It’s important for Stockspot to keep our fees low. One of the ways we do this is by not relying on big advertising costs to grow. What we do want is to help people spread the word about how to be a successful investor.

That’s why we created the Stockspot family and friends invite program. For every friend that you invite who invests with us, we will waive the fees you pay on $5,000 of your portfolio for 12 months. And we’ll do the same for your friends’ portfolio for 12 months as well!

The more you share, the more you (and your friends) save together – and the faster your portfolio grows. This gives your friends the chance to try Stockspot and see how it can help them achieve their financial goals.

Helping people getting started investing – often for the first time – is something best done by breaking the taboo around talking about money.

Here’s our best tips and tactics to start – and keep – those conversations about investing going – and get those invites flowing.

1. Use your magic invite code

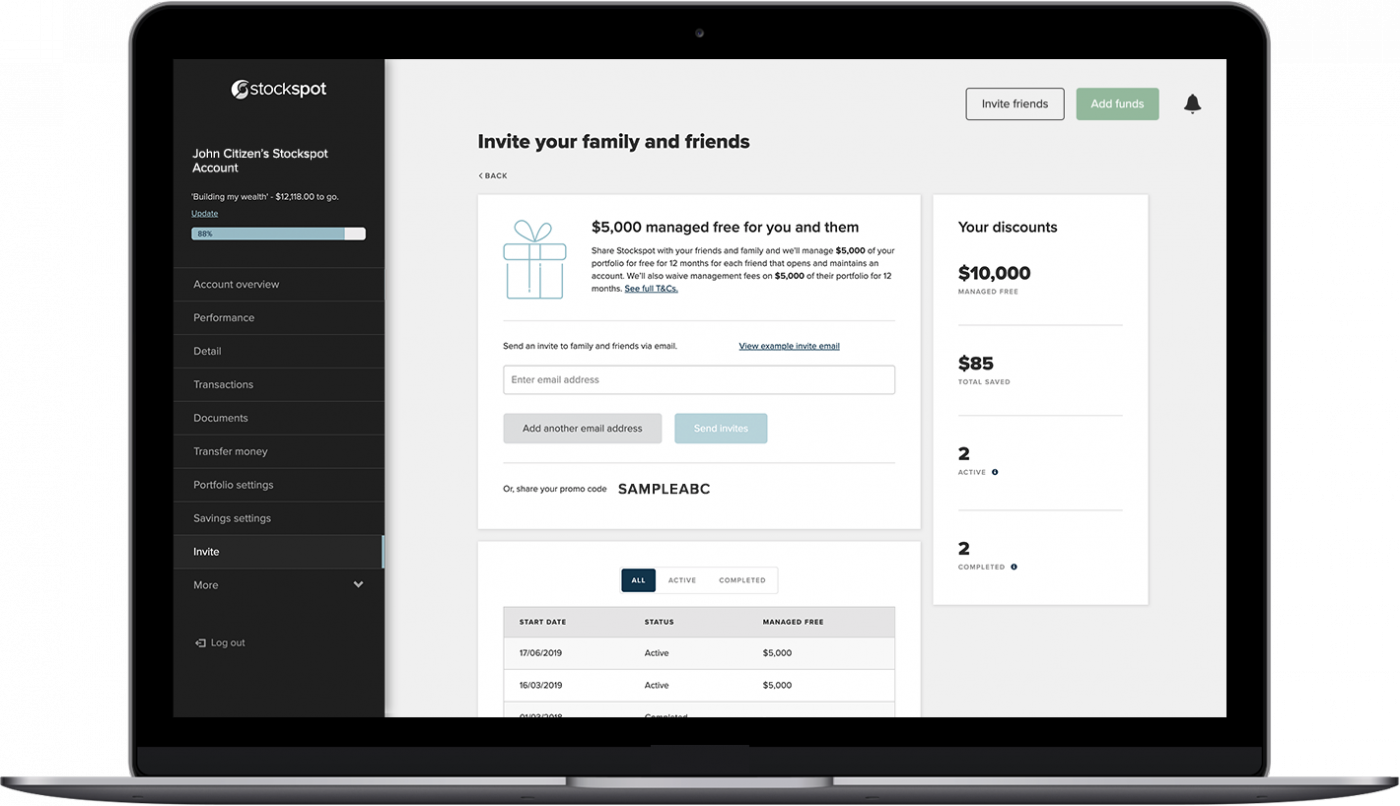

If you’re a Stockspot client, you now have a invite code you can share with friends and family. You can choose to send individual email invites through your Stockspot dashboard, or you can email them your invite code personally.

2. Start a conversation first

“WTF is an ETF?” Maybe you said that too, once upon a time. Makes total sense to share some context, right?

Share this one: ‘Did you know an ETF helps you invest in a broad range of investments like shares and bonds, all around the world. Instant diversification! No need to pick individual stocks!’

Or share this one: ‘Did you know you don’t have to actively buy and sell stocks? Passive (index) investing has better returns than most actively managed portfolios.’

On why it’s so important to start investing today!

Share this one: ‘This one’s an eye-opener. Stockspot taught me investing $2,000 at 25 instead of 35 could triple the returns you make by the time you’re 50.’

On why Stockspot even exists

Share this one: ‘The CEO left his career and founded the company when he saw too many people getting ripped off by high fees and bad advice when it comes to investing.’

On money taboos

Share this one: ‘We’d rather talk about the weather than talk about money. That’s messed up. What can we do about this??’

3. Some more things you can say

So we have to tell you this – when you invite people to Stockspot (or any investment), we don’t recommend that you talk about how your investments performed. Even if it’s great. Weird. We know. Here’s why:

The performance of your investment portfolio is unique to your personal situation. Your friends’ investment portfolio will perform differently based on when they start investing, how much they continue to invest regularly (which we definitely recommend for you btw), what their risk capacity is and their timeframe.

That’s why everyone’s investment portfolio will be unique. What’s important is staying the course to reap the returns from investing over the long-run.

Some ideas for things you CAN say (feel free to steal):

On your experience

If you’ve found it easy to start investing and see your investments in your dashboard, tell them how easy it was. ‘I can see all my investments in one place anywhere, anytime’.

If Stockspot has taken away the complexity to getting started investing – not having to pick stocks, or having to constantly monitor the market, tell your friends ‘I can just sit back and relax knowing my investment strategy is working hard in the background.’

How you don’t need to be a millionaire to build an investment portfolio

You can start building your own investment portfolio with Stockspot with $2k. So put that tax return to hard work this year!

And when you use my invitation when you join, you won’t pay fees on $5k for a year. They are seriously trying to help people start investing.

And finally, you can share our number one rule when it comes to investing – never pay more than 1% in fees! Why? The less you pay in fees, the more you earn in returns!

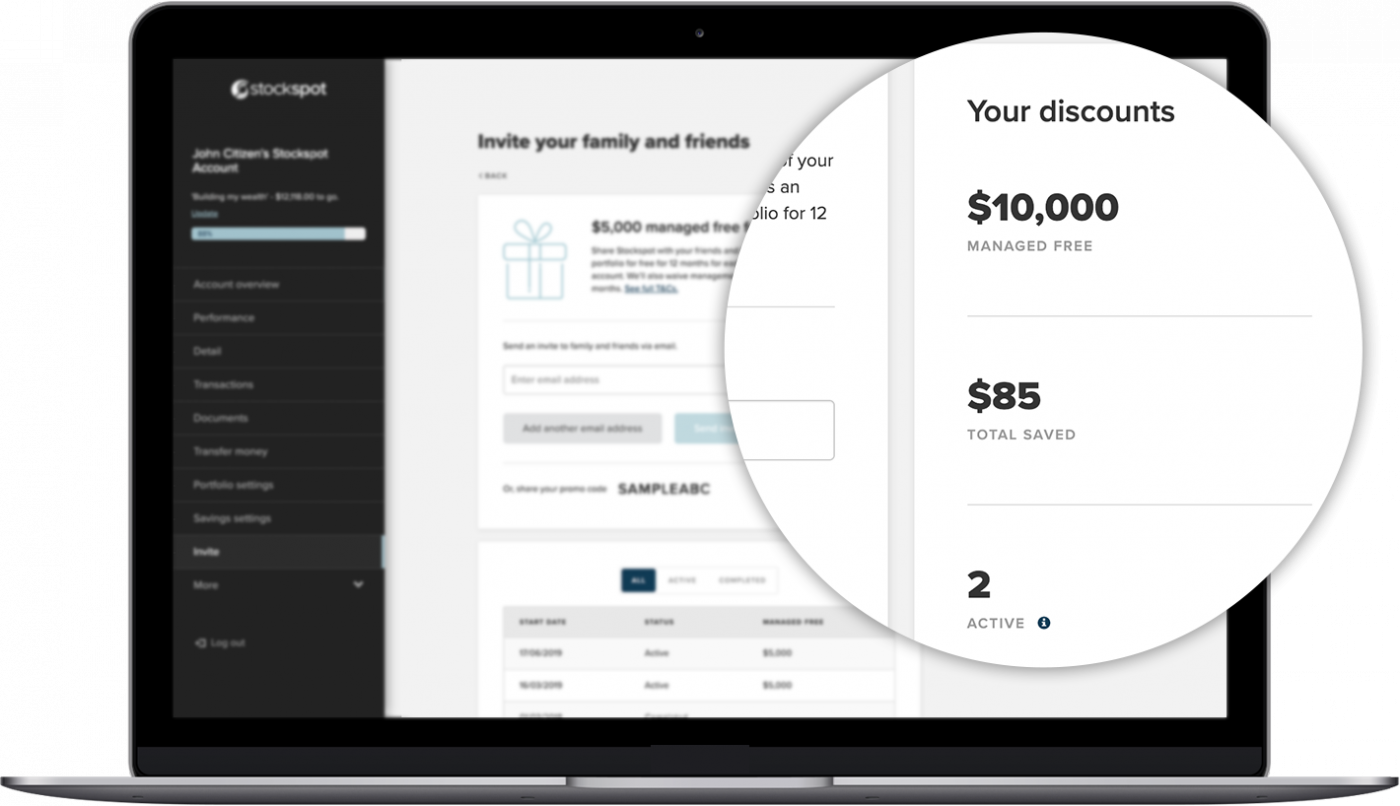

4. How to keep track of everything

You can see how much money you are saving on fees from inivting friends and family to Stockspot in your dashboard. Simply click on the ‘invite’ option in the menu.

5. Share our other good stuff, too!

Sharing what you learned in our blog or newsletter? Absolutely! Feel free to forward any of our blogs or emails that you think would help your friends or family members achieve their goals.

You can also share interesting posts you see on Facebook and LinkedIn (start following us if you haven’t already).

And we highly recommend sharing our compound calculator so that your friends and family can see the power of investing for themselves.

So if you haven’t started yet, you now have all the tools you need to get going. Go forth, friends, and start lifting people up.

Invite a friend today

Log in and hit INVITE on your dashboard to get started.

Not a client yet? Get your portfolio recommendation and get started today!