Ever looked at your bank account balance and wondered where all your money is going? If so you may have fallen victim to lifestyle inflation.

What is lifestyle inflation I hear you ask? It’s increasing your spending as your income rises. Like boiling a frog the change is gradual so it can easily go unnoticed until it’s too late.

One of the key drivers of lifestyle inflation is “keeping up with the Jones'”. This is when people begin to spend more money on items such as cars, boats or luxury holidays because those around them are doing it.

The people around you are likely to be spending a large majority of their income or are accruing debt to maintain that lifestyle. Australian household debt is among the highest in the world at 200% disposable income.

There are other more subtle ways lifestyle inflation can creep into your living. It could be your habit for fine dining and cocktail bars (not quite the same as the $4 happy hour beer you used to hunt down in your early 20s).

Or it could be the gym membership upgrade from your local council gym to the F45 around the corner. Taking an Uber every time instead of waiting for the bus. Paying an Airtasker to do something for you rather than working out how to do it yourself. You get the picture.

Income isn’t wealth

There’s an old saying that income ≠ wealth, and it’s true. If someone earning $300,000 has credit card debt and negative savings, they’re not wealthy.

There are plenty of sad stories of sports stars and celebrities who earned millions and declared bankruptcy because of insane spending habits.

Johnny Depp, who is reportedly in all sorts of fiscal trouble, allegedly paid $3 million to fire Hunter S. Thomspon’s ashes out of a cannon. A rather extravagant expense and a wonderful example of lifestyle inflation gone mad.

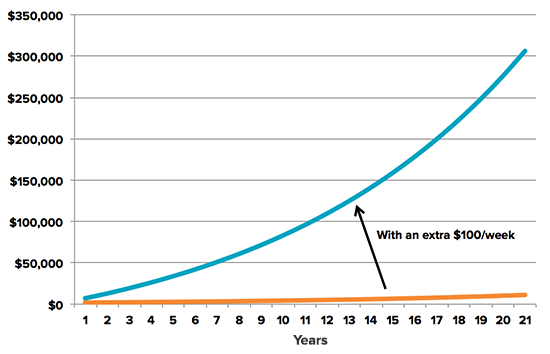

On the flipside someone earning $100,000 a year could be saving and investing say $100 per week by avoiding lifestyle inflation. That weekly $100 can turn into $300,000 thanks to the power of compound growth.

Assumes an initial amount of $2,000 at 9% total return per year

The good news? There are steps you can take to curb lifestyle inflation and get back onto the path of building wealth.

1. Track your spending

Just like many things in life, the first step is awareness. If you don’t know where and how much money you spend there’s no way you can take control of it.

Take a look at your spending for areas you can cut back on. Set limits for yourself on expenses each month that are realistic and achievable. Combine this with a regular review of spending to stay aware of any changing habits.

An easy way to do this is to make sure your spending comes out of a single account so you have a holistic view of your finances (making it easier to see total balance decreasing and drill down into specific areas where spend is increasing). We reviewed the best apps to help you budget and save.

2. Prioritise savings

The easiest way to avoid lifestyle inflation is to set aside a realistic amount of each paycheck to savings (or investments if you already have a rainy day fund).

Dependent on your personal situation, this could be anywhere from 5% – 50% of income. The more you can save the better and will help you build an investment portfolio that will grow and compound over time.

A practical tip to help achieve this is to set-up a direct debit out of your account as you get paid. This way the money isn’t available to spend even if you wanted to.

3. Invest your bonus / salary increases

Receiving a bonus or salary increase is the perfect time to start dollar cost averaging into investing. Why? This is money you didn’t spend beforehand and shouldn’t need for day-to-day expenses or savings.

Delayed gratification

Avoiding lifestyle inflation really just involves a change of mindset.

Start asking yourself the hard questions – do you really need the latest model phone? Would you be better off waiting until you don’t need to borrow money to upgrade your car?

Every dollar you save can help you build an investment portfolio that will grow and compound over time. Building wealth like this can help fund the lifestyle you want for much longer than just one year.

Stockspot makes it easy to grow your wealth and invest in your future.