Rafael Nadal just equalled Roger Federer’s record of 20 grand slam men’s singles titles with his latest French Open victory. In his final match against Novak Djokovic, Nadal only hit 31 winners to Djokovic’s 38, but was still the winner: 6-0, 6-2, 7-5.

So what does this have to do with investing?

Nadal only made 14 unforced errors to Djokovic’s 52.

This is where the lesson is: it was the fewer unforced errors, not the winners, that won the game.

Tennis is an exciting game, mainly because of those memorable winning points. But a player who can consistently get the ball back into the court knows eventually, his opponent will miss. The stock market is also exciting. But as with tennis, winning the investing game is not about trying to hit winners, but cutting out unforced errors.

Some common unforced investing errors include:

- not diversifying enough

- missing out on defensive assets

- only focusing on income

- trading too often.

In this performance update we show you how the Stockspot portfolios have minimised unforced errors, and how this allowed the portfolios to outperform every equivalent diversified fund in Australia over the last 5 years.

Why do portfolios need to be diversified?

Many investors focus on a few areas and invest heavily into them. For example a large portion of Australians only own Australian shares or property. Unfortunately, a strategy like this means your investments aren’t properly diversified.

The Stockspot portfolios include 5 different asset classes including two defensive assets (investment grade bonds and gold). The aim of the defensive assets is to provide a cushion to reduce the impact of market bumps when growth assets like shares perform poorly.

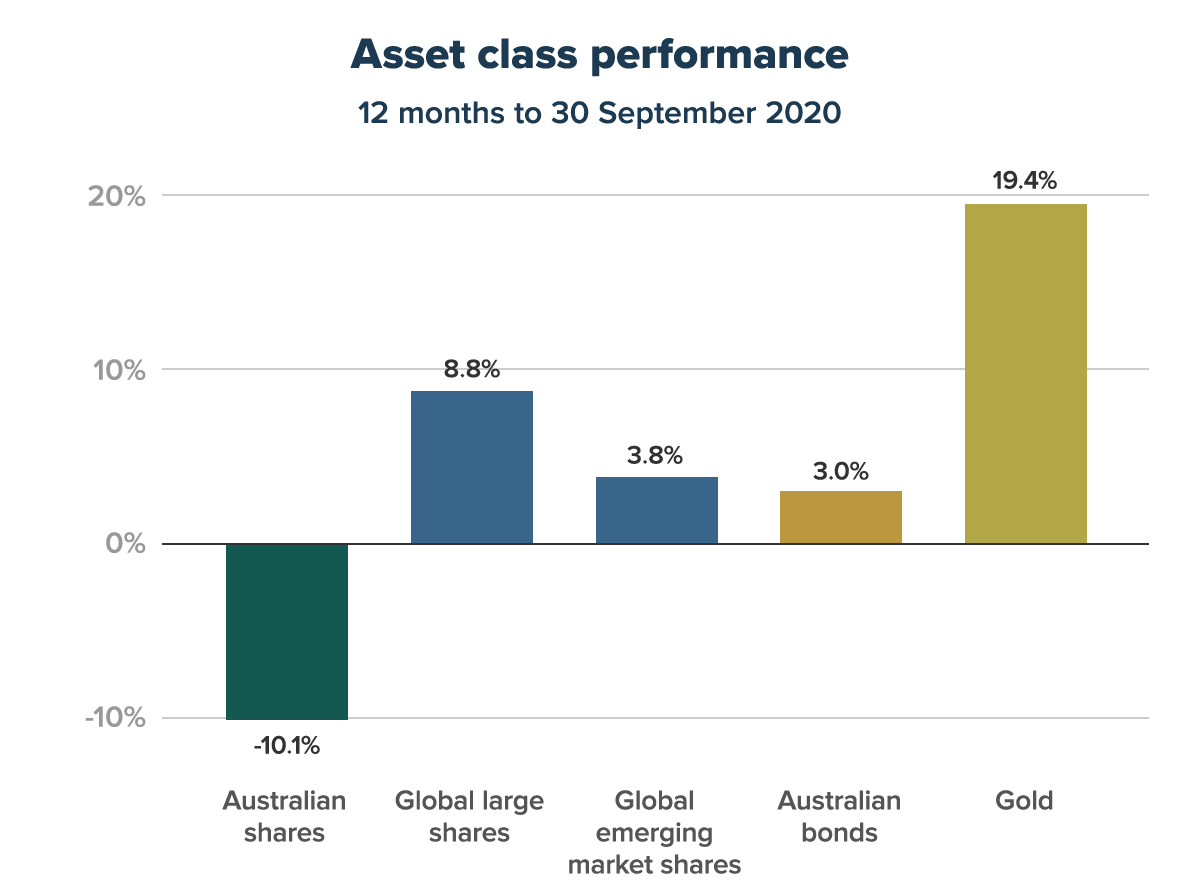

Over the last year, Australian shares performed poorly, posting a -10% return. Other assets like global shares and gold helped to offset Australian shares and keep the portfolios positive.

Can you diversify too much?

The flipside of poor diversification is too much diversification. It can also be tempting to diversify too much – by owning 10 or 20 different funds in your portfolio. This adds more complexity and cost but rarely improves your returns or diversification as many of the underlying investments will be the same or move in the same direction.

The importance of defensive assets

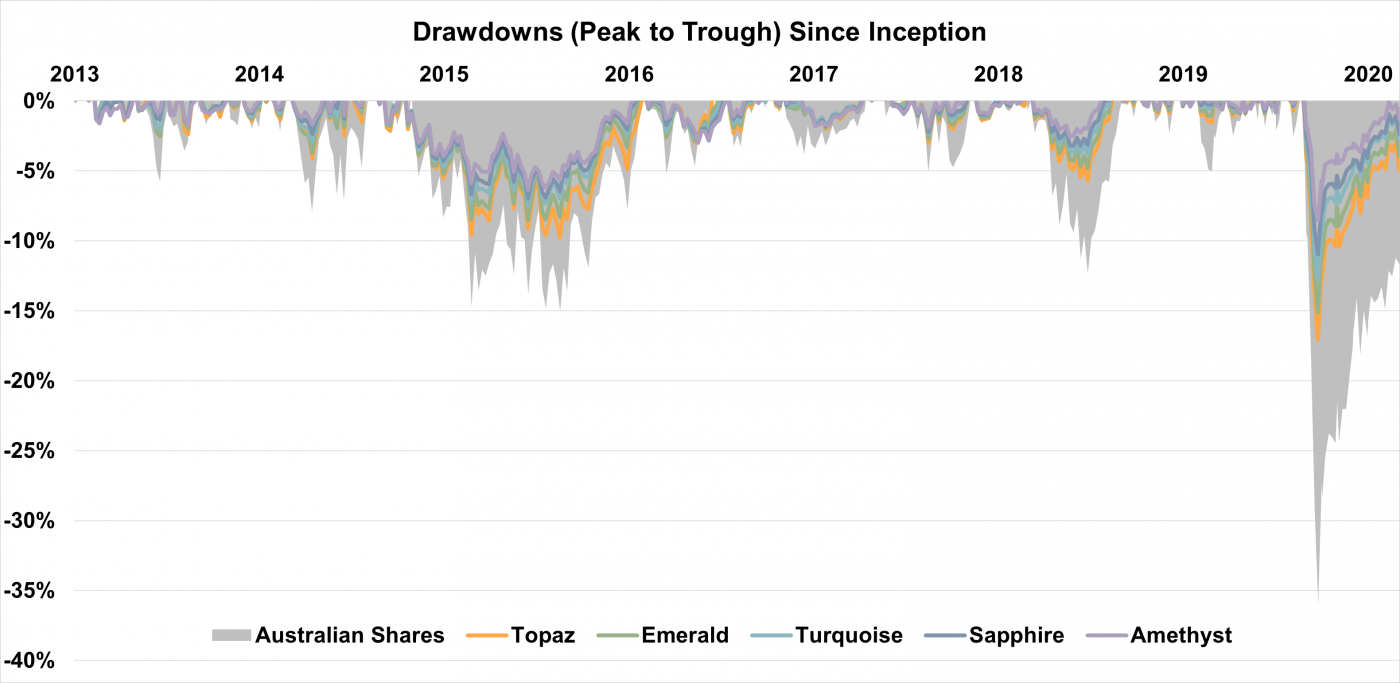

Diversification improves returns, but owning some defensive assets helps to reduce losses when markets fall. The Stockspot portfolios were exposed to 50-80% smaller falls than Australian shares in 2020 because of the allocation to government bonds and gold. Over the last 7 years they’ve offered similar protection against other market dips.

It’s also important that you have the right defensive assets in your portfolio. Investment grade bonds and gold were able to counterbalance the fall in Australian shares whereas other asset classes that some perceive as defensive (like property and infrastructure) provided little to no protection during the market rebound and subsequent bounce.

Why you need to balance income and capital growth (total returns)

Some people load up their portfolio with ‘high dividend’ shares with the hope of earning more income. In this recent update we explain why income chasing strategies are dangerous. It’s much safer to pick a mix of assets for your portfolio based on your investment horizon and risk capacity and sell down some of the capital where needed.

The 5 year returns of the Stockspot portfolios have included a combination of dividends and capital returns. If we’d only focused on high income assets, the total returns would have been much lower since high income assets (like bank shares and Telstra) have had poor total returns over this period.

Infrequent trading leads to positive results

Investors aren’t actually very good at timing the market and trading. In fact, there are numerous studies that show that trading more often harms your investing returns. When investors try to time the market, they usually buy high and sell low instead of doing things the other way around. Then there are the capital gains that must be paid on any profits.

For this reason there are infrequent changes to Stockspot portfolios. In the last three years, we’ve made changes just two times. Once, in November 2017, when we increased the defensive allocation to bonds and gold. Then we rebalanced portfolios in late March 2020 by selling some of the defensive assets that had performed well and bought shares, when many others were panicking and selling after the market crashed by 35%.

When you don’t make changes often, you give yourself the opportunity to capitalise on the unforced errors of others.

Reducing unforced errors has worked

The Stockspot portfolios aren’t designed to hit winners. Our strategy is to cut out unforced errors. Broad diversification, low costs and trading with restraint have all contributed to the Stockspot portfolios beating 100% of 600+ diversified funds as tracked by Morningstar over the last 5 years.

The value of minimising unforced errors has been around 3% per year.

Source: Stockspot, Morningstar website comparison group of investment funds across growth, balanced and moderate multi-sector categories to 30 September 2020. Stockspot Amethyst, Turquoise and Topaz portfolios.

What type of investor are you?

When investing you can play to win or play not to lose.

You can learn how to avoid 10 common investing unforced errors in our Healthy Investing Guide.