Meet Paul Turner

Hi there, my name is Paul Turner. I’m a plumber in my late 30s living in Melbourne.

Since leaving high school I have worked in construction. In my 20s I lived a nomadic life travelling to more than 50 countries. I’ve lived overseas in five Australian states and territories.

I am now settled in Melbourne with my partner Flic and nine-month-old daughter Isla. We have recently purchased our first family home in the leafy suburb of Frankston South.

“My advice when investing is don’t chase the big fish. Catch little ones constantly and watch your wealth grow over time.

Why I decided to trust Stockspot with our investment portfolio

In my 20s I lived a full life of travelling the world, partying, and making bad investment decisions! By the time I reached my early 30s I was seeing all my friends’ buying houses. I started to think maybe I should take care of my money.

The lightbulb moment was listening to episode 12 of a podcast, The Minimalist Podcast. They spoke about compound interest and how it would change your life. Knowing my track record with previous stock picking on the ASX I was not interested in individual stocks. I also understood that term deposits weren’t bringing in the returns they previously did.

After discussing my curiosity of compound interest and investing with a friend he pointed in the direction of Stockspot. He had just opened an account with Stockspot and explained that I didn’t need to know about investing. All I needed to do was make regular deposits into the account and all the investing was done for you.

I was nervous to begin with. My initial investment of $2,000 sat there for a bit until I started to see it grow. From there I made regular deposits to recently having my savings automatically go in each pay day.

Long story short, my money is working for me. I don’t need to spend my spare time reading news about what’s the next big thing on the ASX.

The Stockspot sign up process was very easy

The Stockspot sign up process was very easy. Stockspot asks you questions which help to trigger your understanding of your investment goals. They ask you what you really want to achieve with your money during your investment journey.

To invest with Stockspot is like using a bank account except the team are friendly, helpful, understanding, and accessible. They also produce great returns on your money.

Achieving my investment goals

Since my first investment in 2017, I have achieved above my investment goals. I am on track to achieving my goal of financial freedom by age 50.

What I like about Stockspot

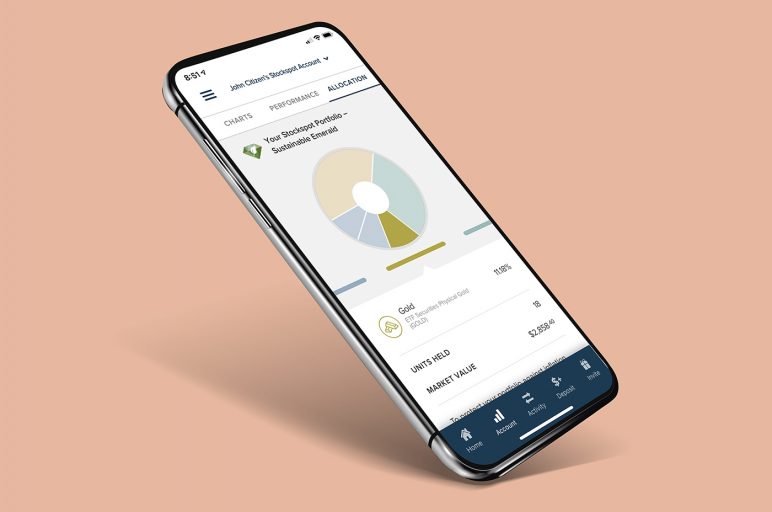

Stockspot is an easy-to-use investment platform. It allows you to make regular contributions to your account that is getting invested on your behalf without you lifting a finger. I like that. I can focus my spare time on family, friends, and health rather than worrying about money.

My money tips for people considering investing

My advice when investing is don’t chase the big fish. Catch little ones constantly and watch your wealth grow over time.

Use the set and forget method of automatic transfer each pay, and you won’t even know your investing.

Anyone who is leaving their investment savings in the bank is crazy. In my opinion if your money is not beating inflation then you are losing money. Stockspot’s track record proves that it brings great returns constantly – even riding big waves like COVID.