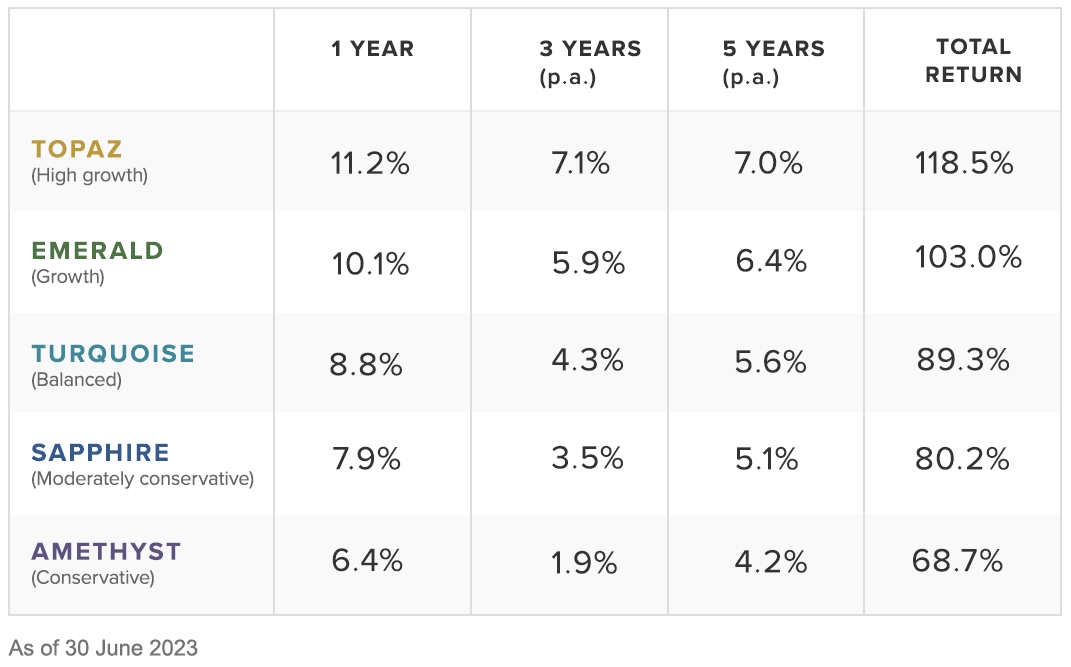

After a volatile 2022 financial year, all of the Stockspot portfolios rose in the 2023 financial year, delivering returns of between 6.4% to 11.2%. Each of our investment assets also enjoyed positive returns over the 12 months to 30 June 2023.

Investment asset returns

Global large shares (ASX: IOO) led gains with a return of 23.4% due to strong performance from large-sized technology companies like Amazon, Meta and Microsoft. This ETF has continued to outperform other global share ETFs due to its large company focus and because it is unhedged.

Australian shares (ASX: VAS) rose 14.1% as resources and financials performed strongly despite higher interest rates. Large companies also performed better than small companies in Australia. Gold (ASX: GOLD) also outpaced inflation with a return of 8.7%.

Australian bonds (ASX: IAF) and emerging market shares (ASX: IEM) were up 1.2% and 2.1% for the year respectively.

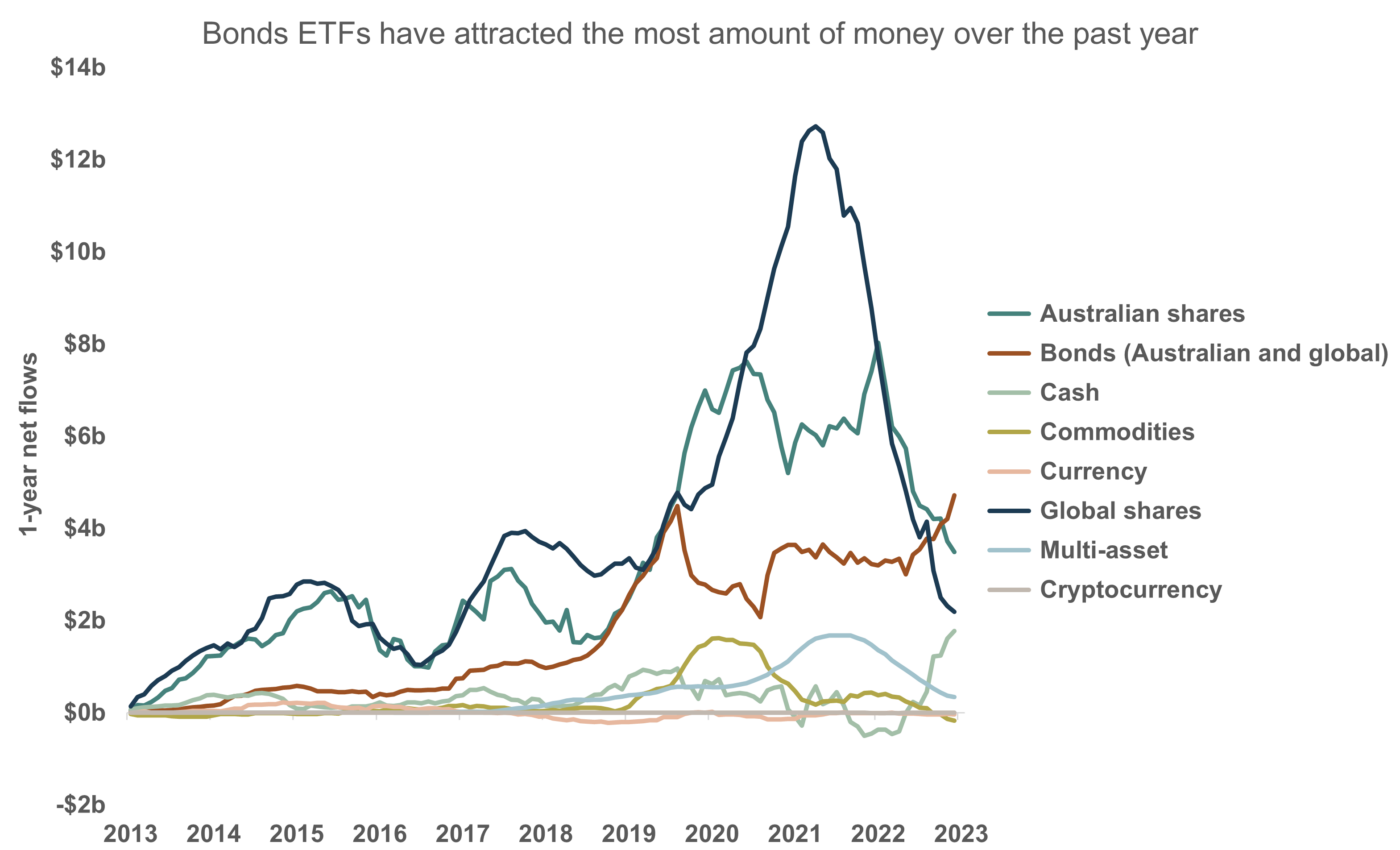

Bonds have experienced a remarkable return in investor popularity this year, primarily due to the more attractive yields now on offer relative to bank deposit rates. As a result, bond ETFs have experienced the highest inflows in the past 12 months of around $5 billion, surpassing Australian and global shares, for the first time in the Australian ETF market history.

Stockspot portfolio performance

The Stockspot Model Portfolios returned 6.4% to 11.2% after fees over the 12 months to 30 June 2023, while the Stockspot Sustainable Portfolios returned 8.3% to 14.4% after fees.

Over the longer-term five-year period, the Stockspot Model Portfolios have outperformed at least 99% of similar diversified funds in Australia.

The comeback of bond ETFs

Few asset classes have experienced such a dramatic shift in popularity as bonds in 2023. After enduring a challenging period in 2022, bonds have made an impressive comeback, capturing the attention of investors once again. The primary catalyst behind this rebound in popularity is the more appealing yields bonds now offer compared to traditional bank deposit rates. As a result, bond ETFs have witnessed unprecedented inflows over the past 12 months, surpassing both Australian and global shares for the first time in the history of the Australian ETF market. A staggering $5 billion has flowed into bond ETFs during this period.

Bond ETFs have long been hailed for their ability to offer portfolio protection and generate a steady income stream. Stockspot’s preferred Australian bond ETF is the iShares Core Composite Bond ETF (ASX: IAF). This ETF includes a diverse portfolio comprising over 500 bonds issued by both the Australian government and companies. IAF’s distribution yield currently stands at an attractive 4.6% per year, which presents investors with a more enticing income opportunity compared to the recent past.

To learn more about what’s driving the interest in bond ETFs, read the recent article I contributed to the Australian Financial Review: Fixed income and cash ETFs are booming like never before

Investing if a recession hits

Investors have been betting that the current rate hiking cycle in Australia and the U.S. may be close to pausing as the possibility of a recession looms. Amidst the current recession talk, one question we keep hearing from our clients is, “How can I invest during a recession?”

Whether it’s talk of inflation, war, interest rate rises or just excessive noise in the media (or perhaps a combination of all these things) our advice to clients is, as always: keep it simple, stay diversified and don’t stop investing.

One of my favourite articles on this topic has the intriguing title “Even God Couldn’t Beat Dollar-Cost Averaging”. The author shows that even with perfect hindsight on market dips, you can’t beat the strategy of regularly investing into the share market (dollar-cost averaging).

It’s a great read, especially for anyone concerned about investing in the current environment.