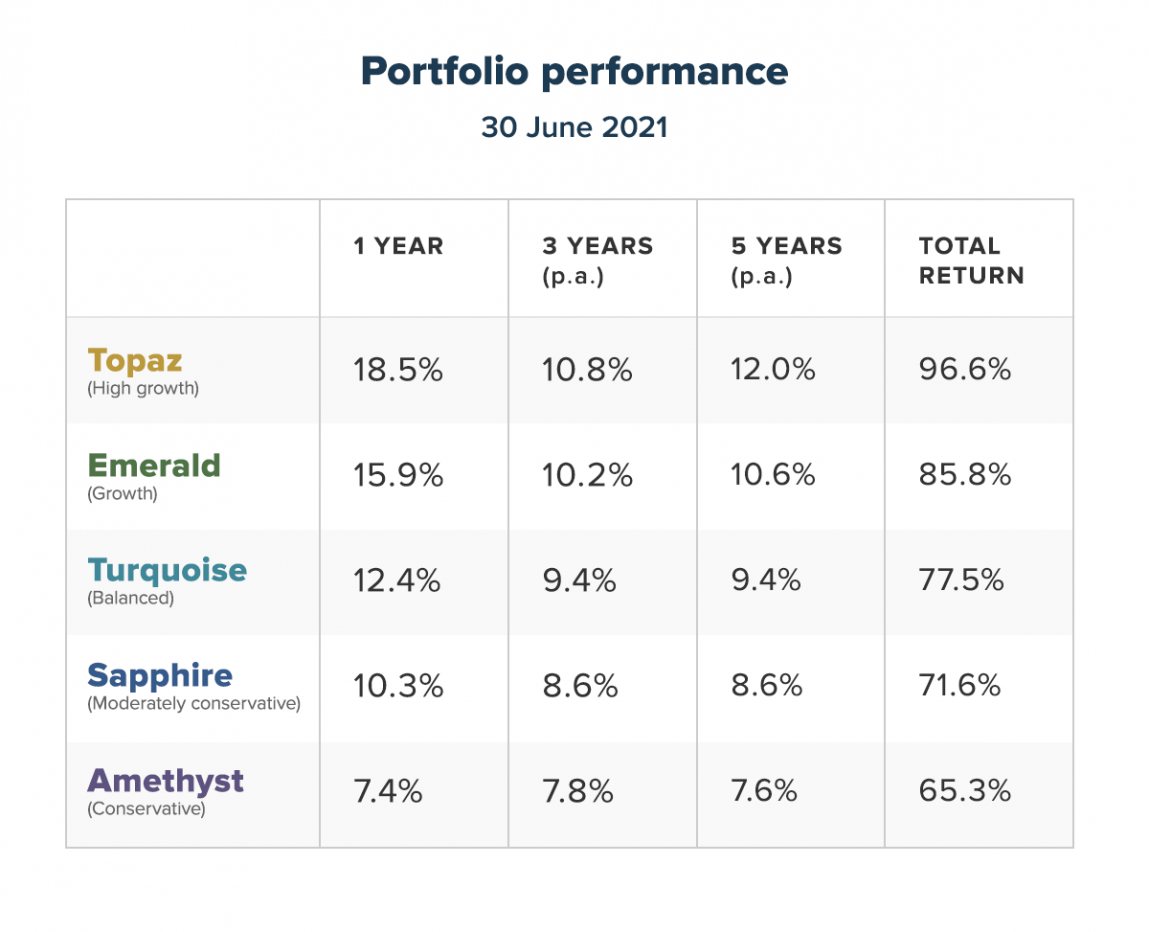

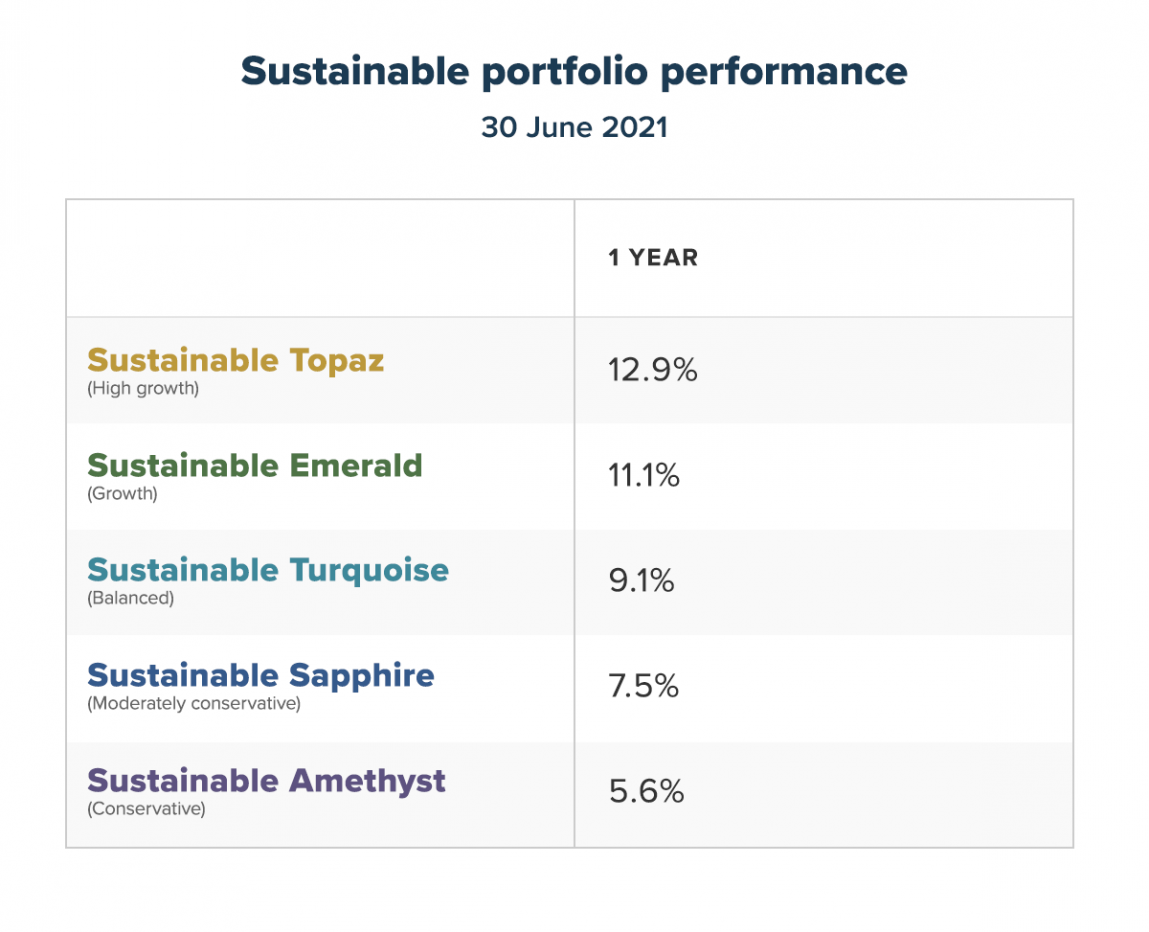

The Stockspot Model Portfolios returned between 7.4% to 18.5% after fees over the 2021 financial year, while the Stockspot Sustainable Portfolios have returned 5.6% to 12.9% after fees over the same period.

We’re proud that this marks the seventh consecutive financial year that all of the Stockspot portfolios have had positive returns. This includes 2020 when the all Stockspot portfolios had gains while many funds suffered significant losses.

Over the long term, the Stockspot Model Portfolios have outperformed at least 98% of similar managed funds, delivering returns of 7.6% to 12.0% after fees over the last five years.

Source: Stockspot, Morningstar website comparison group of investment funds across growth, balanced and moderate multi-sector categories to 30 June 2021. Stockspot Amethyst, Turquoise and Topaz portfolios used for comparison.

Investing on auto-pilot prevails

Markets initially fell when COVID-19 hit Australian shores back in March 2020. Investors who held their nerve, stuck to their long term investment strategy and continued to invest on autopilot with Stockspot have benefitted from the strong share market recovery since. The Australian market is up over 25% for the past 12 months, the best financial year performance in 34 years.

Does it make sense to continue holding defensive assets?

Government bonds and gold were the saviours for investors in the early part of 2020 when share markets fell. After benefiting from their gains, our models rebalanced out of some gold and bonds in March 2020 and redeployed that money back into shares when markets languished.

This helped to add 1% to 1.9% of additional performance to the portfolios in 2020 as share markets recovered. Gold has the attractive characteristic of often moving in the opposite direction of shares, which helps to smooth returns over time and gives you the chance to rebalance when share markets fall.

We increased our allocation to gold in all of the portfolios late in early 2021 to help provide an even smoother return profile to our clients into the future.

Final thoughts

Our advice to clients remains the same as it was last year and the year before that. You can ignore market noise driven by economists, fund managers and online message boards. You can also avoid the temptations of picking stocks or trading because the odds are not in your favour.

If you stay disciplined and stick to your long term strategy of investing into low cost index ETFs, compound growth will do its job and help you build wealth in a consistent and sustainable way.