Exchange traded funds (ETFs) are a great way for investors to gain access to a wide range of investments. However, not all ETFs are the same. The Australian market has seen a rise in Active ETFs being launched on the share market since the first one from Magellan back in 2015.

What is an active ETF?

An active ETF is an investment product that trades on the share market and holds a basket of securities with an active investing approach aiming to outperform an index/benchmark.

Investors can gain access to a range of active investment managers (such as Magellan, Platinum and Hyperion) on the ASX without the need to fill out paperwork, invest large amounts or go through an adviser platform.

Active ETFs vs passive ETFs: what are the differences?

Active and passive ETFs are both tools investors can use to help grow their wealth. However, there are some notable differences as summarised below.

| Active ETF | Passive ETF | |

| Structure | Open-ended fund regulated by ASIC where new shares can be created and redeemed meaning it will trade close to its net asset value | Open-ended fund regulated by ASIC where new shares can be created and redeemed meaning it will trade close to its net asset value |

| Trade and liquidity | Daily – trades on the share market and can be bought/sold when the market is open | Daily – trades on the share market and can be bought/sold when the market is open |

| Investment strategy | Outperform an index/benchmark | Track an index/benchmark (such as the S&P/ASX 200) |

| Transparency | Quarterly requirement to display holdings | Daily requirement to display holdings |

| Cost | High fees (as high as 2.27% per year) | Low fees (as low as 0.03% per year) |

| Tax | ETFs are tax efficient due to open-ended structure, but active ETFs have more internal trading activity (i.e. portfolio turnover) which can increase costs, and capital gains/losses | ETFs are tax efficient due to open-ended structure, but passive ETFs have less internal trading activity than active ETFs and normally trade as part of the regular rebalance cycle (e.g. semi-annually) |

| Market maker (i.e. provides ETF buy and sell prices) | Can use internal market maker to protect intellectual property | Must be an independent external third party |

More active ETFs coming to the Australian market

Active ETFs currently account for 17% of the total Australian ETF market (compared to 7% five years ago). Funds such as Magellan and Resolution Capital have launched active ETFs as an alternative to unlisted funds and investors are moving to active ETFs due to their improved liquidity and intra-day pricing. The number of active ETFs is now more than 70.

One-third of the new ETFs launched so far in 2022 have been active ETFs.

Active ETFs are not popular with investors

While more active ETFs are available to Australian investors, it seems Aussies are not convinced that these ETFs are the best place to invest.

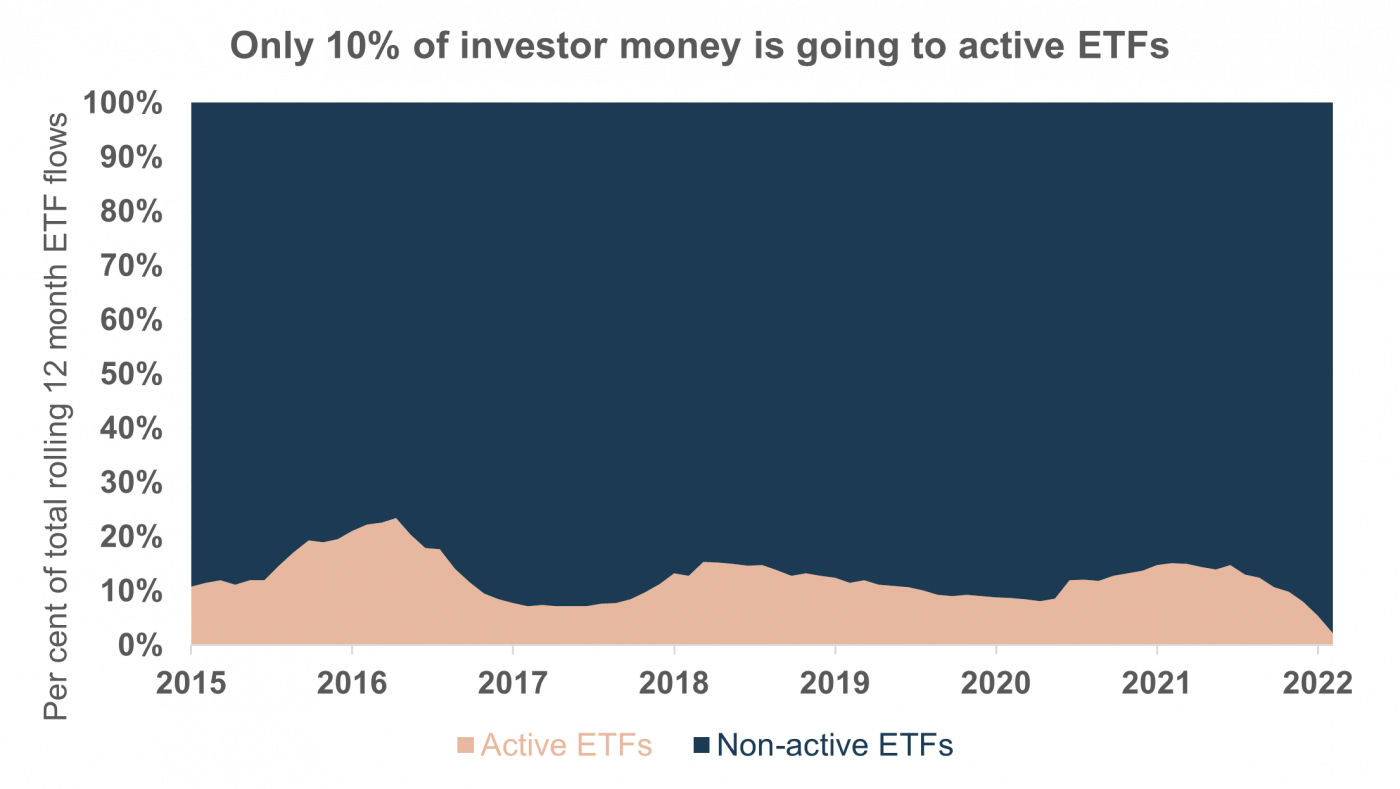

The majority of money going into ETFs continues to flow into low-cost passive ETFs with only $1 out of every $10 finding its way into active ETFs. This is mainly driven by a lack of take-up and large outflows from once market darlings like Magellan who have failed to outperform their stated benchmarks over recent years.

When an ETF does not get enough assets from investors, it may be forced to shut down. In July 2022, Magellan shut down their FuturePay Active ETF (FPAY) and Vanguard closed their global multi-factor Active ETF (VGMF). Both cited low asset growth as the reason for the closure. FPAY reached a peak of $21 million in assets during its short one-year life, while VGMF never held more than $48 million since launching in 2019.

Investors don’t want to run the risk of their ETF closing down which could trigger unnecessary capital gains tax implications and the need to find a replacement investment product.

This risk is a much lower risk when it comes to broad market low-cost passive ETFs.

What are the risks and disadvantages of active ETFs?

Active ETFs come with their own sets of disadvantages which investors may deem as risky:

- High cost – active ETFs are usually more expensive and come with more transactional costs due to their high portfolio turnover. Many active ETFs hold similar holdings to passive ETFs (also known as ‘benchmark hugging’ or ‘closet indexing’) but charge a higher fee. Higher fees mean less money in investors’ pockets.

- Lack of transparency – investors cannot see all the underlying holdings of active ETFs. Unlike passive index ETFs, active ETFs don’t have to disclose their holdings on a daily basis.

- Underperformance – the majority of active funds disappoint, underperforming an index like the ASX 200. Only 25% of active ETFs beat passive index ETFs over the past year as of June 2022. Not a single active ETF beat a passive index ETF over five years.

Should I invest in active ETFs?

According to the latest S&P SPIVA Scorecard, 75% to 95% of active funds underperform their benchmark, depending on the country and timeframe. Of the active funds that can outperform, only 3% of them can keep up their success over subsequent periods.

Even though most professionals can’t beat the market, investors can beat most professionals. The best way to do this is by investing in the market index. Consistently achieving the market average returns can turn into above-average returns over time.

We believe the best way to access the market index is through a passive ETF like the ones we recommend for our clients. Passive ETFs have a number of benefits over active ETFs and can lead to better long-term performance, increased tax efficiency and more transparency.