to do their research.