Kids invest for free with Stockspot – find out more here!

Childcare costs have become an increasing financial burden on Australian families with fees rising 150% in the past decade.

According to National Centre for Social and Economic Modelling, almost one in 4 Aussie kids attend childcare today at an average cost of $75 per day, with some families paying up to $170 per day. This is up from an average of just $30 per day in 2003.

The charges have risen so significantly that parents who choose to return to full-time work can now expect to lose up to 60% of their gross income, once private childcare fees, loss of benefits and higher income tax rates are accounted for.

A recent estimate from the Australian Bureau of Statistics (ABS) predicted that the expense of childcare was now keeping as many as 70,000 women out of work. That means that proportionally, Australia has less working mothers than the UK, US, Canada or New Zealand.

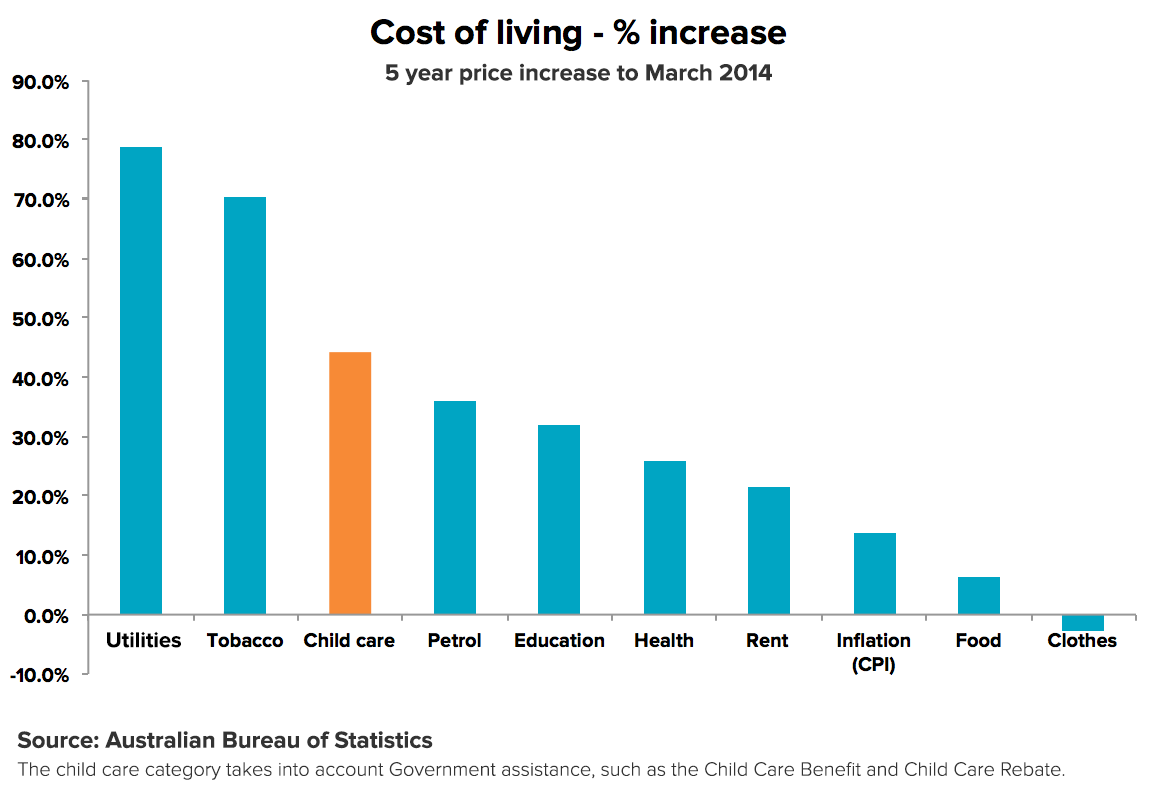

When compared to the main cost of living categories monitored by the ABS, only 2 other expenses (utilities and tobacco) have had a greater price increase since 2009. Childcare costs even rose 12% more than education costs over that period.

And the trend is set to stay, with the Federal Government forecasting further price hikes of about 7% each year for the next 4 years. With such high fees, it’s crucial that Australian families understand the costs involved so that they can plan for the expense of childcare and start saving early for it.

What childcare costs could I expect to pay?

The average family who has one dependant in childcare for 4 years would need to budget for approximately $25,328 in fees, after the government Child Care Benefit (CCB) and Child Care Rebate (CCR) subsidies are taken into account. This is assuming their childcare facility charges a rate consistent with the current national average and excludes additional costs like food and nappies, which are sometimes charged separately.

| Year 1 | $5,705 |

| Year 2 | $6,104 |

| Year 3 | $6,531 |

| Year 4 | $6,988 |

| Total | $25,328 |

Note: Based on an average of $4,352 in 2013 plus a forecast increase of 7% per year

If the facility was to charge $170 per day, like some centres in inner-city Sydney, that would skyrocket to $57,410.

Even parents returning to work part-time and staying home 2 days a week would need to put aside $16,000 on average.

How can I get started saving?

Starting early is the best approach to save up for any large expense. Setting aside dedicated savings as soon as you plan to start a family will give you the benefits of:

- Maximising the time you have to reach your required savings target.

- Taking advantage of compounding returns. This means you can generate additional returns on any reinvested earnings that are made on your earlier savings.

In deciding where to place those savings, consider factors like potential returns, risks, fees, recommended investment timeframes, tax implications and ease of access.

Whilst having cash in savings accounts or term deposits are low-risk options, interest rates are currently at all-time lows. This means that the childcare costs are probably rising much faster than the interest you’re earning.

Another alternative is to invest some savings into a diversified portfolio of shares and bonds. One benefit of investing savings into growth assets like shares is that the returns have historically been higher than bank interest over the medium term.

Diversification can help reduce some of the bumps (volatility) of your capital over time however it’s important to understand that investing in shares and bonds always involves some risk and requires an investment horizon of at least a few years to improve the chances of a positive return.

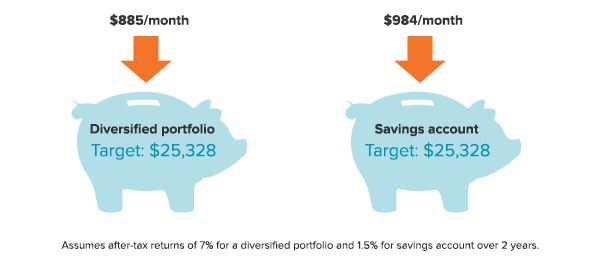

We calculated that a household would need to put $885 per month into a diversified portfolio for 2 years in order to save up for child care costs of $25,328. This assumes an after-tax return of 7%, which is consistent with how diversified portfolios have performed over the past 20 years but may vary as markets can go up and down.

On the other hand, the same household would need to deposit $984 per month into a bank savings account to accumulate the same total. This assumes an interest rate of 1.5% after-tax.

There are many ways to save up for childcare costs but it always pays to start early. Setting up a direct debit or regular transfers to your selected bank or investment savings account will stop you from forgetting or finding something else to spend those savings on.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.