Kids invest for free with Stockspot – find out more here!

Raising a child is one of the biggest costs a family will face, and it helps to be financially prepared for it. Here we look at the cost of raising a child in Australia.

While it’s common knowledge that children bring indescribable joy to their families, they also come at a large financial cost. The most recent NATSEM report1 found that the cost of raising a child has risen twice as fast as incomes over the last 8 years. Meanwhile the median age of people moving out of home is currently at 20.9 years which is as late as its ever been.

If these trends continue, the importance of having a sensible budget and savings plan in place to ensure the best for yourself and your kids is critical.

Here’s what you can expect to fork out along the road ahead…

0-2 yrs: Infancy

On average, parents will spend $144/week on their child which equates to $14,976 over 2 years.

From the moment your bundle of joy takes its first breath, you will begin to spend money on items you never knew existed.

You’ll need…

- A pram – setting you back anywhere from $150 to $1,599 if you’re after a top of the range 4 wheeler that offers ‘a mix of pure function with Italian style’.

- A cot – setting you back anywhere from $100 to $600 (mattresses sold separately).

- A car seat – generally priced between $100 and $400 (depending on weather or not your child needs cup holders).

- A baby carrier, bedding, clothes, medication, vaccinations, food, toys, bottles, dummies, baby wipes and nappies… mountains of nappies.

During their first year of life babies can go through up to 10 nappies a day. If you factor in wipes, this department alone can cost up to $2,000 in the first year. When you look at it this way, toilet training will eventually take on a whole new meaning.

3-5: Childcare

On average, parents will spend $26,000 over these 3 years.

The Australian Paid Parental Leave scheme gives eligible employees who are the primary carer of a newborn or adopted child 18 weeks’ leave paid at the national minimum wage. Once the 18 weeks are over, parents have to decide whether to go back to work and use childcare services, or take unpaid parental leave.

As a result, childcare presents a major cost to many families up until a child’s first day of kindergarten and a full day of childcare can cost up to $170 a day.

While the federal government is addressing childcare in this year’s Budget to help offset some of these costs, steep childcare costs can act as a disincentive for a secondary earner to work, especially if take-home pay only just covers childcare spending.

On top of childcare, these munchkins will be eating more food, growing into larger clothes sizes and demanding the newest iPad.

6-12: Primary school

On average, parents will spend just over $82,000 on a child during these 7 years.

Transport becomes a major cost contributor during the primary school ages. Running the kids to after-school piano lessons, karate, and Saturday sports such as soccer, netball, tennis and footy can account for a sizeable portion of the weekly fuel budget. Not to mention all the necessary gear. All up, parents can expect to spend almost $79,500 in transport expenses per child from birth to move out day.

Food also accounts for a significant portion of the household income during these years as kids go through one growth spurt after another. On average, families can expect to pay around $70,000 on food per child over the course of their time spent in the family home.

Other items like school excursions, uniforms, birthday party gifts, clothes, shoes and recreational items like bikes, trampolines and computers start to add up.

During this time, you’re likely to find yourself spending more on lessons and activities too.

13-18: High school

On average, parents will spend close to $131,300 on a child during these 6 years.

The main cost during this age is education.

NATSEM estimates that private schooling costs parents an average of $216 per week in fees, compared to an average of $81 for Catholic schools or $12 a week for government schools. The Private vs. Government vs. Catholic school choice is a major one for parents as after 6 years of high school, the total cost ends up being around $68,000, $25,000 and $4,000 respectively per child.

With such a huge focus on education during these years, many kids will also attend before or after-school private tutoring. Regardless of whether it’s for extension maths, french or playing the piccolo, a single tutoring session can cost parents up to $80 an hour.

19-Moving out: University, TAFE, further training

On average, parents could spend up to $150,000 during their time at university if fees are paid upfront and the child continues to stay at home.

Australian Bureau of Statistics (ABS) says that of the 54% of Australians continue to study beyond high school, either at universities or end up studying for certificates and diplomas at other institutions.

Those who choose to take advantage of the government’s Higher Education Loan Programme (HELP) can reduce this cost, but there are still costs associated with textbooks and travel.

Another way to help with the cost is for the child to get a part-time job, which will also benefit them in gaining work experience.

The moral of the story

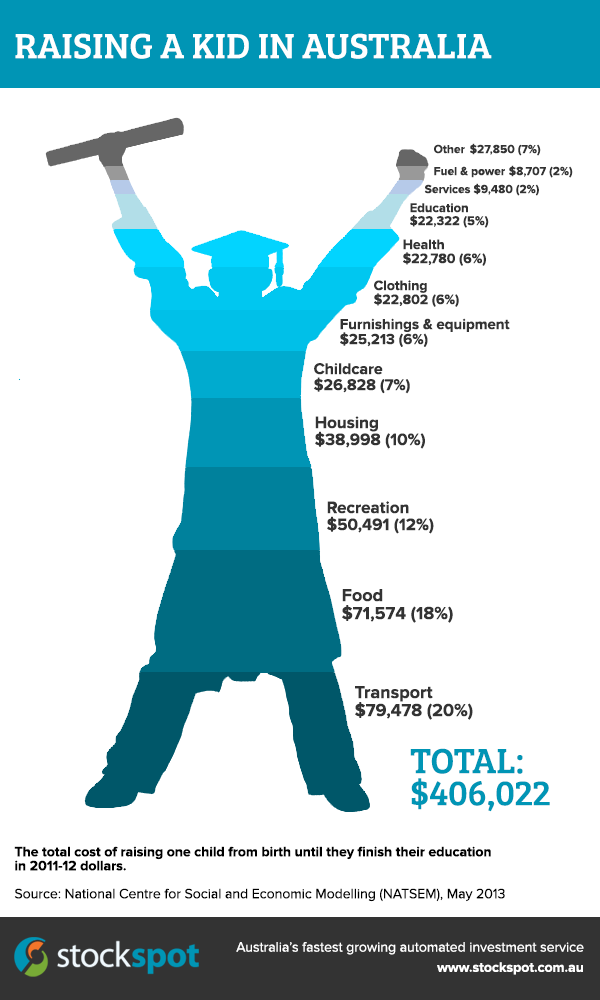

How much does it cost to raise children in Australia? The cost of bringing up a child for a typical middle-income family sits at approximately $406,0001, so it’s wise to get a handle on your finances as early as possible.

ASIC’s MoneySmart Savings Goal Calculator estimates that a $1,000 upfront investment in a diversified portfolio earning 7% pa, plus a regular contribution of $100 a week, could give parents an education fund worth $100,000 by the time their child is ready for high school.

What to consider when investing for a “kids” fund

Compounding returns

Compounding returns means your interest and dividends earnings are re-invested, which enables you to achieve additional returns over the long-run. High fees can have the opposite effect, eroding your investment balance over time. Striking the right balance between returns and fees is vital and can have a meaningful impact on the final investment balance. Check out our investment calculator to see for yourself.

Ability to invest regularly

Make sure that the option you choose allows you to easily invest for your child on a regular basis without incurring fees like entry fees or brokerage. (We don’t charge entry, exit or brokerage fees – in fact, we don’t charge any fees for kids investment accounts, up to $10,000).

Ability to withdraw money as it’s needed along the way

As your kid reaches the various stages in life, you’ll need to start drawing on the money in the fund. Therefore, it’s important that the funds are not tied up in illiquid assets that can’t be sold easily and in small pieces. Property is one investment which typically can’t be sold slowly over time – whereas shares and bonds allow for small frequent sales. Again, try to avoid any investments that charge exit or brokerage fees when withdrawing the funds.

Educating your kids about money

Educating your kids about saving and investing early will set them in good stead for their own financial futures. Encouraging them to establish effective saving habits early could even mean they’ll be financially independent sooner rather than later! A portfolio that they can login to online is also a great educational tool that helps them learn about investing. Here’s an example of the Stockspot dashboard:

Start early!

Investing smart and investing early can mean the difference between scraping the barrel and having enough of a cash cushion to live comfortably as you raise your children.

Find out how Stockspot makes it easy to help the little people in your life get a great financial headstart!