Gold has been one of the biggest contributors to portfolio returns in recent years. In February 2021 we increased our allocation to 14.8% after shares and bonds began moving in the same direction more often, which made bonds a less reliable cushion.

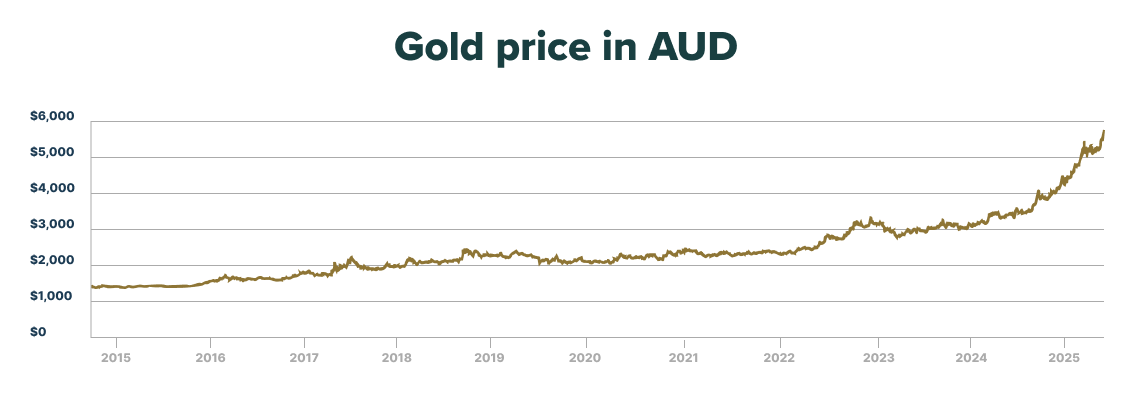

Since then the gold price has surged 148%, climbing from AU$2,350 to AU$5,840 per ounce (US$3,865). Over the past year alone its gained 52%… its strongest run since 1979.

Our GOLD ETF has risen from $23.05 to $53.60 in just 4½ years, while Australian government bonds have fallen as interest rates moved higher.

This shift in our asset mix, reducing bonds and increasing gold, has been a major reason Stockspot portfolios have outperformed many peers and stayed resilient through turbulent markets. The 14.8% allocation has added around 4.8% p.a. to returns since 2021.

We are now trimming our gold allocation from 14.8% to 12.3% and increasing bonds by 2.5%.

This isn’t a change in conviction. Gold remains a core part of every Stockspot portfolio. The adjustment is about refreshing our strategic asset allocation to reflect today’s risk-return trade-offs, and to keep portfolios resilient across a wide range of market conditions.

In this article we explain why we’re making the change and what it means for your portfolio.

Why we increased our gold allocation in February 2021

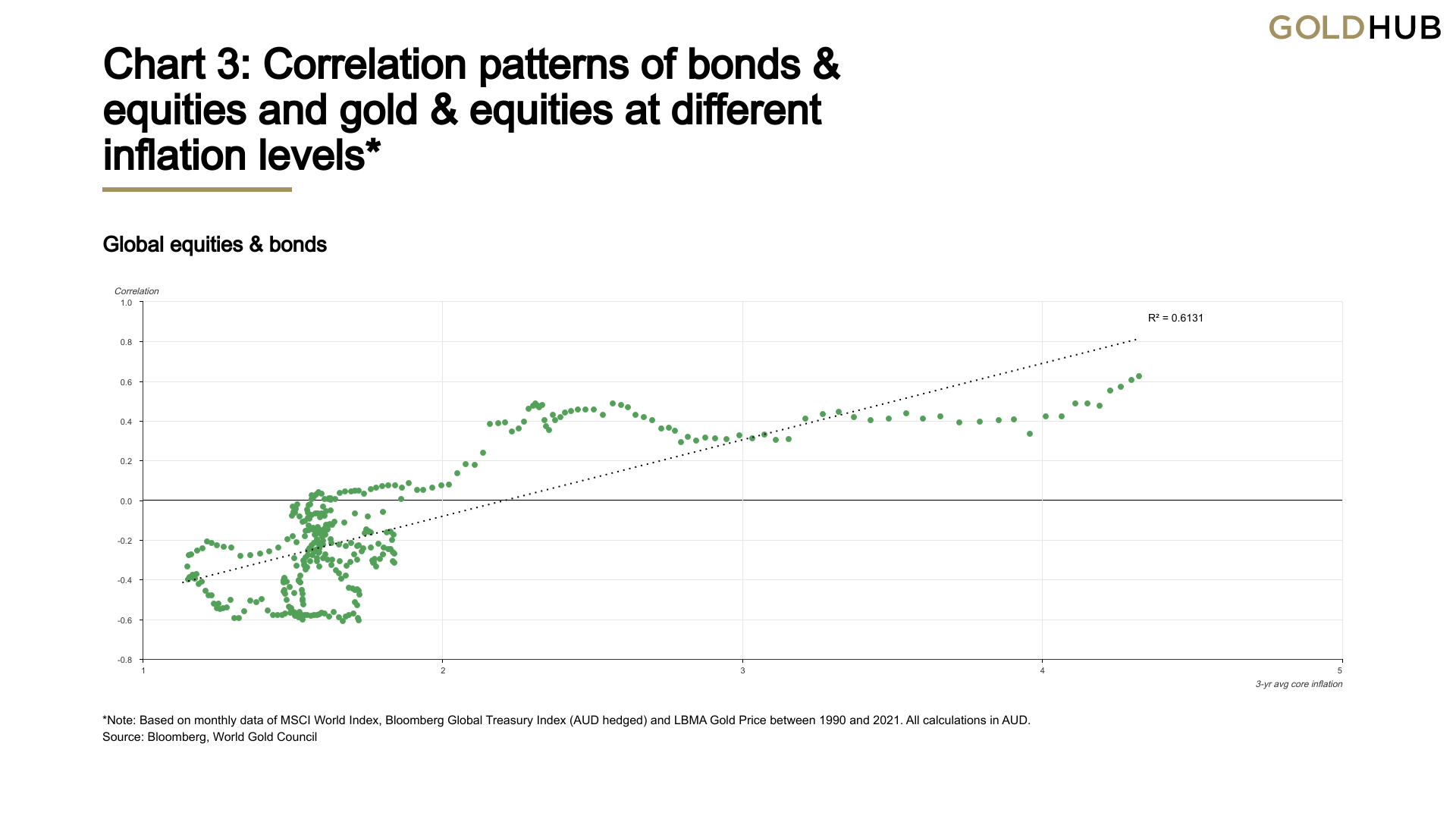

When we increased the allocation to gold in February 2021 we detailed it at the time in this blog. For decades, bonds reliably balanced portfolios when shares fell. The 3-month rolling correlation between shares and bonds was negative around two-thirds of the time before 2021, and this negative link was the foundation of traditional portfolio construction in super funds and diversified funds.

That changed in early 2021. Correlations flipped, and shares and bonds started moving in the same direction about 85% of the time. With inflation expectations rising, bonds were no longer the dependable hedge they once were. The chart below shows that bonds become less reliable as a portfolio hedge the higher inflation goes.

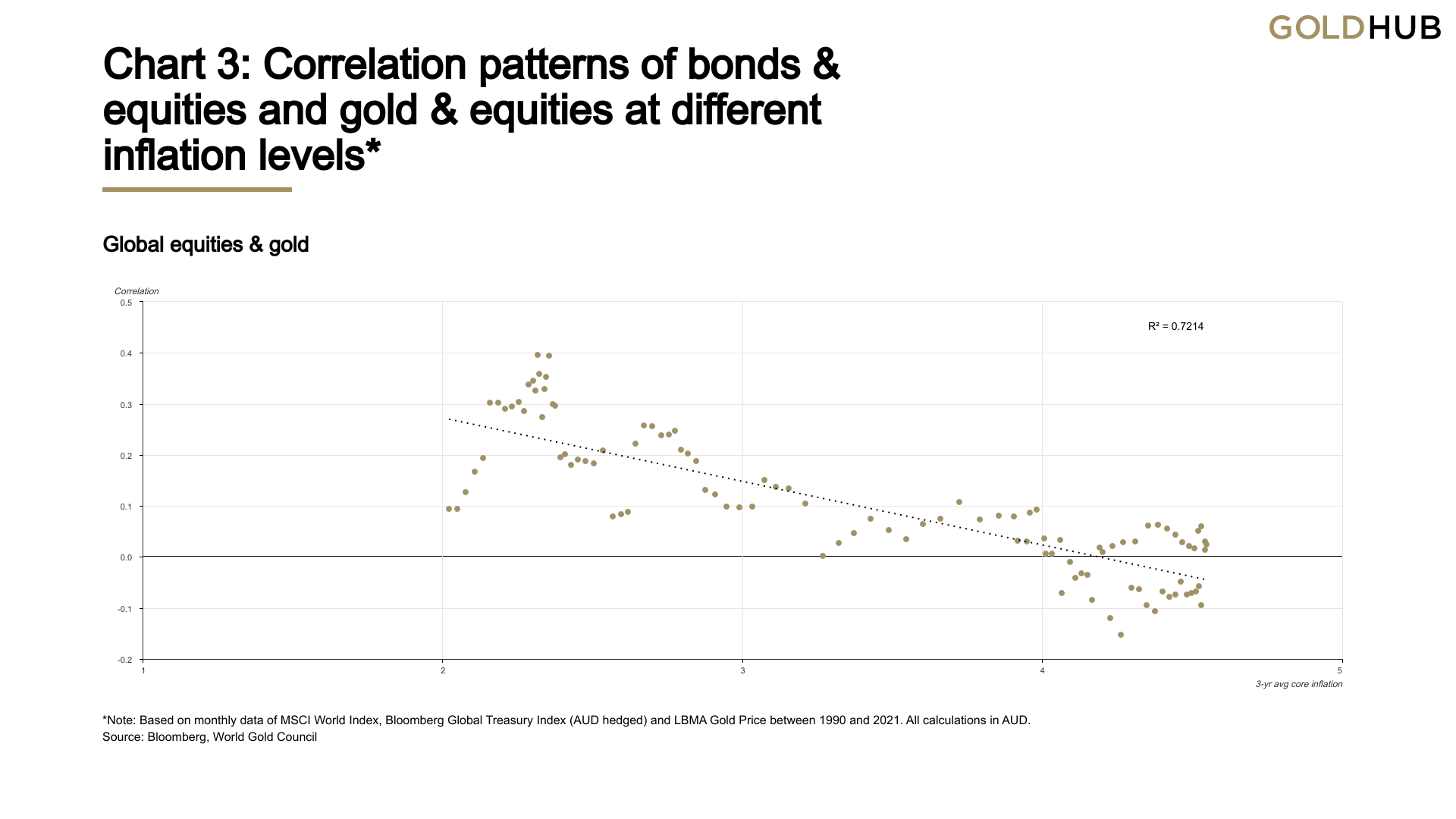

Gold, meanwhile, had been left on the sidelines. Investors, asset allocators and even central banks were largely ignoring it, which made it an even more compelling diversifier. Gold behaves differently from both shares and bonds, and it has a long track record of resilience in inflationary and uncertain periods. The chart below shows that gold becomes more reliable as a portfolio hedge the higher inflation goes.

That call turned out to be the right one.

Why we are reducing gold now

This adjustment is not about calling the top of the gold market. It is about updating our strategic asset allocation. We already rebalance regularly to keep portfolios on target – what’s different this time is that we’re resetting the target itself from 14.8% to 12.3%.

The diversification benefits of gold, while still strong, have reduced compared to when we lifted the allocation in 2021. One reason is that gold has recently been moving more in sync with Australian shares. When gold and shares rise and fall together, gold’s ability to smooth portfolio returns in a downturn is less powerful than when the two assets move independently. At the margin, the risk-return balance is now improved by reallocating a small portion back into bonds.

Bonds today offer better defensive qualities than they did several years ago, while gold’s outsized role in cushioning portfolios has moderated.

By trimming gold to 12.3%, we are resetting the strategic mix to an optimal level for the current environment. This keeps portfolios balanced, maintains resilience across a wide range of scenarios, and ensures no single defensive asset dominates outcomes.

What’s driving the gold price?

A few powerful forces are driving gold’s big move and shaping its role in portfolios today:

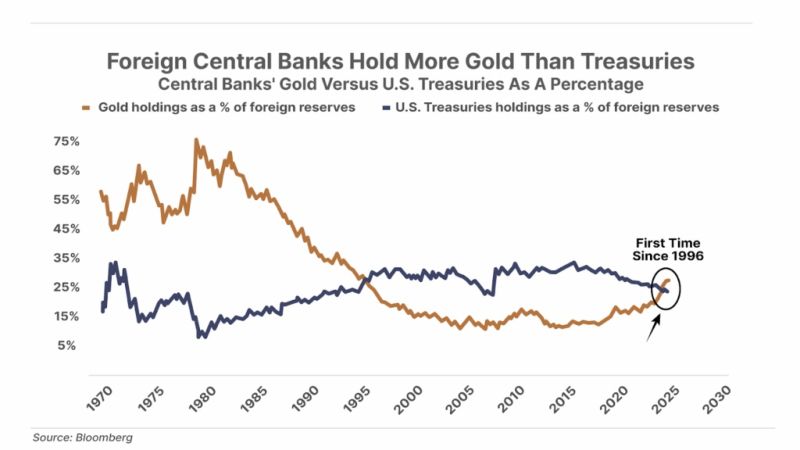

- Central bank demand. Central banks are buying gold at the fastest pace in decades as they diversify away from government bonds and the US dollar. This structural shift is likely to keep a floor under long-term demand.

- Debt and deficits. Global debt has reached levels that limit how far central banks can raise rates. This raises the risk that policymakers “inflate away” debt, which is supportive for gold as a store of value.

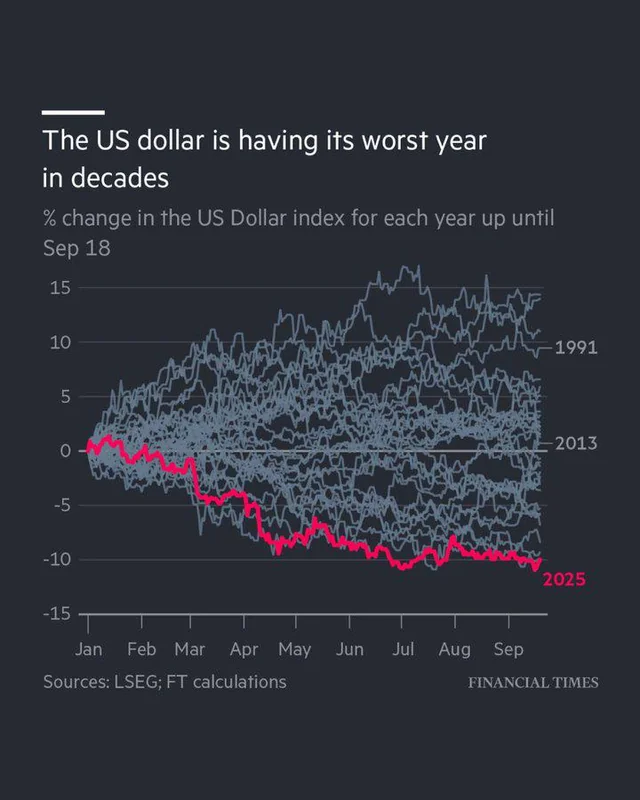

- Currency debasement. Periods of fiscal stress and money printing tend to undermine confidence in paper currencies. This year is on track to be the worst year for the U.S. dollar since 1973. Gold, by contrast, has no credit risk and cannot be printed.

- Fragile correlations. Shares and bonds remain more correlated than in the past, which makes gold one of the few reliable diversifiers.

- Investor flows. After years on the sidelines, many institutions are now increasing their gold exposure. The CIO of Morgan Stanley even suggested that the traditional 60/40 portfolio should evolve into 60/20/20, with bonds cut back to make room for gold. This kind of long-term shift would echo the 1970s, when persistent inflation and market volatility saw gold become a core portfolio holding.

- Recent rally. Gold’s rally from US$2640 to US$3865 in 2025 has been fuelled by fears of a 1970s-style stagflation – where central banks cut rates to support jobs even as inflation remains stubborn. At the same time, U.S. trading partners have been redirecting the dollars they earn from trade into gold rather than U.S. Treasuries. For the first time in nearly 30 years, foreign central banks now hold more gold than U.S. government debt. This trend began over a decade ago and accelerated in 2022 after G7 economies froze Russia’s foreign exchange reserves. Since 2015, central banks have added more than 3,500 tonnes of gold.

These forces point to gold remaining a strategic asset for many years. But even as a defensive holding, it comes with volatility. Gold is best thought of as insurance and diversification, not a straight-line investment.

History shows this clearly. In the 1970s gold rose more than 2,300% between 1971 and 1980, yet the journey included several sharp setbacks of 30–50%. That’s why it makes sense to hold a meaningful allocation, but not let gold dominate your portfolio, and why at times it’s prudent to trim exposure.

Why 12.3% is still a meaningful allocation to gold

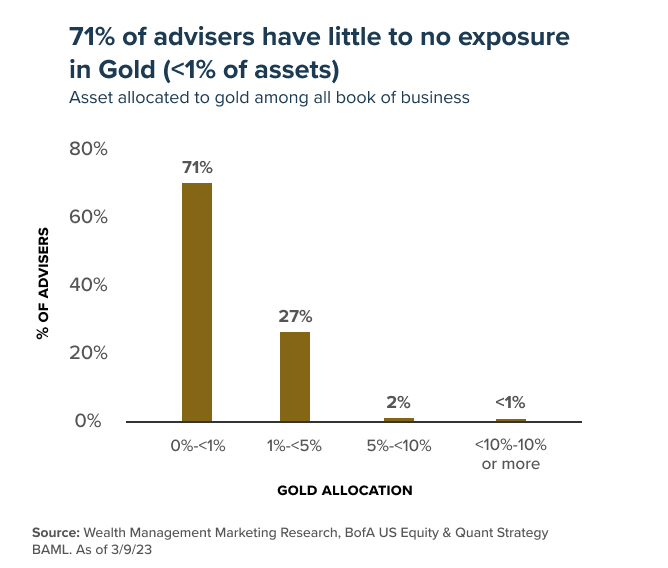

Even after the small reduction, 12.3% is a very meaningful allocation for our investment portfolios and Stockspot Super portfolios. Most diversified funds and super funds in Australia hold less than 1% in gold. Many hold none at all. In fact a study by Bank of America found 71% of U.S. financial advisers have less than a 1% allocation to gold and less than 1% have more than a 10% allocation.

Our clients will continue to benefit from one of the largest gold allocations available in any diversified portfolio or Super investment option in Australia. It is still enough to provide genuine diversification and protection in times of stress, without overexposing portfolios to a single defensive asset.

Could we increase the allocation to gold in the future?

Yes. This reduction isn’t permanent. If share–bond correlations rise further, or if new stresses emerge that weaken gold’s diversification benefits, we may lift the allocation again. We’ll adjust if the data shows a higher weight would improve the overall risk-return balance. Flexibility is part of our process. While we rarely make changes (only two in the past 11 years before this one) we’re open to adjusting when the evidence is clear.

What this means for your portfolio

You don’t need to do anything. During October 2025 we will rebalance your portfolio to the new weight if required and you will still hold more gold than almost any other super fund or diversified portfolio in Australia. The difference is that the position will now be sized to keep your risk and return balance optimal.

Final thoughts on our asset allocation changes

Reducing our gold allocation to 12.3% and increasing our bond allocation by 2.5% is about refining our strategic asset allocation. It keeps your portfolio balanced and resilient after an extraordinary run. It preserves gold’s benefits as a diversifier and inflation hedge, while ensuring no single asset dominates outcomes.

We remain strong believers in gold’s role in portfolios. We expect it to continue playing a central role in protecting wealth in the decade ahead. And if conditions call for it, we are ready to increase the allocation to gold again.

FAQs

Why is Stockspot reducing its gold allocation?

We’re adjusting our strategic asset allocation. Since 2021, gold has been a powerful diversifier as bonds became less effective. More recently, the benefits of holding gold at 14.8% have reduced, while bonds are now offering better defensive qualities than they did a few years ago. By trimming back to 12.3%, we’re keeping portfolios balanced and optimised for the next decade.

Does this mean Stockspot is negative on gold?

No. This isn’t about calling the top of the market. We remain strong believers in gold as a core part of diversified portfolios. It’s still a big allocation — 12.3% is higher than any super fund or diversified product in Australia. Gold continues to act as insurance against inflation, debt problems and policy mistakes.

Why not leave it at 14.8% since gold has done so well?

Position sizing discipline is one of the keys to good long-term results. Too much of any one asset, even a great one, can increase total portfolio risk. By locking in some of gold’s gains and redistributing a small portion back to bonds, we reduce concentration risk and improve the overall risk-return trade-off.

Does this change the mix between defensive and growth assets?

No. The balance between defensive and growth assets is unchanged because we’re simply replacing some gold with bonds. Both are defensive assets, so the overall growth/defensive split remains the same.

Could Stockspot increase gold again?

Yes. If correlations between shares and bonds worsen, or if conditions shift so that gold once again offers stronger diversification benefits, we would consider lifting the allocation again. We always follow the data and make changes when the evidence is clear.

Do I need to do anything?

No. We’ll rebalance portfolios automatically to the new target weights in October, using deposits and distributions where possible to minimise costs and tax. Your portfolio will still have one of the largest gold allocations in the country, helping protect and grow your wealth. If your portfolio is set to Buy Only or Pause Rebalancing refer to the question below.

What if I’m on a Buy Only or Pause Rebalancing setting?

If you’re on Buy Only we won’t be immediately selling your gold. Instead, any new top-ups you make will go towards increasing your bond allocation. This way we can gradually bring your portfolio in line with the new target weights without triggering unnecessary sales. If you’re on Pause Rebalancing we wont be making any adjustments either. Keep in mind that your gold allocation will likely remain above our target weight of 12.3%, so you can always switch to Rebalance Always if you’d like us to do a full rebalance for you if needed.

Why hasn’t my portfolio been rebalanced yet?

We try to minimise unnecessary capital gains. If your current gold allocation is already close to the new 12.3% target, we may not need to sell. Instead, we’ll often use any new deposits or distributions to gradually increase your bond allocation instead. This way, your portfolio moves into line with the new weights without triggering avoidable capital gains.

How will this affect my portfolio’s performance?

This adjustment is designed to keep your portfolio well balanced. By trimming gold and adding more bonds, we’re looking to strengthen its defensive qualities and help smooth the journey for investors. The focus is on managing risk sensibly so your portfolio stays resilient through different market conditions.