There’s nothing quite like a crisis to bring out the superhero in all of us – especially investing superheroes.

So, which one were you in the first half of 2020?

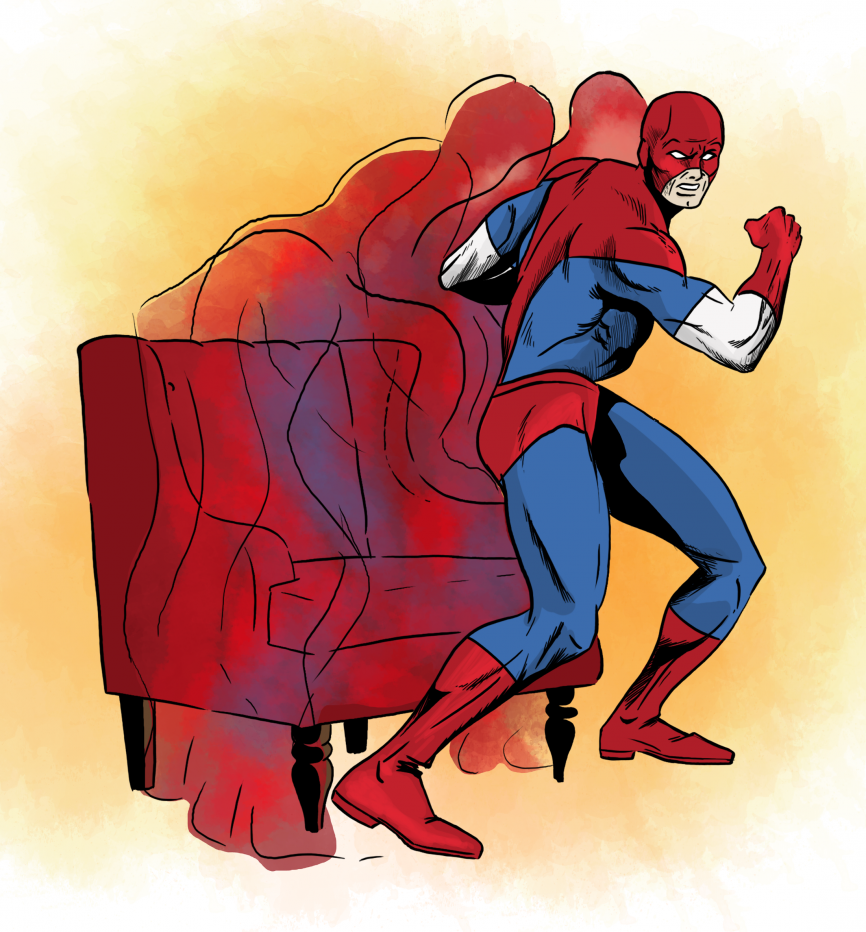

1. Captain Panicker

AKA The One Who Over-Prepared

Sold out of all investments in March as the market was free-falling. Stocked up on 96 rolls of toilet paper. Gloated to family and friends about correctly predicting the market crash. Forgot to buy back in. Missed the market’s 35% rally. Now not sure whether buy back or stay in cash. Hasn’t decided how to break it to the family yet. Down to 81 rolls of TP.

Superpower: X-Ray Vision. Ready to pull the trigger at the first sign of market volatility.

Weakness: Knows they shouldn’t be trying to time the market, but does anyway.

Tips for even more power: Resist the temptation to sell. Market corrections present a better opportunity to invest.

2. The Ever-changing Expert

AKA The Armchair Economist

Became obsessed with the COVID-19 data, charts, and media updates. Could recite the R0 in each city and state and would regularly do so to anyone who would listen. Stocked up on surgical masks. Was convinced we were heading towards a financial depression. Has now shifted focus to the RBA and Federal Reserve’s bond buying program and the implications of Modern Monetary Theory (MMT).

Superpower: Shapeshifting. Able to quickly shift so that they sound like an expert on any topic.

Weakness: Struggles to explain how they have still underperformed the market index every year.

Tips for even more power: Understand why markets can go up even when the data is ugly.

3. Day-Trayda

AKA The Part Time Day-Trader

Discovered the share market when their Sportsbet account started offering the ability to bet on the ASX. Decided to give it a try in the absence of NRL same game multis. Purchased a second computer screen with Jobseeker money to monitor their trading account and updates from investing mentor, Dave Portnoy. Has recently found success in an investment strategy based on pulling scrabble tiles from a bag. Finally clawing back some of their cryptocurrency losses from 2018.

Superpower: Invincibility.

Weakness: Oil futures, companies in receivership, 10:1 leverage, the ‘BUY HOLD SELL’ TV segment.

Tips for even more power: Here are five tips…but we fear for this group. The way to learn may be to lose money.

I’m sure Warren Buffet’s a nice guy, but when it comes to stocks, he’s washed up.

Day-Trada

4. The Zen Master.

Also known as The Still One.

Kept a balanced portfolio of low cost index funds through the crisis. Continued to regularly invest to dollar cost average. Automatically rebalanced out of some defensive assets into shares at the end of March. Ignored the advice to sell everything from Early Panickers. Ignored investment advice from the Everchanging Expert, knowing that anything they said was probably already in the price. Ignored stock tips from Daytraders knowing that they will almost certainly lose their pants at some point. Like Bruce Lee, the Zen Master did well by being like water.

Superpower: Invisibility.

Weakness: Sometimes fails to protect their family and friends from the shiny allure of Captain Panicker, Day-Trayda, and The Ever-changing Expert.

Tips for even more power: Stay away from financial charlatans who sell stock picking and market timing to uninformed citizens.

The successful warrior is the average man, with laser-like focus.

– Bruce Lee