What are NFTs?

NFT stands for “non-fungible token”. Non-fungible tokens are unique verifiable digital assets that represent ownership of an item such as a piece of artwork or a video clip of your favourite basketball athlete.

The two keywords in this term are:

- Non-fungible: The term ‘fungible’ means ‘interchangeable’, so “non-fungible” means the item in question can’t be exchanged for an equal item. So, if you owned a vintage car, a rare Pokemon card, or a piece of land, you could possibly exchange these for something else, but you couldn’t exchange them for an equal asset because they’re unique.

Conversely, if something is ‘fungible,’ you can trade it for something that’s the same. A simple example would be money. You can trade $50 for another $50, whether you trade that $50 for another $50 note, or two twenties and a ten.

- Token: a digital currency that represents a certain asset.

NFTs are not the same as cryptocurrencies like Bitcoin. Cryptocurrencies are fungible and therefore interchangeable (i.e. you can trade 1 Bitcoin for 1 Bitcoin). Rather, NFTs are a digital trademark of a particular item that cannot be recreated or replaced. NFTs are also indivisible. You either own all of an NFT or none.

An NFT can either be one-of-a-kind, like a real-life painting, or one copy of many, like trading cards. Regardless, the blockchain keeps track of who has ownership of the file.

Whilst NFTs seem to have suddenly appeared, they’ve been around for years. Origins can be traced to 2012, but NFTs gained notoriety in 2017 with the rise CryptoKitties (a game where users can buy and sell virtual cats) and CryptoPunks (a unique collectible set of 10,000 digital characters).

NFTs are backed by blockchain technology…but what does that mean?

NFTs are built using the Ethereum blockchain network and smart contracts (smart contracts are a program that runs on the Ethereum blockchain).

Lines of code are used to facilitate the transaction. Blockchain creates a certificate of ownership over a specific virtual file, meaning that the NFT lives on a digital perpetual ledger that is able to be tracked and verified.

Having collectables stored in an online public server makes it possible for creators to retain ownership of their content without someone copying and pasting or deleting it. The immutable and verifiable nature is what gives an NFT the nature of a collectible.

Why the sudden interest in NFTs?

In parallel with the recent interest in Bitcoin and other cryptocurrencies, interest in NFTs has exploded. NFTs are now a $1b industry thanks to some recent notable NFT transactions including:

- A video of NBA basketballer Lebron James selling for over $250k on the NBA Top Shot Platform

- Grammy award-winning band Kings of Leon becoming the first band in history to release their new album in NFT format

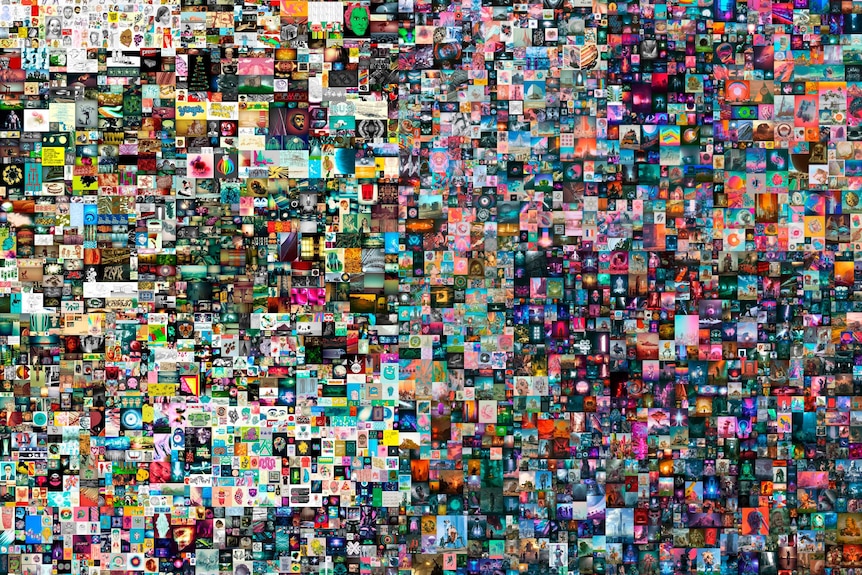

- Mike Winklemann (aka Beeple) selling a piece of artwork for almost $90m.

What are the risks of investing in NFTs?

NFTs are catching the attention of high profile technology investors, major global corporations and the artistic community. NFT proponents say that they could be the future of collectibles and will allow users to prove they own digital assets. But the flurry of interest echoes the Gamestop Saga and the rise of Wall Street Bets on Reddit.

Like any investment, NFTs come with their own risks. Given their infancy, the fact that NFTs are yet to gain mass acceptance means they’re a speculative investment. This means they’re prone to both high rises and steep drops in value.

NFTs are driven by supply and demand, and because of the sudden surge in demand, buyers are prepared to pay what might seem ludicrous prices. However, there’s no guarantee that prices will continue to rise.

Another factor to consider is that NFTs are also at the mercy of the currency that they run on (Ethereum). If the price of Ethereum falls, so will the value of the NFT.

Additionally, NFTs don’t have the same liquidity as other investments such as shares or ETFs (exchange traded funds). The only way you can get out of an NFT is if you find a seller who is willing to buy it from you.

The other issue is around safety. If you don’t store your NFT safely, there is a risk that your NFT could be hacked or stolen.

Find out how to invest in Bitcoin and other cryptocurrencies

The future of NFTs

While they may be speculative at the moment, many technologists believe NFTs represent an entirely new economy based on digital ownership.

Song writers or creators can make money by selling directly to their fans and collect a royalty every time the NFT is re-sold. Developers may be able to build infrastructure and platforms to enable these new markets.

NFTs may just be starting to revolutionise the gaming, music and collectible industry, and could be a permanent feature and a new way of exchanging collectible assets and monitoring individual ownership.

As with all new technology, initial excitement and price rises could be followed by a period of falling prices and stagnation as real adoption catches up. This happened with the internet bubble that ended in 2000 and was followed by an 80% price fall before ‘dot com’ shares started to rise again.

How do I invest in NFTs?

If you’re looking for ways to invest in NFTs, you’ll need to become familiar with cryptocurrency and need to own it in a digital wallet. You can use platforms like CoinJar, Coinspot or Independent Reserve to purchase Ethereum which can be used as currency for NFTs.

Then, there are many platforms that facilitate the NFT marketplace such as OpenSea, Rarible, Nifty Gateway and Mintable. These marketplaces trade different types of art and collectables. You could also have a more specific NFT platform like NBA Top Shot. Just pay attention to the fees you are paying as some platforms can charge up to 3% in transaction costs.

Should I invest in NFTs?

There’s a wide range of reasons people are attracted to invest in NFTs. People may want to collect NFTs for emotional reasons (social status), or the prospect of re-selling it for a higher price based on the current excitement and momentum.

Like with any speculative investment, you should limit your position size for this exposure to only be a small part of your overall investment portfolio. To do this, you could design your investment portfolio into two buckets: “core” and “explore.”

The “core” part of your portfolios could account for 90% of your investable portfolio which should be in a diversified low cost portfolio of ETFs covering shares, bonds and gold, like Stockspot’s strategies. The other 10% (the “explore” part) could be invested in more speculative or ‘fun’ investments. These are investments you might be passionate about, or just want to learn more about – but you need to be willing to accept substantial losses too.

If the past is anything to go by, the best time to buy speculative investments is ahead of the masses getting involved (which is hard to predict), or after the masses have given up. An example of this is technology shares, which fell 80% after 2000, or Bitcoin which fell 85% after 2017. In the same way, patient investors may have a second chance to buy NFTs once the early adopter excitement has faded.