Stockspot portfolios spread investments across thousands of stocks to help reduce risk and balance out companies having inevitable bad years with others doing well.

See how our investments are spread across regions, asset classes, and sectors to help our clients achieve their goals.

Find out more about Stockspot portfolios, including our positive returns across 1, 3 and 5 years.

Investment by Region

All of the Stockspot model portfolios presently have between 55% and 64% of their holdings in Australian shares and bonds. This helps to limit the impact of short-term currency movements on the overall portfolio value.

An allocation to overseas investments is also important to reduce the reliance on Australia and benefit from other economies which may be performing well when Australian companies are not.

Performance across regions

Between 2010 and 2020, most global share markets have performed better than Australian shares. This has benefited those with an international allocation in their portfolio. Even when Australian shares start to perform well again, owning some international shares helps reduce the overall risk.

Find out more about the importance of Australian shares in your portfolio

Investments by asset class

An asset class is a group of investments based on similar characteristics or attributes. The Stockspot Portfolios have 3 key asset classes:

- Shares – investing in publicly traded companies (i.e. becoming a part owner in a business) in order to achieve a return.

- Bonds – a type of loan to a government or company in return for income in the form of interest. Bonds generally cushion your portfolio when shares fall.

- Gold – a precious metal and popular investment that’s used as a hedge against currency debasement and inflation.

Find out more about the role of the above asset classes and how they work together.

A fully diversified Stockspot portfolio contains Australian shares, global developed market shares, emerging market shares, Australian bonds and gold. We use different ETFs (exchange traded funds) to gain exposure to these asset classes.

For portfolios less than $10,000 we phase in each of the 5 asset classes. We start with Australian shares and bonds then phase in gold, emerging and global market shares as portfolios near $10,000. This helps to ensure that all investments are made in “marketable” denominations under ASX Rules. Investing in this way allows us to appropriately manage the level of risk versus return for the amount of funds invested.

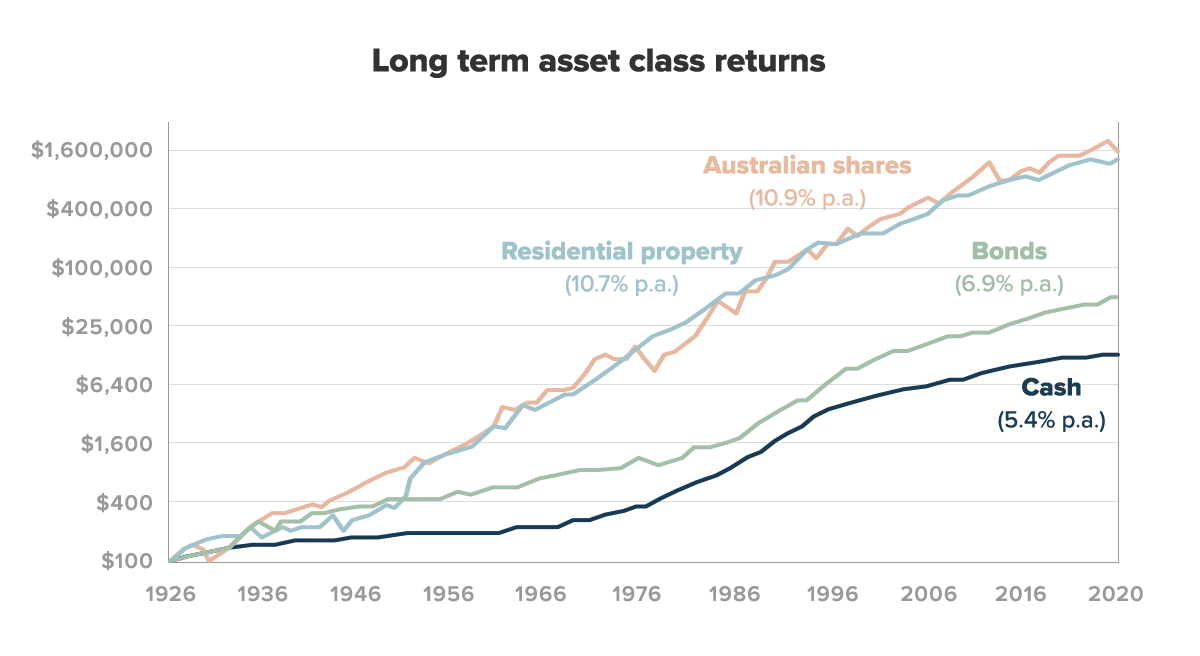

Performance across asset classes

The graph below illustrates how different asset classes have performed in Australia since 1926.

Investments by sector

Sectors are groups of companies that are defined in a certain industry based on their principal business activities. For example, the Australian market has a higher allocation to finance and materials, whereas the U.S. has a larger weighting to technology and healthcare.

An allocation to global shares means that the Healthcare and Information Technology sectors feature in the Stockspot strategies more than they would in most Australian-only portfolios.

Our 14.8% allocation to gold across all of the strategies helps to reduce risk and steady returns during times of market turmoil.

Performance across sectors

Performances among the sectors go through cyclical peaks and troughs based on different economic conditions and consumer patterns.

Over the last 10 years, technology companies and consumer-focussed companies have benefited from the rise in digital innovation and increased purchasing of consumer goods

Australian technology stocks delivered a return of over 52% p.a. over the last decade, while the consumer sector returned over 12% p.a.

In contrast, in the previous decade (2000 to 2010), materials and utilities were the market leading sectors up 14% p.a. and 7% p.a. respectively.

Financial companies have had muted returns over the last 10 years because of lower interest rates and reduced profit margins. The energy sector was the worst performer over the last 10 years due to price declines in commodities like oil and growing interest in renewable energy.

Finally, healthcare has become a greater component of global markets due to an overall ageing population and the rollout of COVID-19 vaccines. These two tailwinds have fueled decent returns in the health sector over the last 10 years.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.