After 2 years of steady returns and low volatility, US shares fell 8% in early February and speculators who poured US$33 billion into the market in the previous week wore some heavy losses.

What happened?

Speculators underestimated the chance of a sudden fall, they ‘doubled up’ on the hottest markets: the US, tech shares, Japan and Europe at exactly the wrong time. (Stockspot reduced our investments in these markets in late 2017 due to rising correlations between shares and bonds)

For long term investors, the falls in early February 2018 were a blip on the longer term uptrend. In fact even if the US share market fell another 30% it would still be above where it was in early 2016.

The falls did bring to light a murky area of financial products – exchange traded products linked to volatility. There have been dozens of these products created by investment banks (fortunately none in Australia yet).

Not suitable for long-term wealth

Despite being sold as ‘investments’ that fit into a broad ‘ETF’ category, these products linked to market volatility are the furthest thing from suitable long term investments to build wealth. They are purely speculative gambles. And extremely dangerous ones at that.

When you invest in shares you have an expectation of positive returns over time. The economy always grows over the long term and earnings growth follows the economy.

However, there is no rhyme or reason to volatility. No long term trend and certainly no way to predict it. Investing on the future direction of market volatility isn’t investing, it’s speculating.

How is volatility measured?

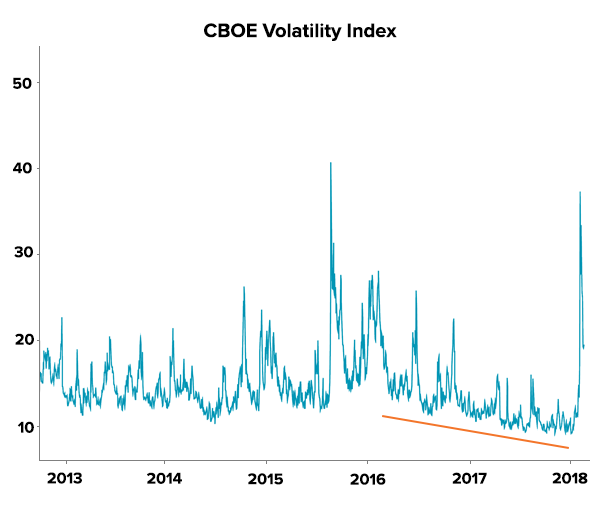

Since the late 1980s volatility has been measured by the CBOE volatility index (aka VIX). It’s calculated from the ‘implied’ volatility within option prices.

Here’s a chart of volatility over the last couple of years.

Between 2016-2017 share markets around the world climbed and volatility was low. VIX fell steadily from the 20s in 2016 to as low as 8 for a brief period in late 2017.

Market volatility is like the swell in the ocean. You get long periods when there is no swell and all is calm, then one day you wake up to a storm and the ocean is wild.

The storm happened for volatility ‘investors’ on 6 February 2018. In under 24 hours, volatility jumped from 17 to just over 37. It was the biggest percentage jump of all time, larger than the 1987 crash or the financial crisis where volatility increased more gradually over a period of time.

What did it mean for ‘investors’ in volatility ETNs?

Volatility ETNs are bets that markets will stay calm. If market volatility stays low or doesn’t rise by a large amount in any single day, you make money. If there’s a sudden ‘spike’ in market risk, investors lose.

In his book Black Swan, Nassim Taleb describes this type of strategy as ‘picking up pennies in front of a steamroller’. In other words, usually you make money but occasionally you get run over.

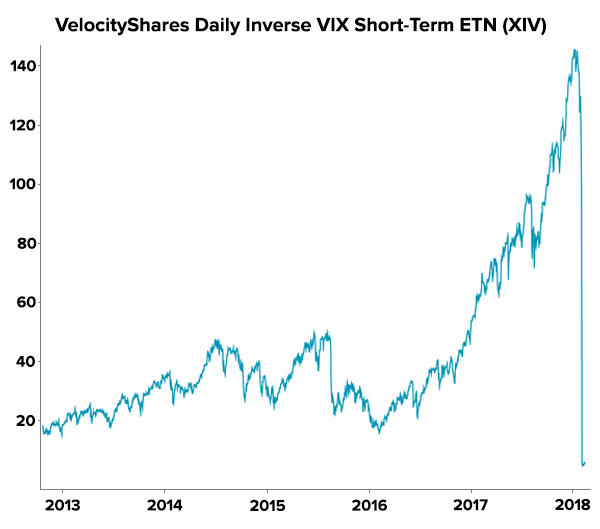

Investors in volatility ETNs made good returns for a couple of years and were riding high in spirits and profits.

One such product was XIV, in 2016 the XIV product rose from $25 to $50 (100% gain). In 2017 it did better rising almost 200% from $50 to $145. At the end of January 2018, over $3 billion was invested in this giant bet on market calm.

These may sound like extraordinary gains but that’s exactly how this product was structured to work. For the 999 out of 1,000 days when markets were calm, ‘investors’ in these products should feel like geniuses with ballooning profits and seemingly low risk.

What many failed to understand is that on the rare 1 in 1,000 day, they’d lose everything.

So when VIX jumped from 17 to 37 on 6 February, investors in the XIV fund lost 96% in a single day. The ETN fell from a high of $145 a week earlier to just $6.

$3 billion was lost in a single day and many individual investors in this product lost millions of dollars overnight. Credit Suisse announced they will be closing down the product a couple of weeks later on 20 February.

What can investors in Australia learn from this blow-up?

There’s a lot to be learned from this all too familiar story of mum-and-dad investors being burnt by an unsuitable investment product. Here are 5 lessons you can take away:

Not all ETFs are smart investments

Just because it’s an ETF, ETMF (managed fund), ETN (note), or other exchange traded product doesn’t mean it’s a smart investment. There are plenty of poorly structured ‘speculative’ ETFs too.

For example, we’re not a fan of the Betashares Dividend Harvester ETF because of its overly complex structure and strategy. It’s why we review the ETF universe quarterly and produce our Annual ETF Report which we’ve done since 2015.

Simplicity is beautiful

If you don’t understand it, dont invest in it. All the ETFs we invest in have simple and easily explainable investment strategies, that is: investing in a broad mix of Australian and global shares, bonds and gold. Investing in these assets have consistently grown wealth over at least the last 100 years.

Products with complex structures, leverage, hard to explain stock picking methods or proprietary ‘factors’ are not required to grow wealth.

Complexity = danger.

Get a professional investment adviser

Credit Suisse, the creator of the now debunked XIV ETF, regularly reassured investors their product would have ‘survived’ past volatility crises like the 1987 crash and 2008 financial crisis.

They told investors XIV was a robust fund. They were wrong.

The creators of financial products should never be your investment adviser because their objective is to sell products, not give good advice to grow and protect your wealth.

Never put much weight on investment advice from product creators (or from other retail investors). Both have biases that are squarely in conflict of good judgement and sound investment advice.

If it sounds too good to be true, it probably is

Anyone making 100% or 200% per year isn’t investing, they’re speculating.

Typically speculators don’t keep their profits for too long.

Markets rise about 10% per year (sometimes better, sometimes worse), that’s what you can expect from long term investing.

Compound 10% per year and you’ll make a lot of money, but it won’t happen overnight. If you want to speculate to make a higher return that’s fine but do it with a small amount of your portfolio you can afford to lose.

Markets always revert to the average

Sometimes people make outsized profits and it’s tempting to follow their strategy to join in. If you speak to an investor in bitcoin, tech shares or Sydney residential property you’ll know what I mean.

However ‘above average’ profits never ever ever last. They can go on for a long time but there’s always a moment in time when returns come back to average. Don’t be fooled by the ‘mirage’ of higher returns or you’ll end up being the sucker who bought at the worst time.

What it all means

Rising US rate expectations were one of the catalysts for February 2018’s market sell-off. We suspect this theme may continue for as investors price in a higher interest rate environment.

As markets come to terms with higher rates in the US, more speculative bets on low market volatility may need to be unwound which is likely to cause further volatility. This is good news for long term investors who could get some great opportunities to dollar cost average in 2018.

In November 2017, we made the Stockspot portfolios more conservative and increased their allocation to gold. This helped insulate our portfolios from the recent market falls. We’ll continue to monitor the situation to ensure our portfolios put clients in the best position to grow and protect their savings over the long term.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.