For the tenth time in eleven years, all Stockspot portfolios delivered positive returns in 2024.

Over the 12 months to 31 December 2024, the Stockspot Model Portfolios achieved strong after-fee returns of 14.4% to 19.0%.

Over the past decade, our model portfolios have outperformed 330 out of 331 comparable diversified funds (99.6%)^

The Stockspot Sustainable Portfolios delivered strong after-fee returns of 16.6% to 20.9% in 2024. These higher returns were largely driven by the continued outperformance of technology stocks compared to resource shares.

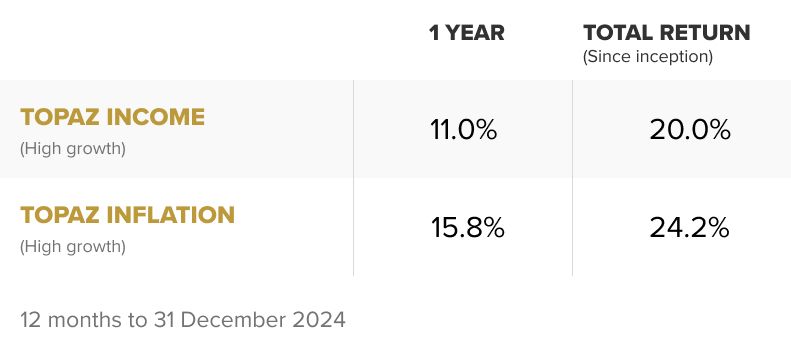

Our Topaz Income Portfolio and Topaz Inflation Portfolio delivered returns of 11.0% and 15.8% respectively over 12 months.

When should you go against the crowd when investing?

Something I’ve noticed about markets is that they have a way of tricking the crowd. Consensus doesn’t have to be wrong, but when sentiment is overwhelmingly positive, that optimism is usually priced in. At that point the incremental buyers – the fuel for further gains – may have run out. Markets don’t need bad news to fall; sometimes they just run out of good news or see expectations delayed.

Right now with the post-U.S. election and Trump inauguration buzz, I can’t remember a time when so many were convinced it’s a clear positive for markets, particularly U.S. shares. But what if this wave of optimism is met with a vacuum of good news over the next few months? Or if unseen negatives, like inflation or higher interest rates rear their heads in the face of this euphoria?

The market narrative is seductive, but when everyone’s bought into the same story it might be time to lean in the other direction.

This is why I believe systematic portfolio rebalancing, like we do at Stockspot, works so well. It’s not supposed to feel comfortable – in fact it’s designed to be hard. It means cutting risk when everyone else is adding, and adding when everyone else is cutting.

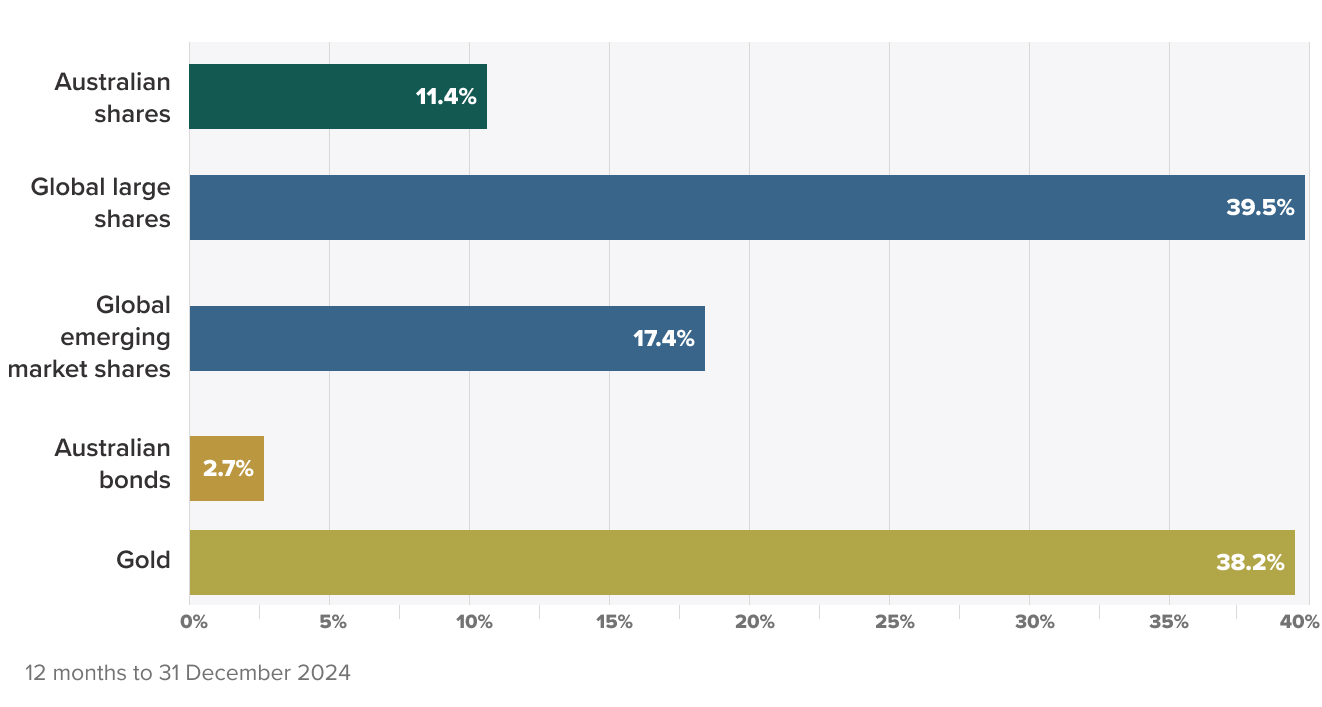

In recent months some Stockspot clients have asked why their portfolios have been rebalanced into government bonds, given their modest 2.7% return last year compared to the impressive gains of 38.2% for gold and 39.5% for global shares. That very skepticism and the fact that bonds are so unloved right now is one of the strongest reasons to hold onto them in your portfolio.

Tech turbulence: the rise of DeepSeek

Tech shares have recently been shaken by the debut of DeepSeek, an AI model from a Chinese start-up that rivals ChatGPT and other U.S.-built models. What makes this story fascinating is the cost: the Chinese company reportedly trained their model for less than AU$10 million, compared to the hundreds of billions spent by U.S. tech giants.

This raises concerns that U.S. companies may have overinvested in AI chips and data centres. If demand weakens, it could mirror the early 2000s when tech spending plunged after Y2K, leading to a downturn in the U.S. economy.

Market predictions for 2025

A question I’m often asked is, “How do you think the markets will go this year?” The truth is, no one can predict markets with any level of certainty. Time and again, market analysts and commentators get it wrong. Last year for example, the average forecast for the end-of-year market level missed the mark by 18.8%!

That said, I recently shared a video with some anti-consensus market ideas for 2025 to highlight the importance of staying diversified across countries, currencies, and asset classes.

Exciting progress with Stockspot Super

Since launching Stockspot Super to clients late last year, we’ve already seen over $10 million in superannuation moved into the platform – and we’re excited to roll it out to the public soon!

Superannuation is one of the most important investments for your future. If you haven’t already, I encourage you to check your super and consider the benefits of an ETF-based approach. It could make a big difference to your long-term financial goals.

^Stockspot, morningstar.com.au comparison group of 331 surviving investment funds and their after-fee returns over the 10 years from 1 January 2015 up to 31 December 2024. Comparison is based on the after-fee returns of a Silver tier investment in either Stockspot Amethyst, Turquoise or Topaz portfolios (our most popular portfolio in each risk category) on the basis that they have similar exposure to growth assets to the moderate, balanced and growth multi-sector investment funds that have been compared. Past performance is no indication of future performance.