It’s been a rocky two months for investors. The Australian share market has fallen steadily since hitting an all-time high on 10 February. Last week markets were shaken again after US President Trump announced a surprise set of aggressive ‘reciprocal tariffs’.

This unexpected move has increased the risk of a US recession. Investors are now watching closely to see whether Trump pulls back or the US Federal Reserve steps in.

Markets don’t cope well with uncertainty. And a sudden trade shock like this brings plenty of it. Tariffs mean higher costs for companies – which usually leads to lower profits and slower growth. If other countries retaliate, the risk of a global slowdown grows even more.

What’s happened in markets?

The market’s reaction to last week’s tariff news was swift. The U.S. share market dropped more than 10% in just a week.

Since the start of the year, Australian shares have now fallen 8.3%. Our global share ETF is down 14%. Emerging markets have fallen 3.7%.

The Australian dollar tumbled 5% in a single session last Friday. And bond markets are now pricing in 1.1% of rate cuts from the RBA in 2025.

That’s a lot to digest. But there’s some good news for Stockspot clients.

How Stockspot portfolios have held up

Despite the market chaos, our portfolios have performed well.

Why? Because they’re built to withstand shocks like this.

Gold has surged 19.7% this year. Bonds are up 2.6%. And because our global share investments are unhedged, the falling Australian dollar has provided significant insulation from global share market falls.

Our most conservative portfolio, Amethyst, is up 1.3% since the start of the year. Even our high growth Topaz option is only down 2.8%. That’s a 66% cushion against the broader share market fall… and a clear example of how diversification works in practice.

Over 12 months the results are even stronger. While Australian shares have fallen, all our portfolios are up.

Don’t panic, stay invested

We know it’s stressful when markets fall. It’s human nature to feel like you need to do something. But history tells us that reacting to headlines usually hurts more than it helps. This isn’t the first time politics has rattled markets, even over the last decade. We’ve seen it before with Brexit, the Ukraine war, and COVID. The pattern is usually the same. Markets panic and fall. Then either governments or central banks step in – or the issue fades. And markets recover.

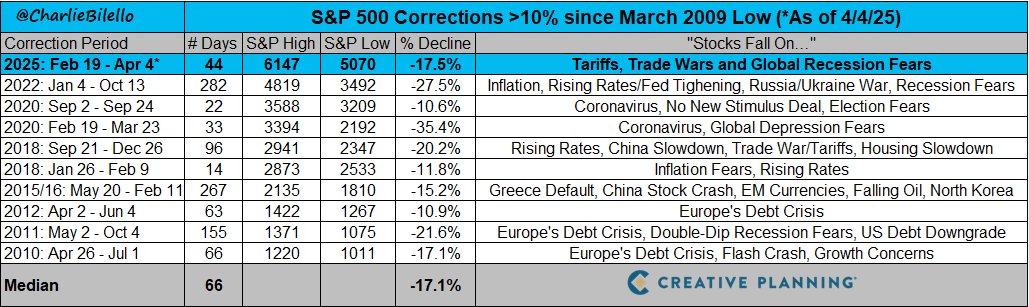

In fact, this is the tenth time since the end of the financial crisis in 2009 that the U.S. share market has fallen more than 10% (and seventh of over 15%). Each one has felt uncomfortable at the time. But every dip so far has been followed by a recovery.

A study by Vanguard looked at 22 major geopolitical shocks. The average total return 12 months after the event was 9%. The lesson is simple. Markets recover. But only if you stay invested.

Should you change your investment strategy?

No. The best thing you can do is stick to your plan. Selling during a downturn locks in losses. It also means trying to guess when to buy back in. That’s almost impossible to get right consistently.

We also don’t adjust our portfolios based on news headlines. Instead, we use automated rebalancing to make smart decisions for you. Over the past few days, that’s meant selling gold for some clients (up 65% since the start of 2024), and buying more shares while they’re cheaper. It’s all part of the automated rebalancing process and one of the reasons our portfolios have done well over time.

What you can do right now

If you’re feeling uncertain, here are a few simple strategies that can help you stay calm and confident.

1. Keep investing regularly

Investing through all parts of the cycle means you’re buying at lower prices when markets fall. This lowers your average cost and improves long-term returns. Think of it like the share market going on sale.

2. Take a break from the news

If watching markets is making you anxious, check your portfolio less often. Focus on where you’ll be in 5 or 10 years… not what’s happening today.

3. Stay diversified and keep costs low

A mix of Australian and global shares, bonds, and gold helps cushion against falls. And keeping fees low means more of your money stays invested over the long run.

4. Don’t forget dividends

Even during market dips, you’re still earning income from dividends and distributions. Reinvesting them at lower prices helps you bounce back faster.

Final thoughts

Market falls are never fun. But fear is one of the biggest threats to your long-term returns.

Whether it’s a pandemic, war, or tariffs, short-term noise can throw investors off course. The best investors are the ones who stay calm, ignore the headlines, and stick to their plan. This period of volatility will pass. It always does. And when it does, those who stayed invested will be better off.

If you have any questions about your portfolio, our team is always here to help.