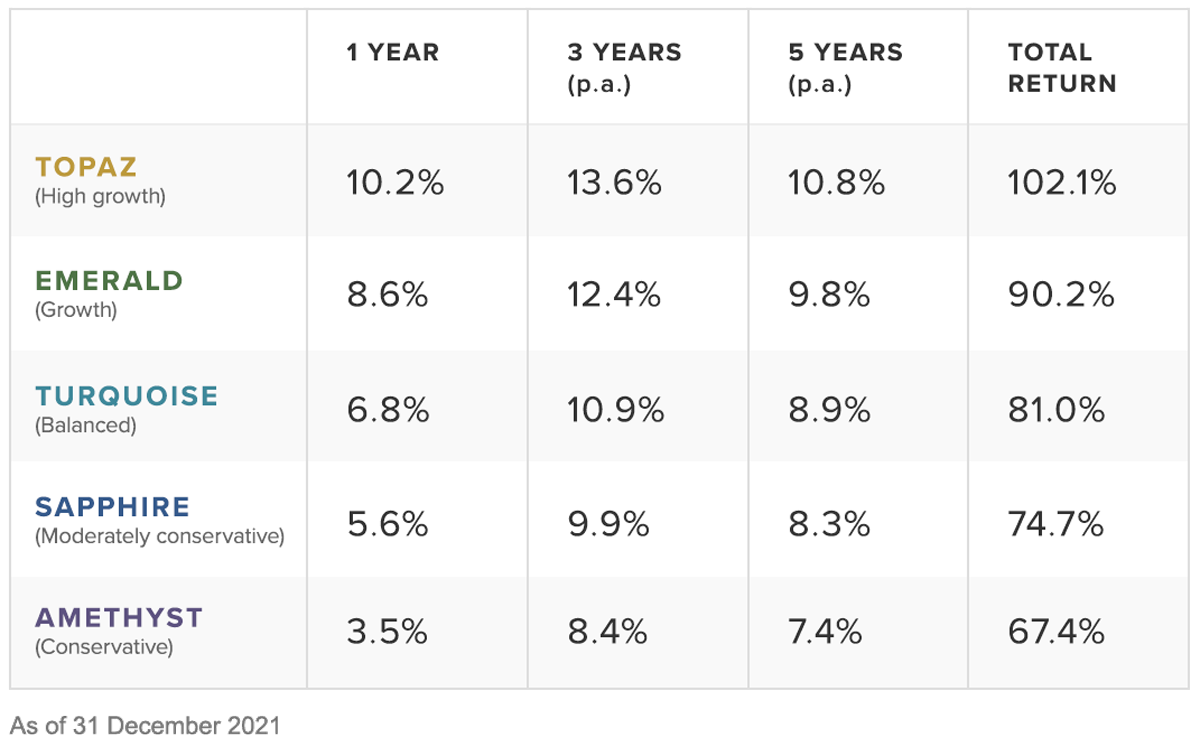

The Stockspot Model Portfolios returned 3.5% to 10.2% after fees during the 2021 calendar year, while the Stockspot Sustainable Portfolios returned 6.8% to 15.1%.

This is Stockspot’s eighth consecutive year of positive returns across all strategies. During 2021 Stockspot grew by 89%, now managing more than $600 million on behalf of 11,000 clients.

Investing in diversified ETFs means we are not setting out to be the best performing investor every year. We aim for the consistent returns that come from diversification and the power of compounding over the long run. In addition, we aim to avoid big losses which can wipe out your portfolio.

It’s this consistency that has enabled the Stockspot Model Portfolios to outperform 99% of similar diversified funds over five years.

Source: Stockspot, Morningstar website comparison group of investment funds across growth, balanced and moderate multi-sector categories to 31 December 2021. Stockspot Amethyst, Turquoise and Topaz portfolios used for comparison.

It’s this consistency that has enabled the Stockspot Portfolios to outperform 99% of similar diversified funds over five years.

The share market index rose, but many companies did not

In 2021 the Australian share market returned an impressive 17%. Despite this, almost half of the companies (48%) had negative returns over the year. This includes many of the popular retail owned shares like Afterpay and Zip which are down 50% and 70% from their highs.

Sectors and companies within the market contribute to the overall index return differently each year. Australian technology companies were up 58% in 2020, but fell 2.2% in 2021. Financials and real estate posted negative returns in 2020 but rose 25% and 23% in 2021.

| Australian shares sector | 2020 Return | 2021 Return |

| Technology | 57.8% | -2.2% |

| Real Estate | -6.2% | 23.1% |

| Financials | -6.3% | 25.2% |

Stockspot doesn’t make bets on which shares or sectors will perform best each year. The surest way to own the best performing shares and sectors every year is to invest across the entire market index.

By investing in the index with ETFs we ensure that our portfolios are sufficiently diversified to capture the groundswell of the ever evolving movements in the economy.