Something you may not put a lot of thought into when you invest is how those investments are held. Sometimes investments aren’t legally owned by you but instead owned by another entity on your behalf.

That may sound like a minor difference however there can be significant consequences when it comes to security, tax, costs and the portability of your portfolio.

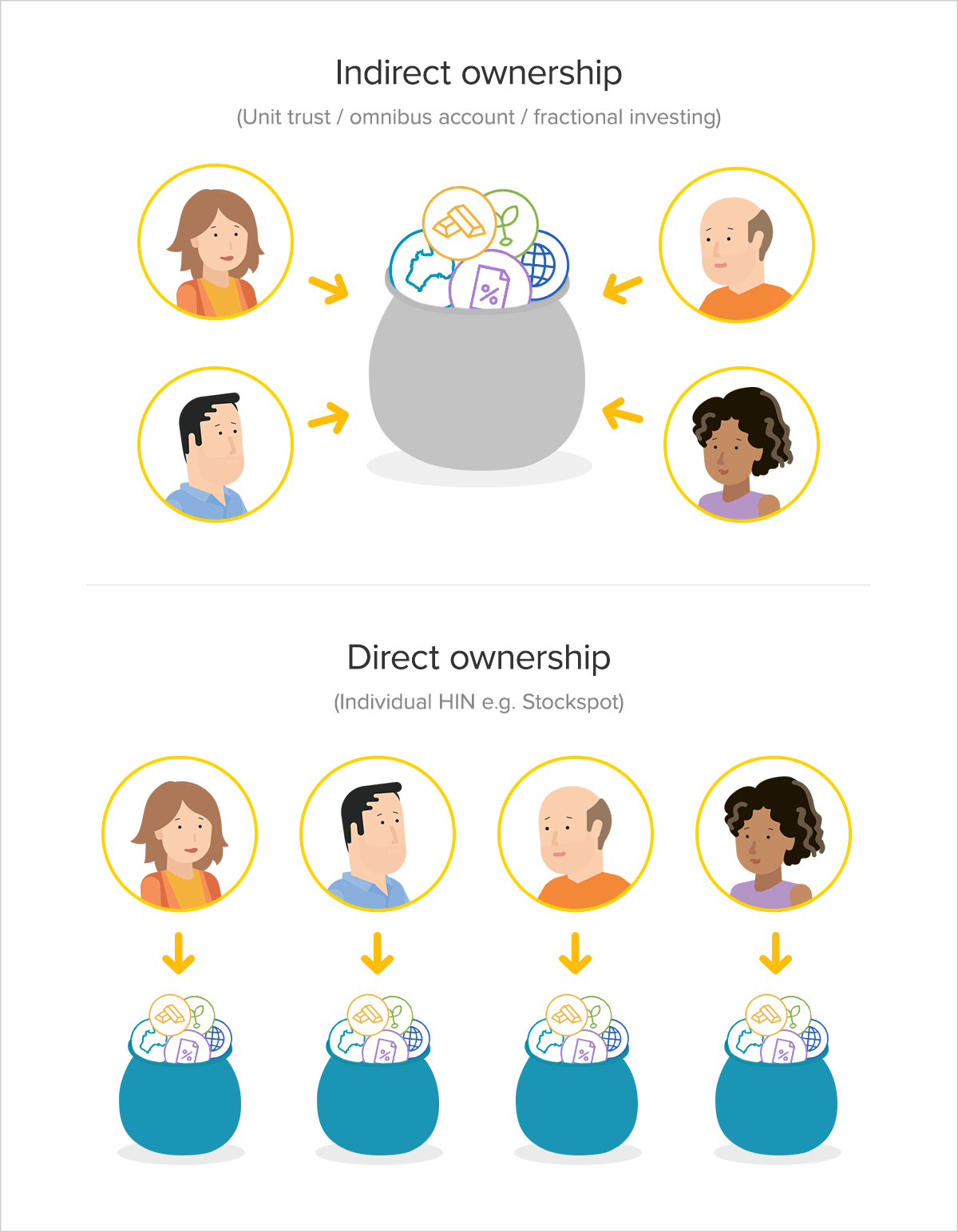

Broadly investments can be held in 2 ways:

- Directly by you on your own HIN (Holder Identification Number)

- Indirectly via a commingled fund or omnibus account structure

Historically stock brokers used a direct ownership model, so each of their clients had their own individual investment account or HIN and all investments were registered on the ASX’s computer system called CHESS (Clearing House Electronic Subregistry System). If the stock broker went bust it didn’t impact the end client because their investments were safely separated.

Indirect ownership: popularity and risks

In the 2000s there was a move towards indirect ownership because it was a way to reduce trading costs, improve efficiency and increase profitability for investment companies.

This typically involved investments being housed by a 3rd party who keeps a log of who owns what. Indirect investments can be commingled or managed under an omnibus account structure.Indirect ownership relies on investors having a contract with ‘counterparties’ who promise the separation of your investments from others.

The weakness of this model was exposed around the global financial crisis in 2008-09 when there were some well known cases of financial counterparties not being able to meet their obligations and investors losing money as a result. Some of the infamous examples include Lehman Brothers in the US and Opus Prime, Storm Financial and MF Global in Australia.

Direct vs indirect ownership

When establishing Stockspot 5 years ago we made a purposeful decision that direct ownership was a much safer way to go for our clients. Instead of having your account mixed up with others, all investments are held legally and beneficially in your own name.

This means our clients are not exposed to counterparty risk. If something ever happened to Stockspot or one of the external suppliers we work with, it wouldn’t impact your investments because those investments are owned by you and you can simply take them with you.

One of the more recent investment product trends is fractional investing. This allows you to invest in ‘fractions’ of one share or one ETF down to $5. While this new model has helped people invest small amounts, there can be hidden costs like netting spreads and extra risks associated with commingling accounts.

We believe clients benefit from direct ownership via a unique HIN in 3 main ways:

-

Better safety of your investments

-

Transparency around what you own and what costs you’re paying

-

Potential tax benefits

If you are considering investing indirectly it’s worth assessing these factors and getting comfortable with them before handing over your savings.

Here are the main differences between direct and indirect investing.

Flexibility

| Direct ownership (Individual HIN – e.g Stockspot) |

Indirect ownership (Commingled fund / omnibus accounts) |

| Tax | |

| Tax is calculated on an individual client basis based on the timing of each investment, income received and capital gains. | Those investing indirectly can be impacted by the actions of others within the structure and can inherit a tax liability from others. You might also miss out on some tax benefits. |

| Distributions and dividends | |

| Distributions and dividends are paid directly into client cash accounts. Clients get the full tax benefits and have control over whether dividends and distributions are reinvested or withdrawn. | Typically all dividend and distribution income is automatically reinvested. If clients would prefer to receive their distributions as income, investments need to be sold and capital gains/losses realised. |

Costs

| Direct ownership | Indirect ownership |

| Fees | |

| Fees are paid directly out of your cash accounts. Generally a single management fee. | Some fees may be paid directly. Other costs like trading costs, index license costs, responsible entity fees and netting spreads are built into the unit price or entry/exit prices. Total costs actually incurred can be difficult to calculate and obscured by these peripheral costs. |

| Trading | |

| Trading costs are incurred on an individual client level which can make direct ownership more expensive. | Trades are done in bulk while buys and sells are ‘netted’ to save on costs. Usually this netting benefit is earned by the investment company rather than passed on to clients. |

Safety

| Direct ownership | Indirect ownership |

| Ownership | |

| All investments are held on your own individual HIN so you retain full legal and beneficial ownership. | Your investments are pooled with others and managed by a 3rd party. You rely on their ability to accurately account for your investments. |

| Custody risk | |

| No custody risk since all cash and investments are always held in your name. | There is a risk that the Fund may incur a loss arising from the failure of the Custodian to meet its obligations, including its obligation to provide for the safe custody of the assets of the Fund. |

| Flexibility | |

| You have the flexibility to move your investments to a different broker or platform in the future. | Investments typically need to be sold if you want to leave which may result in unwanted capital gains. |

| Fractional units | |

| Fractional units aren’t possible so clients own whole units only. For this reason the minimum investment amount is usually at least $500 to meet the ASX minimum parcel rules. | Fractional units are held in a pooled account. This can reduce the minimum investment amount to $5. |

Stockspot makes it easy to grow your wealth and invest in your future.