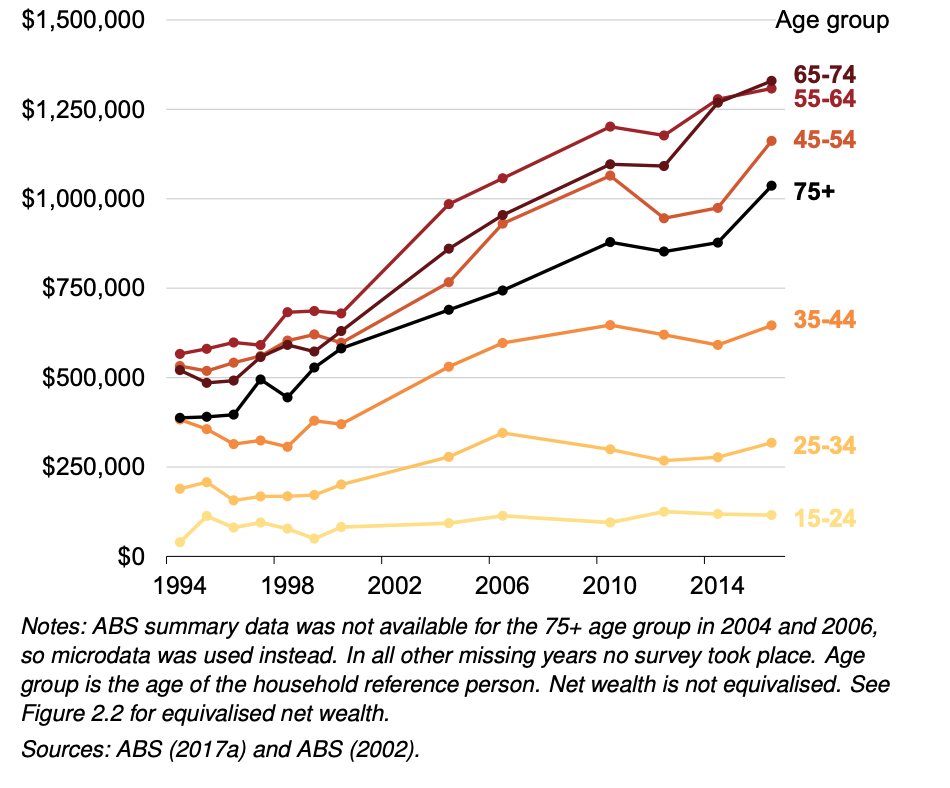

The wealth of younger Australians isn’t keeping up with the rising cost of living. According to The Grattan Institute’s 2019 Generation Gap Report, those in younger age groups have increased their wealth much slower than those who are older.

As a result, today’s young Australians are in danger of being the first generation in memory to have lower living standards than their parents’ generation.

The wealth gap between young and old is growing

The slower increase in wealth and decrease in living standards could have a lot to do with housing affordability and housing costs. Measuring housing affordability is difficult, but statistics from the Australian Institute of Health and Welfare show that many households spend up to 50% of their gross income on housing costs including utilities and rent/mortgage.

Figures like this can make it seem like it’s difficult to get ahead, but the fact is, your 20’s is actually the perfect time to start thinking about investing.

You’re young, so your investments have time to grow, and a portfolio of diversified shares and bonds has historically offered excellent investment returns compared to leaving savings in the bank.

In the video and article below, you’ll find out some tips to help you get started on your investment journey.

1) Start investing sooner rather than later

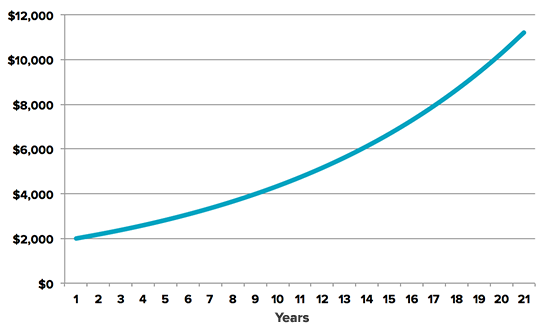

Investing in your 20s means you can take advantage of compounding.

Compound returns are like double chocolate topping for your money. Compounding allows not only your initial investment to grow, but also increases the value of re-invested profits.

For example: if you earn a 9% capital gains on your initial $2,000 investment in the first year and your profits are reinvested, you would then be earning returns on $2,180 in your second year (initial $2,000 and additional $180 reinvested).

As shown in the chart below, compounding can make a huge difference to your final balance over a longer period. Assuming a 9% growth per year (post-tax), the initial $2,000 investment would end up being $3,077 after 5 years, $4,735 after 10 years and $11,209 after 20 years with compounding. As you can see, the steepness of the slope increases over time.

This is what investment pioneer John Bogle describes as “the magic of compounding returns”.

When investing in shares or bonds, you’ll sometimes receive dividends and distributions. It’s tempting to keep these returns, but you’ll get compounding returns by re-investing the dividends and distributions you receive.

* Assumes an initial amount of $2,000 at 9% return per year

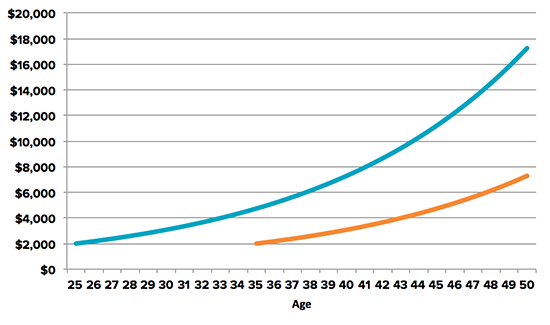

Because the impact of compounding gets bigger with time, the earlier you start investing, the better the result. Investing $2,000 at 25 as opposed to 35 could double the profit you make by the time you’re 50.

* Assumes an initial amount of $2,000 at 9% interest per year

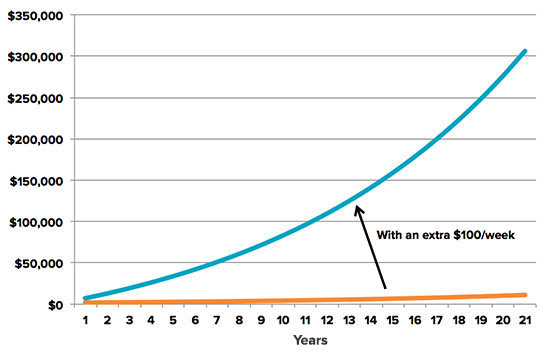

2) Invest regularly

If you start investing in your 20s, putting savings aside every month will help boost your final balance, even small amounts like $100 a week.

* Assumes an initial amount of $2,000 at 9% interest per year

Regular investments helps you take advantage of something called dollar-cost averaging to help reduce your risk. Dollar-cost averaging is a strategy to reduce the impact of volatility in the market by investing smaller amounts over time.

Because the markets rise and fall over short periods, it can be hard to pick the right time to be buying and selling, so investing regularly can help balance out how much you pay for your investments.

Investing regularly is a great way to achieve goals quicker – whether it be a new car, round-the-world holiday, deposit for a property, or a wedding ring. Plus it helps you be more disciplined with spending.

3) Diversify your investments

Many people invest by just picking a few stocks. While it can be exciting watching your stocks go up and down, being exposed to just a few companies can put your capital at significant risk. If just one of the companies faces financial hardship or disappoints the market, a significant portion of your portfolio might be lost.

Only investing in a few shares leads to a higher risk portfolio which means that you are more likely to see big swings. This can lead to you making a decision to sell because of your emotions rather than sticking to the long term plan.

One alternative to picking stocks is investing in managed funds or exchange traded funds (ETFs). These enable you to spread the risk across hundreds or even thousands of companies so you are not overly exposed to any one business.

Managed funds and ETFs can also give you access to bonds and global shares which can provide additional diversification to your portfolio. Spreading your assets (diversification) across countries and assets is important, as price falls in one country or asset class can be balanced by rises in others.

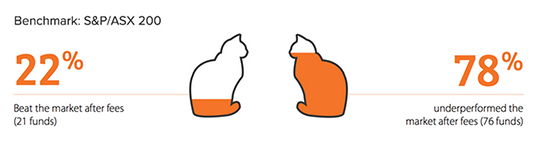

People often think that they need someone to be actively managing their investments, but active management can mean high fees. That’s why it’s worth considering “passive” ETFs.

When you start investing early, one of the key things to consider is keeping your fees low, so that you’re giving your money optimal chance to grow.

The concept of ETFs can be tricky to understand, but . when you buy an ETF, you es essentially get access to shares in thousands of companies like Apple, Google, BHP, Woolworths and Westfield so you don’t have to worry about picking the wrong stock.

By considering investing early and regularly, and by creating a diverse portfolio of investments with a range of ETFs, investing in your 20s can be an investment in your future.

Find out how Stockspot makes it easy to grow your wealth and start investing in your 20s.