What is a recession?

A recession is a period of economic downturn that typically occurs after six months of negative growth. As the economy slows down, consumer demand tends to fall, which generally results in businesses producing fewer goods and employing fewer people.

Australia has had four recessions in the past 50 years (1974-1975, 1982-1983, 1991-1992, and 2020). Even though recessions occur nearly every decade, it’s important to have an investment strategy to handle these market conditions when they happen.

What are the best stocks and ETFs to buy during a recession?

Some investors try to pick which stocks will rise during a recession. This is not as easy as it sounds, as recessions can occur for different reasons. A recession could be caused by a sector (such as the housing market in the 2008 global financial crisis) or an economic factor (such as inflation and an oil crisis in the 1970s) or a combination of many things.

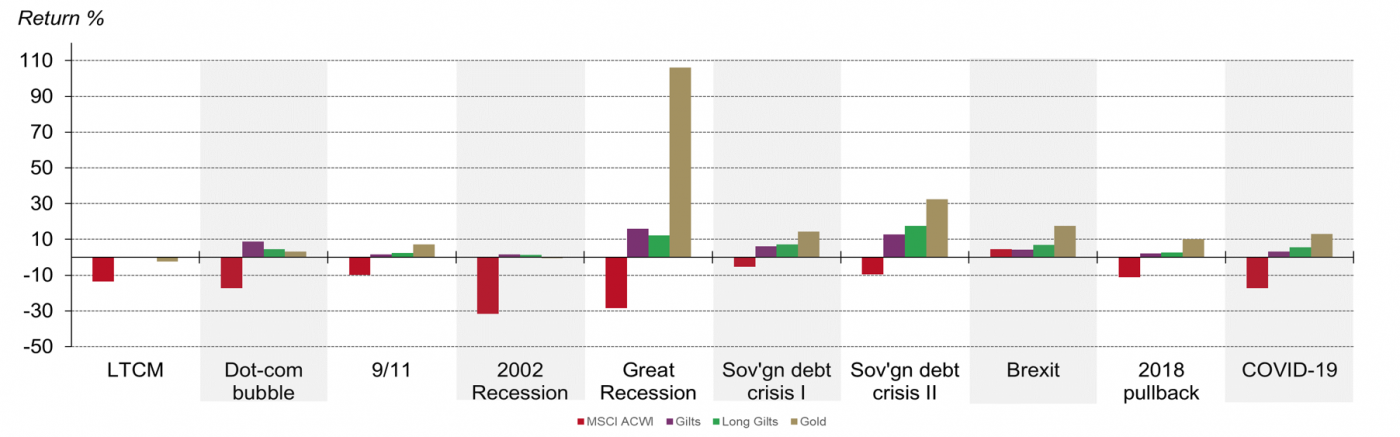

Historically, defensive assets such as bonds and gold have provided protection for investors during troubling economic times. Commodities, like gold, are strong performers in recessionary environments as investors seek safe-haven assets.

Gold was up during the last three U.S. recessions: the dot-com bubble (+5%); the global financial crisis (+100%); and the COVID-19 pandemic (+11%).

The Stockspot portfolios have an allocation to the Global X Physical Gold (GOLD) for our preferred gold ETF exposure.

When buying shares, defensive sectors such as consumer staples, healthcare, energy and utilities can provide some protection. For example, consumer staples can do well as these companies supply consumers with goods that they purchase regardless of economic conditions (for example, food, household goods, and hygiene products). Stockspot offers the iShares S&P Global Consumer Staples ETF (IXI) as our preferred consumer staples ETF, which we offer to clients as a Stockspot Theme.

Investors may also want to consider having their money invested in cash. As the saying goes, “cash is king”, especially during recessionary times. However, if the recession is caused by rising inflationary pressures and interest rates remain low, then the after-inflation return you are getting on your cash may be negative. We offer the BetaShares Australian High Interest Cash ETF (AAA) as our preferred cash ETF, which we offer to clients via our Stockspot Savings product.

Where are Australians investing during a recession?

Many Australian investors seem unphased by a potential recession and have continued to top up their portfolios according to the latest ETF flows data. We’ve seen the same with our Stockspot clients too. There have been consistent inflows into broader Australian and global share market ETFs.

Global share ETFs still make up the lion’s share of investor allocations, accounting for 64% of the total year-to-date market flows.

Australian investors have been buying bonds consistently, due to potential protection in down markets and the rising yields. Despite bonds having their worst start to the year in decades, Australians have added over $1.7 billion into bond ETFs so far this year, making up 19% of the total amount of money flowing into ETFs. The Stockspot portfolios have an allocation to the iShares Core Composite Bond ETF (IAF) for our preferred bond ETF exposure.

Gold ETFs have also seen a notable increase in flows since the start of 2022. Investors looking to protect their portfolios against inflation have poured $275 million into gold ETFs in 2022. This follows a similar trend to the COVID-19 period where investors piled $1.3 billion into the precious yellow metal in 2020. Cash ETFs have suffered since 2020 in a world of falling interest rates, with flows still negative in 2022. However, recent rate increases by the Reserve Bank of Australia have seen a resurgence in cash ETFs, now that they are paying more than 2.5%.

Tips for investing during a recession

Past recessions show that markets don’t always go down. In fact, many recessions lead to markets going up. How is this possible? The bad news is often already baked into stock prices, and as we saw in 2020, the share market and economy are not always in sync with one another. For example, over the last 100 years, the U.S. share market has, on average, had positive returns during recessions.

| Recession Period | Returns 6 months prior to recession | Returns during recession |

| Nov 1948 – Oct 1949 | 9.8% | 4.1% |

| Jul 1953 – May 1954 | -6.5% | 27.6% |

| Aug 1957 – Apr 1958 | 9.3% | -6.5% |

| Apr 1960 – Feb 1961 | -1.0% | 18.4% |

| Dec 1969 – Nov 1970 | -7.8% | -3.5% |

| Nov 1973 – Mar 1975 | 2.9% | -17.9% |

| Jan 1980 – Jul 1980 | 7.7% | 16.1% |

| Jul 1981 – Nov 1982 | -1.0% | 14.7% |

| Jul 1990 – Mar 1991 | 3.1% | 7.6% |

| Mar 2001 – Nov 2001 | -17.8% | -7.2% |

| Dec 2007 – Jun 2009 | -2.3% | -35.5% |

| Mar 2020 – Apr 2020 | 1.9% | -1.1% |

| Avg | -0.2% | 1.4% |

Predicting when a recession might start and end is hard, and predicting how the share market will react is even harder.

Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.

Peter Lynch

Bull markets (i.e. periods when share prices are rising) typically start during a recession, which is when you want to be invested in the market.

It can be tempting to make changes to your portfolio by adding recession-proof stocks or ETFs in the lead-up to a recession. However, simplicity is usually the best approach.

We believe the best way to invest during a recession is to stay disciplined and have a mix of stocks, bonds, gold and cash to handle volatile times.

It’s this philosophy that underpins the way Stockspot invests money for tens of thousands of Australians. The Stockspot portfolios protected investors by 50% to 80% during the COVID-19 recession in 2020.

Recessions are temporary and normal. After the short-lived recession, economies then experience a recovery and subsequent expansion as part of the normal cycle. No one knows how long each cycle will last.

Instead of trying to predict the market, prepare yourself by having a portfolio that can withstand any market conditions. It’s the simple, yet effective, way to recession-proof your portfolio.