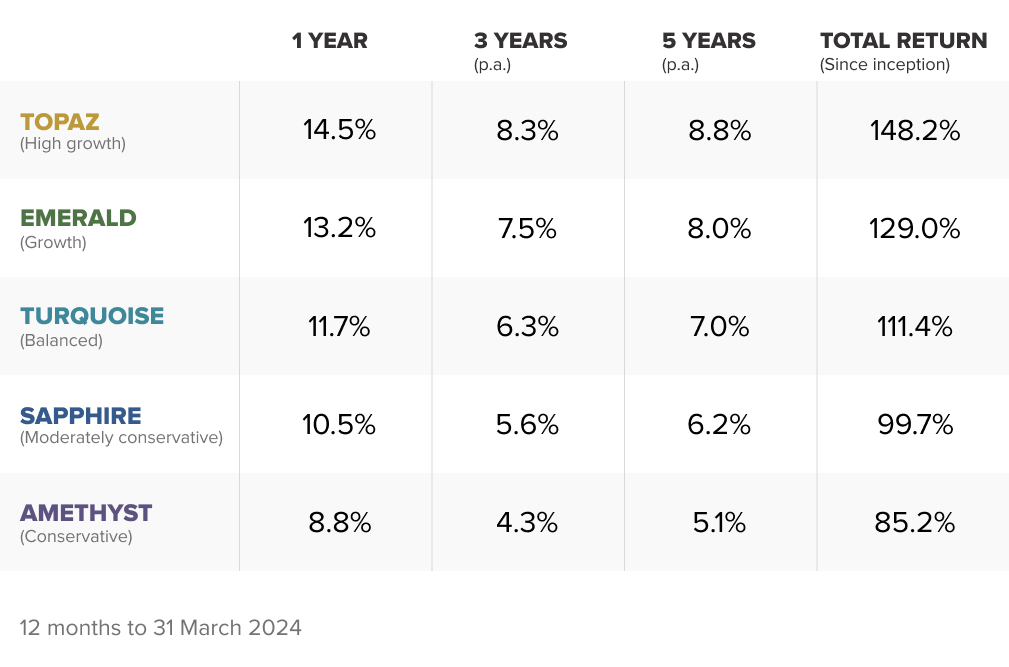

The Stockspot Model Portfolios returned 8.8% to 14.5% after fees over the 12 months to 31 March 2024, while the Stockspot Sustainable Portfolios returned 12.2% to 19.5% after fees.

The Stockspot portfolios have also outperformed 99% of similar diversified funds in Australia over the last 5 years.^

^Stockspot, morningstar.com.au comparison group of 373 surviving investment funds and their after-fee returns over the 5 years from 1 April 2019 up to 30 March 2024. Comparison is based on the after-fee returns of a Silver tier investment in either Stockspot Amethyst, Turquoise or Topaz portfolios (our most popular portfolio in each risk category) on the basis that they have similar exposure to growth assets to the moderate, balanced and growth multi-sector investment funds that have been compared. Past performance is no indication of future performance.

Our recently launched Topaz Income Portfolio and Topaz Inflation Portfolio delivered returns of 10.2% and 7.5% over six months, having been introduced in October.

The Topaz Inflation Portfolio experienced strong performance in March, buoyed by ongoing inflationary pressures evident in economic data. These factors have reduced the chances of interest rate cuts in the U.S. and Australia this year.

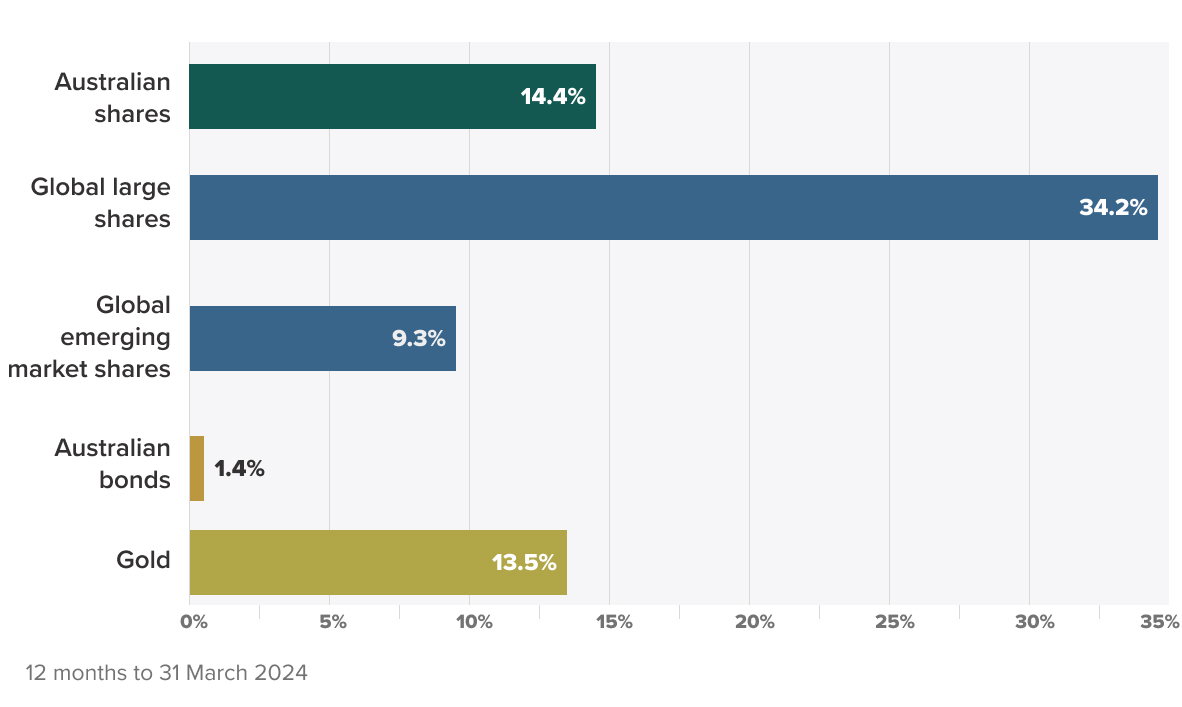

Investment asset returns

Australian shares exceeded expectations during the recent reporting season despite analyst forecasts of a sluggish economy and higher household borrowing costs. Our local market rose by 5.7% for the quarter to post an annual return of 14.4%.

Globally, large cap shares saw continued growth driven by the technology sector, with an impressive 16.0% gain for the quarter and 34.2% return for the year.

Emerging markets demonstrated stronger performance this quarter, boosted by a resurgence in Chinese shares, contributing a significant 7.1% increase for the quarter and 9.3% gain for the year.

Bonds were flat for the quarter and year while gold rallied 11% in the quarter to post a 13.5% return over 12 months. Gold continues to perform strongly relative to other safe-haven assets like bonds.

Diversification in action

This quarter provided a vivid demonstration of the power of diversification in action. In early March, Australian shares suffered a significant 1.8% sell-off, marking their worst day in a year, mirroring a 1% drop in the U.S. market triggered by a weaker-than-expected jobs report.

Despite this downturn in the stock market, three other assets within the Stockspot portfolios experienced gains on the same day. Bonds showed a slight increase of 0.1%, emerging market shares saw a rise of 0.6%, and gold surged by 1.4%.

The key takeaway here is the importance of diversification across various asset classes. While shares can offer substantial gains in favourable economic conditions, a well-constructed portfolio must navigate diverse economic environments.

Assets resilient to negative economic news can help mitigate volatility and uncertainty, even though they may occasionally lag behind the stock market. Diversification involves acknowledging economic uncertainties while maintaining the confidence to invest throughout market cycles.

Investing with persistent inflation

In the past month, worries about inflation have resurfaced following economic data showing a rebound.

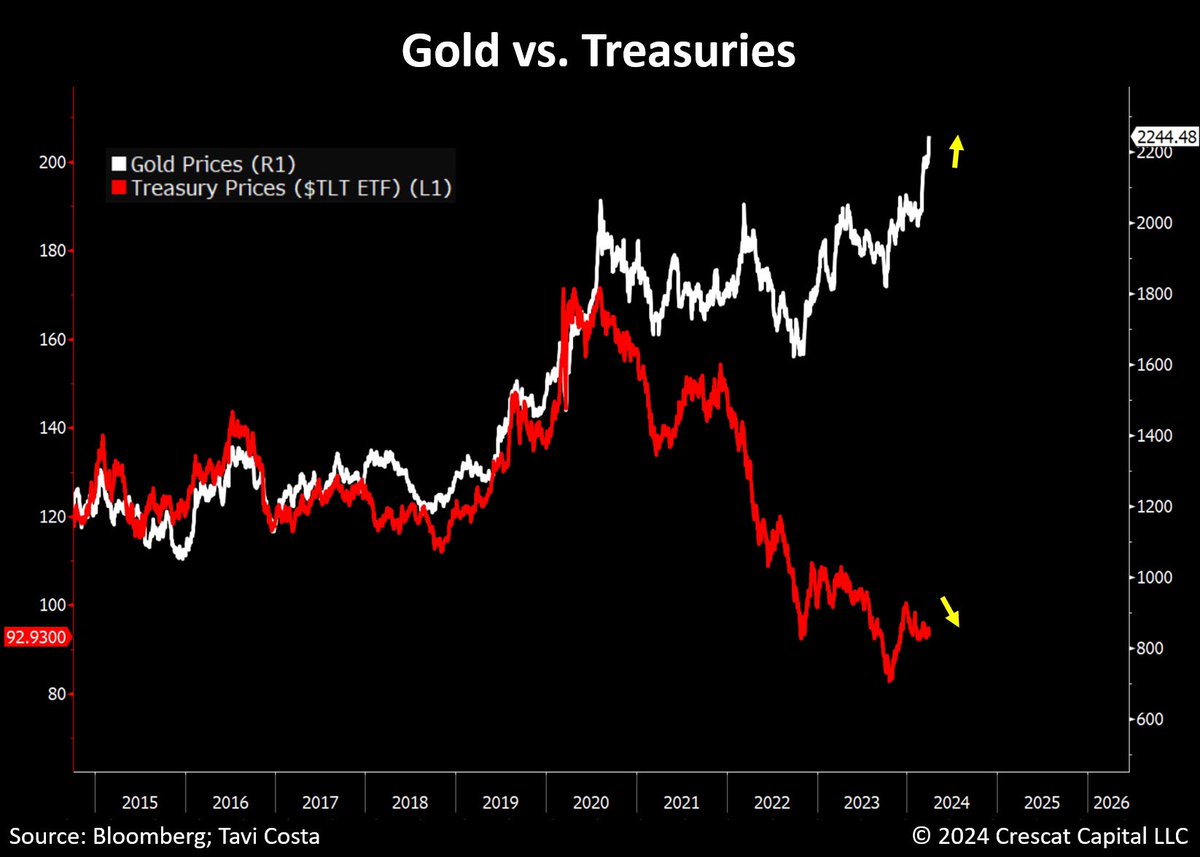

Typically, this would lead to a negative reaction in gold prices, as higher inflation often implies higher interest rates, increasing the opportunity cost of holding non-income-generating assets like gold.

However, in a fascinating turn of events, rising inflation expectations have been viewed as negative for government bonds but positive for gold.

This divergence in performance between gold and government bonds is reminiscent of market dynamics seen in the early 1970s and signifies a significant shift. This shift is particularly pertinent today, considering the low exposure to gold within conventional investment portfolios managed by super funds, financial advisers, and asset consultants.

Credit: Tavi Costa, Crescat Capital

Despite gold’s high liquidity, inflation protection, and robust diversification qualities, it remains underrepresented in many portfolios. We believe this oversight needs reassessment. Continued divergence between gold’s performance and real interest rates is likely to prompt a reevaluation of portfolio allocations, potentially shifting more assets from government bonds, cash and other defensive assets into gold.

We continue to believe our current 14.8% allocation to gold across all Stockspot portfolios is prudent in the current market environment.

Stockspot comparison group is defined by the Morningstar multi-sector asset allocation ranges: Growth (61%-80% growth assets), Balanced (41%-60% growth assets) and Moderate (21%-40% growth assets).