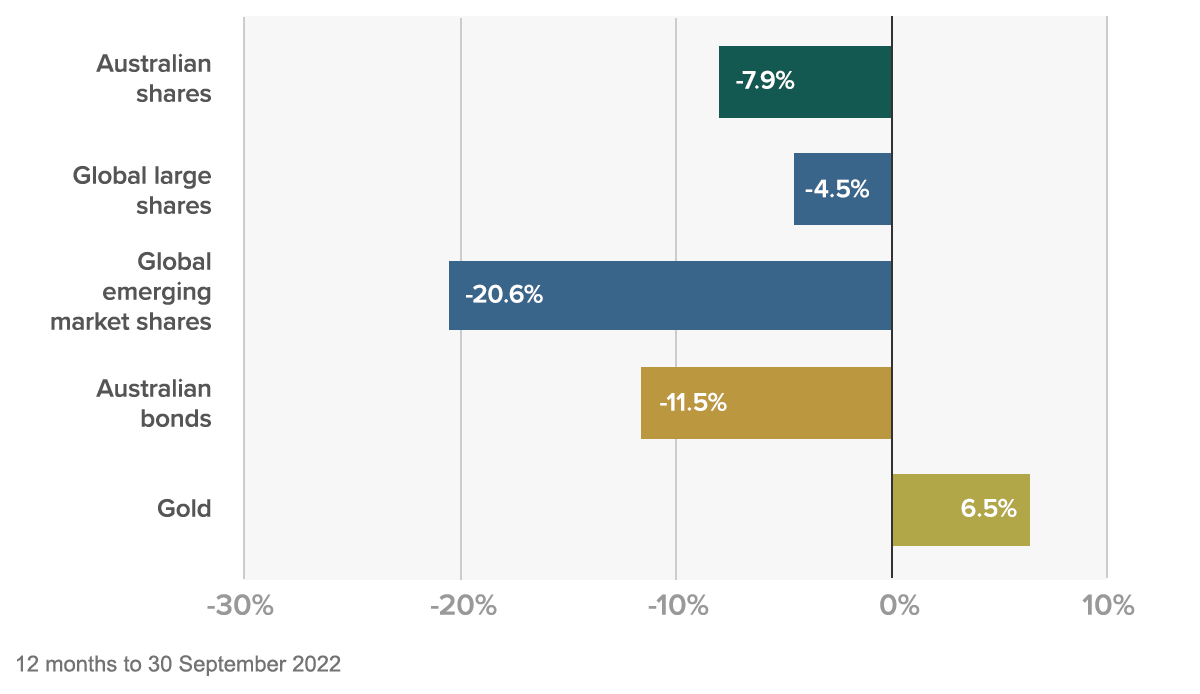

With three months to go, 2022 is shaping up to be a dreadful year on the markets.

This could be the first time in history that both the Australian share market and 10-year Australian government bonds both fall by over 10% in a year.

If you’ve held on through this period of uncertainty and kept investing into low-cost ETFs, you ought to be commended. Not only have you outperformed the majority of active investors, day traders and professional money managers, you’ve also survived an extremely rare market event.

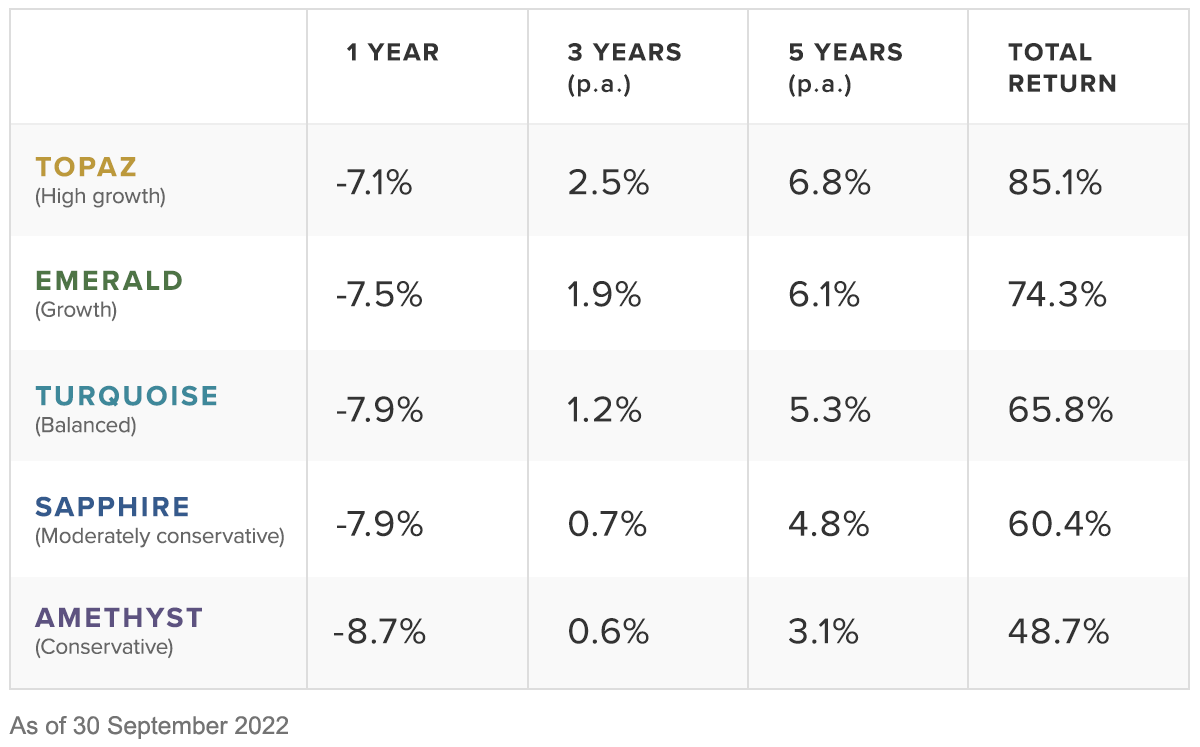

Despite a negative 12 months, the Stockspot Model Portfolios have continued to outperform at least 92% of similar diversified funds over five years with returns of 3.1% p.a. to 6.8% p.a. after fees.

Investor optimism is at an extreme

The latest weekly data from the American Association of Individual Investors (AAII) showed the percentage of individual investors who are positive about short-term market expectations at very depressed levels (20.4%). This reading hasn’t been lower since the global financial crisis and is the fourth lowest reading ever.

Extremes in negative sentiment tend to be a good contrarian indicator for share market returns.

The more extreme the pessimism the greater the performance over the next year.

There have been 21 occasions of extreme pessimism over the last 35 years where sentiment has been similar to today. The average 1 year return from those points in time was +11.5%.

This illustrates Warren Buffet’s famous quip from his 1986 Chairman’s letter to shareholders:

“Be fearful when others are greedy, and greedy when others are fearful.”

Sometimes sentiment is already so negative that markets rise simply because the bad news is already anticipated. This is why our advice is to keep investing even when the economic news seems dire.

Investing in the current environment

Markets will continue to be volatile as investors grapple with the impact of higher inflation and higher interest rates on asset prices. The benefit of being well-diversified and having a long-term investment time horizon is that you continue to benefit from growth and dividends without having to check your portfolio daily.

S&P recently released their latest research into fund manager performance. Not surprisingly, the research has again found that most active funds underperform an index, with that underperformance worsening over time.

In the first half of 2022, 50% of Australian share fund managers underperformed the index. Over five years that number increases to 83%. The longer you plan to invest, the better off you are from indexing.

This is why we believe the safest approach for investing is to stick with low cost ETFs regardless of whether markets are going up, down or sideways over the short-term.