“Rent money is dead money” or so the saying goes. It’s a popular myth perpetuated by plenty of people working in the real estate industry. However as at December 2020 capital city house prices experienced a modest rise of 2% total annual growth (Source: CoreLogic), but are still well below their March 2019 peaks.

When house prices drop, renting starts to look attractive again because the main benefit of owning (capital growth) disappears. COVID-19 led to a decline in rental values for certain properties in some Australian cities, with weekly unit rental amounts falling almost 6% in 2020 (Source: Domain).

But, like any financial decision, there are costs and benefits associated with both buying or renting.

Here we discuss some of the important pros and cons to consider when deciding whether to rent or buy and look at which one has really worked out better over the long term in Australia.

You can also read more about the pros and cons of paying down your mortgage here.

Pros of buying

1) Appreciation of property

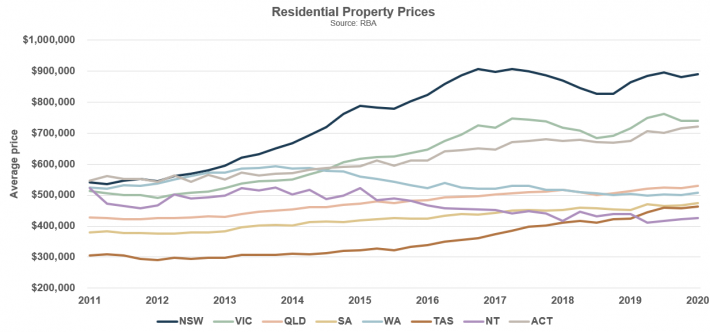

It’s hard to miss the stories that house prices have been rising, and fast over the past 5 years. The median Sydney property rose more than 14% between 2015 and December 2020 and other major cities like Melbourne and Brisbane have seen steady gains.

There are also good tax benefits for owning your own home over the long run because you don’t pay tax on capital gains on your primary place of residence.

But while house prices have consistently risen over the long-term, they can also have periods of weak growth or even fall in value. During the financial crisis, house prices in the US fell by an average of 33.8%.

There’s little tax benefit in Australia of owning your home if prices fall because you can’t claim house price losses for your primary residence against your income. Tax benefits from property tend to come from investment properties.

House owners also need to understand and be prepared to cope during periods of house price weakness.

2) You can leverage your investment

Buying property allows you to benefit from leveraging. Leveraging means borrowing money to finance an investment.

In the case of buying property, when you borrow money to buy a property, the bank lends a percentage of the purchase price to you.

In Australia, banks often lend a high percentage of the total value which means the use of borrowed money to invest in the property, or the leverage, can be quite high.

For instance, it’s typical to contribute a 20% deposit and the bank mortgage covers the remaining 80%, or an 80% Loan to Value Ratio (LVR). Let’s say you buy a property for $1,00,000 with a deposit of $200,000 and borrow the remaining $800,000.

If you sell the property a year later for $1,100,000, the property itself has risen 10% in value but your return on investment is 50% (ignoring interest and other costs) since you have made $100,000 profit on the $200,000 original deposit. That’s 5x leverage because you earned a 5x 10% return.

It’s worth noting that after transaction costs, interest and principal repayments, the actual return is likely to be much lower. Also, the opposite would be true if the house price fell from $1,000,000 to $900,000. Your profit would be -50% or worse after repayments and costs are accounted for!

3) Security and stability

Buying also provides some intangible benefits, like the security of not being displaced when the landlord decides to kick you out, and the flexibility to renovate the property.

Cons of buying

1) Interest repayments.

If rent money is dead money then interest repayments are the same. Let’s use an example variable interest rate of 3%. This means that you would pay about $24,000 of interest each year on a $800,000 loan to buy a $1,000,000 house.

That’s almost the same amount as the $27,000 you would pay to rent a similar value property for a year.

In 2020, interest rates were all time lows, which means in time, the interest rate will be higher again. This means your mortgage repayments could increase in the future, depending on the amount of principal you have left.

The RBA estimates that long term variable mortgage rates have been about 6.20% over the long term. On an $800,000 loan that would increase a typical interest bill to a whopping $49,600 vs $16,000 (2%) today.

2) Opportunity cost.

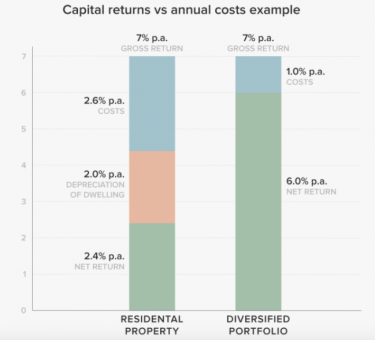

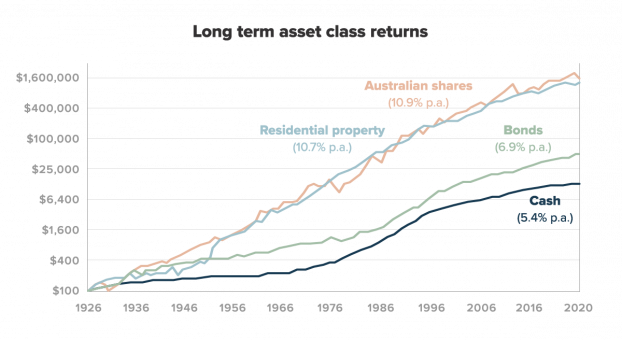

In simple terms, opportunity cost refers to the returns you could get elsewhere instead of putting down a house deposit. That could be returns from investing into a diversified portfolio (historically 8-10% per year), or investing in your own business.

3) Ownership costs.

The transaction costs of buying and selling a property are high. The RBA estimates that the costs of buying a house including stamp duty and other buying costs including conveyancing can be 4.3% on average.

The cost of selling a house including real estate agent commissions and advertising costs add up to about 3.0%. Therefore the total costs of buying and selling a house are in the vicinity of 7.3%.

And this ignores the ongoing running costs of owning a property which the RBA estimates to be at least 2.6% per year including council rates, repairs, depreciation, body corporate fees, water and insurance costs.

See more in Why property investing returns may be lower than you think.

Pros of renting

1) You can get a return on your savings

Renting frees up your savings to earn a return elsewhere and depending on where those savings are invested, you may be able to earn a higher return than would be possible in property.

When interest rates are low returns from term deposits and savings accounts fall. . Because of this, other investments like shares and bonds become far more attractive.For example a balanced portfolio of shares and bonds have historically returned closer to 6-9% over the long-term.

2) Flexibility

While owning a property provides more stability, renting gives more flexibility. This may be attractive especially for young Australians and families who may need to move from place to place due to work, or schools.

3) Diversification of investments

When you buy your own home, most (if not all) of your eggs are in one basket so to speak. Most of your total wealth could be riding on a single investment that can be impacted by a whole list of factors outside your control.

Renting allows you to spread that risk across a much broader range of investments. A typical balanced portfolio like our Stockspot portfolios contains over 1,400 stocks and bonds from around the world including property stocks. So you get the benefit of investing in property while also spreading your risk across many more investments.

Cons of renting

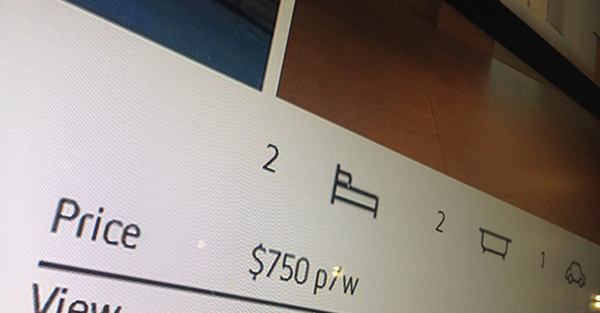

1) Rental costs

Renting can be expensive – especially if you’re renting in cities like Sydney or Melbourne. A typical total rental yield (annual rent costs / house value) for a house in Sydney or Melbourne is now 2.7% but ranges from 2.0% to 5.0% depending on factors such as location, property value and whether it’s an apartment or house.

However, the flexibility of renting means that you can shop around for a property that will give you some left over money to invest.

2) No forced savings

Unlike buying where you are forced to contribute to a mortgage each month (which includes interest and principal repayments), renting doesn’t encourage forced savings. This can make it tempting for renters to spend spare cash rather than setting it aside.

However, technology powered budgeting apps like Pocketbook and investment apps like Stockspot make it easy for consumers to budget, save and invest – so keeping up with the returns of homeowners is becoming easier for renters in Australia.

Buy vs Rent: the results

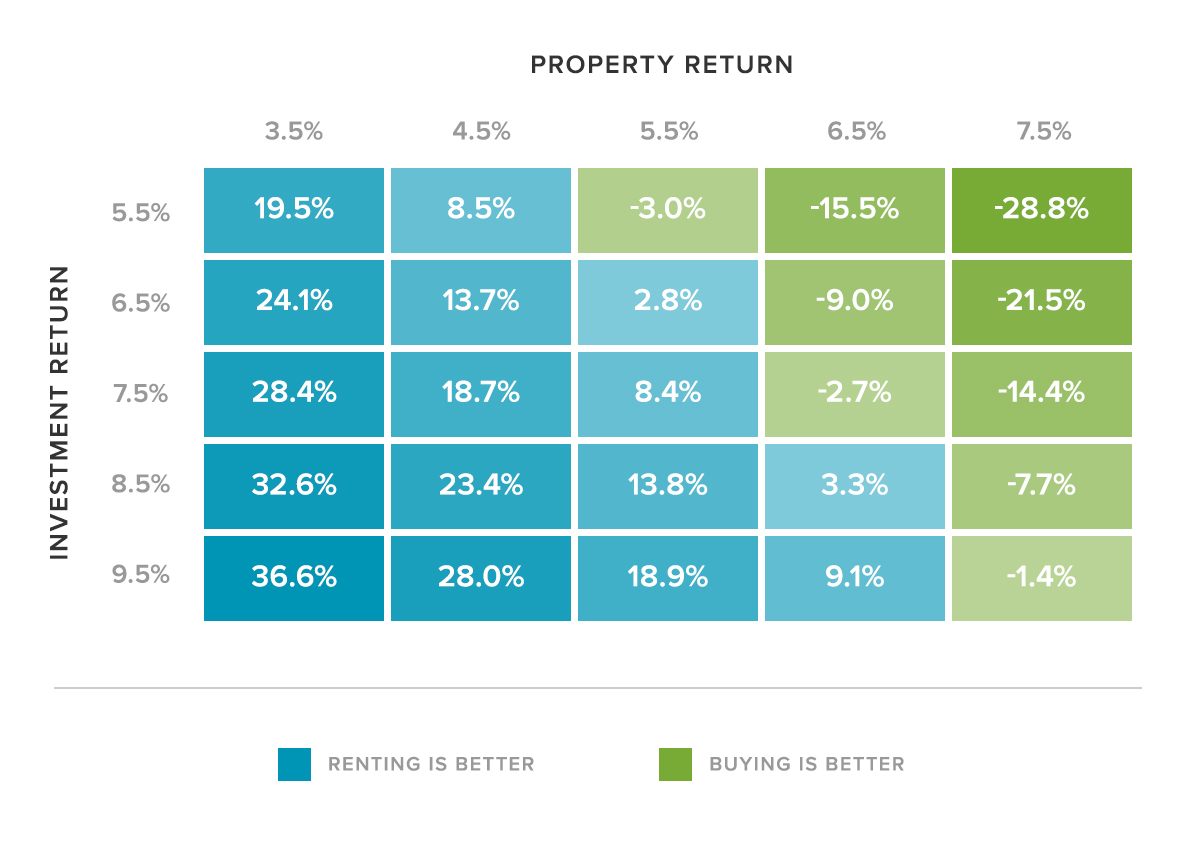

We have looked at whether someone would be better off buying, or renting and investing their savings in a diversified portfolio over the next 7 years. The results show the difference in overall financial position based on different possible return rates for property and investing and assumed costs.

A positive number shows where renting is better than buying and the percentage amount reflects the difference in returns over 7 years. Renting beats buying in 16 of the 25 scenarios and by 8.4% in our ‘base case’ of 5.5% property growth and 7.5% investment portfolio growth.

We have used a number of assumptions and different assumptions would impact these results. It should be noted that we have not considered the impact of ‘negative gearing’ which is a tax benefit that may be available if the property is held as an investment. Equally, franking credits on the share part of the portfolio have not been included in the investment returns. We also haven’t put a dollar value on the emotional benefits of owning or renting like security (owning) or flexibility (renting).

The case for buying

Over the last 5 years buying in major cities like Sydney and Melbourne has been a profitable strategy. Sydney prices have increased about 70% since 2013 so combined with 5x leverage (80% LVR), investors in property would have enjoyed a return of nearly 300% on their initial investment. That’s huge!

What are the risks? Buying with borrowed money magnifies both the good and bad. So if you buy a Sydney property today with a 20% deposit (80% LVR), the property value would only need to fall 20% in value (i.e. where prices were 3 years ago) to completely wipe out the value of your investment.

This happened to many property owners in the US between 2007-2010 when property prices fell by 33.8% between April 2006 and December 2011. US homeowners that ended up with zero or negative equity after the property collapse and couldn’t keep up with interest repayments simply ‘handed back’ their house keys to their mortgage lender and their houses were sold to cover the loan.

Where the funds recouped from sale were insufficient to cover the outstanding loan, the banks couldn’t go after the borrower for the subsequent loss because US loans are “non-recourse”.

In Australia however, mortgage loans are “recourse loans” which means that the banks can chase you for any loss they incur when foreclosing your loan. This puts Australian borrowers at more personal risk in the situation of a property bust.

The case for renting

Renting frees up your savings to invest elsewhere; either in term deposits, your business or a diversified investment portfolio. While rental yields are low (just 2.7% in Sydney compared to a long term average of 4.2%), it’s an attractive time to be renting and investing your savings somewhere else that could earn a higher return. This is why rent money isn’t really dead money – provided that savings are invested rather than spent.

Renting also enables you to avoid two big risks:

1) the risk of leverage which could mean your savings are overextended if property prices fall, and

2) the risk of poor diversification. When you buy, all of your eggs are in one basket so your wealth is almost completely reliant on the success of one asset. Renting allows you to spread those risks much more widely.

Our conclusion

Our analysis suggests renters are likely to be better off than property owners over the next 7 years based on long-term assumptions. The market cycle, property yields and the current payback period are all suggesting that now isn’t the best time to be buying.

Prospective property buyers should think twice before jumping at the opportunity to sink their savings into a house. Leverage and poor diversification make home ownership much riskier than many people assume.

The other risk is the unpredictability of interest rates. The Reserve Bank of Australia (RBA) once said that one-third of borrowers “have either no accrued buffer or a buffer of less than one month’s repayment”. This puts owners on dangerous footing if interest rates rise.

Historically, having a mortgage has forced people to save, but technology now assists everyone to budget and invest.

Sources: ABS, REIA, Global Financial Data, AMP Capital

Over the last 60 years, statistics show that owners and renters have ended up in roughly the same place. This, of course relies on renters being disciplined about investing their savings in a portfolio that will deliver them consistent returns.

Assumptions

Buying

| Factor | Long term assumption | Explanation |

| Mortgage interest rate | 6.20% per year | While current variable interest rates are around 4.5%, this is a 50-year low and average rates over the next 10 years are likely to be higher. RBA uses 6.20% in their long term assumptions. |

| Property appreciation | 3.5% to 7.5% per annum | The average appreciation rate since 1955 was 5.5% so we have looked 2% either side to account for the potential for a weak or strong property market. |

| Property ownership costs | 2.60% per year | This is an RBA estimate which includes depreciation, council rates, body corporate fees, water and insurance. |

| Property transaction costs | 6.0% | This is conservative compared to the RBA estimate of 7.30%. We have assumed 4% purchase costs which includes stamp duty / conveyancing and 2% sales costs which included real estate agement commissions and advertising costs. |

| Loan to Value Ratio (LVR) | 70% | This is roughly the national average which varies from 65% to 75% by state. |

| Loan term | 30 years | Typical mortgage loan term |

Renting

| Factor | Long term assumption | Explanation |

| Rental yield | 4.20% per year | Long term average since 1955 has been 4.20% compared to 3.90% now. |

| Rent increases | 2.80% per year | Assumes rents increase in line with the RBA expected inflation rate. |

| Investment portfolio return | 5.5% to 9.5% per annum | The 10 year rolling average return of a balanced portfolio after fees was about 7.5% so we have looked 2% either side to account for the potential for a weak or strong stock market and bond market. |

This article was originally posted in April 2015 and has been re-published with updated information in February 2021.