You have a better chance of picking a Melbourne Cup winner than a global fund manager that has outperformed the market after fees for 3 years.

Over $140 million was waged on ‘the race that stops a nation’ and about 13% of Australian punters picked the winner – Fiorente. Bookmakers were the big winners, probably pocketing $5 million in profits on the Cup alone.

But lets put that in perspective – yesterday the Commonwealth Bank (CBA) made $21 million profit. That’s just one company, on an ordinary day, and nobody stopped for that.

By far the most successful ticket clippers in this country are the banks. They offer a wide field of runners on their platforms and take a healthy clip on each investor bet. Sure their ‘horses’ are packaged up nicely under product disclosure statements – but the results are alarmingly similar. Over the 3 years to June 30, only 12% of international equity funds beat their benchmark.

Put another way, there’s a better chance of picking a Melbourne Cup winner than a fund manager that has outperformed the market after fees for 3 years.

Despite the risk, millions of Australians take the losing side of this bet every day by investing in high-fee funds and superannuation. Perhaps it’s the bank platforms and super funds that should be carrying the ‘gamble responsibly’ consumer warning!

Unlike the rent-seeking banks, we want to see Australians generate wealth – not fees.

To achieve this, Australians need to invest smarter, avoid conflicted advice and cut out unnecessary costs.

Stockspot stands for better wealth management.

1) Globally diversified portfolios that have been built using the investment principles of Nobel laureates

2) Low-fee index tracking to help you back the bookmaker instead of a horse

3) No kickbacks or commissions

4) Transparency so you can track your portfolio any time, anywhere

5) Direct asset ownership so your investments stay safe and are never compromised by pooling funds

6) Portability so your portfolio can be taken with you to future advisers without incurring nasty tax & exit fees

We hope you’ll join our journey towards better wealth management when we launch early next year.

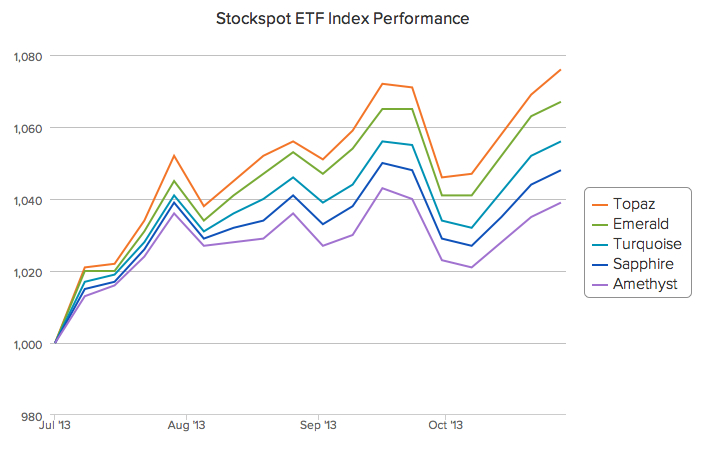

In the meantime we have published the November monthly Stockspot Index Performance so you can check how our portfolios are performing. The Stockspot ETF Indices continue to track in line with our risk and return expectations. The higher return portfolio (Topaz) is up 7.6% this financial year and our lowest risk portfolio (Amethyst) is up 3.9%.

Stockspot ETF portfolios…

Learn more about our risk-optimised ETF Portfolios

Low fee, hassle-free investing

Stockspot is Australia’s fastest growing automated investment service. We can help you build and manage a personalised portfolio tailored to your financial situation and your goals. With Stockspot, there’s no paperwork, no need to be an expert and no hassles.

Related posts

- Are your savings going backwards?

- Best Performing Managed Funds in Australia

- Retrain your investment brain

- 17 money saving tips

- Choosing a robo-adviser or investment app

Main image: morningrisestud.com.au