Everyone learns trigonometry at school but very few people actually need to understand the angles in triangles.

On the other hand, the basic maths of money is something that can radically improve your life for the better.

With that in mind, here’s five basic financial lessons we think everyone should understand because they can have an enormous impact on your wealth, freedom and family.

1. Save more than you spend (budgeting)

One of the most important personal finance rules everyone should follow is to spend less than you earn. Spending more than you earn requires going into debt (or eating into any savings you may have). Both of these scenarios are not ideal for getting ahead!

The best way to ensure you save more than you spend is to set a budget. A common system that is easy to follow is to put your money into different ‘buckets’. This requires setting limits on how much to spend on different expenses each month (eg. $200/month for food, $500/month for rent).

Most importantly, everyone should always set aside money in savings for emergencies!

2. Avoid high cost borrowings

One of the biggest financial traps out there is high cost credit (borrowing). These commonly come in the form of credit cards or personal loans. According to Finder research, there’s over 16 million credit cards in Australia with the average balance being $3,273.

There’s also more modern versions of these including ‘buy now, pay later’ model offered by businesses like Afterpay and ZipMoney.

Simply put, borrowing allows us to bring forward our spending. This can be productive if you’re buying something like a house which is likely to increase in value over the long run.

Credit is easy to access for most Australians and can be extremely tempting. This can often encourage reckless spending in a culture that encourages consumption beyond your means. On the flip side, when managed properly using credit can have perks (eg. credit card rewards points).

However getting the benefits requires you to be disciplined and pay it back each month so you’re not paying interest. Credit card companies rely on people paying late to reward those who don’t.

If you’re considering a credit arrangement it’s important to look into the conditions. These conditions dictate the ‘cost’ of the money. When do you need to pay it back by? What is the interest rate? When are the payments due?

Here are the best ways of dealing with a credit card debt

3. The power of investing

Now that you’re saving more than your spending, you may ask the question: what do I do with my savings? You can leave your money in a savings account although it’s likely this isn’t going to give you great returns.

Investing is the key to making your money work for you. It may seem confusing and risky at first but with the right strategy and advice investing doesn’t need to be daunting.

The key to successful investing is having discipline with what you’ve got (it doesn’t need to be a lot!). If you save more than you spend you can build up your investments which will compound nicely over time.

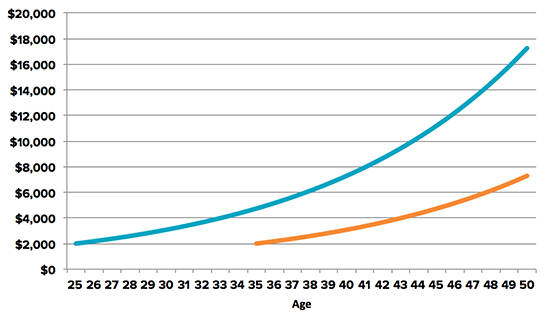

The earlier you start the better off you’ll be. By investing $2,000 ten years earlier you could double the money you have by age 50.

Assumes an initial amount of $2,000 at 9% return per year.

4. Compound effect

They say compound returns are one of the wonders of the universe…

So what is ‘compounding’? When you invest for the long-term you can generate returns on your initial investment and the profits you’ve already made.

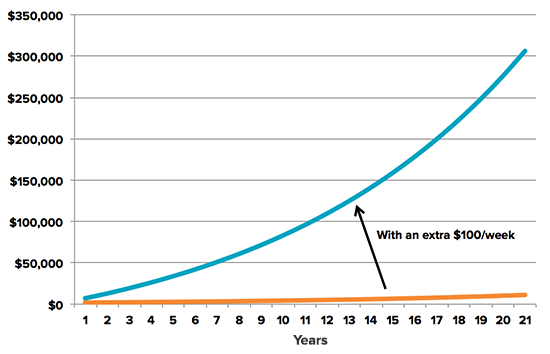

As your returns increase it snowballs over time and your total investment builds in size. You can also magnify the compound effect by combining it with a ‘dollar cost averaging’ strategy. By investing an extra $100 per week over 20 years your final balance can be enormously different.

Assumes an initial amount of $2,000 at 9% return per year.

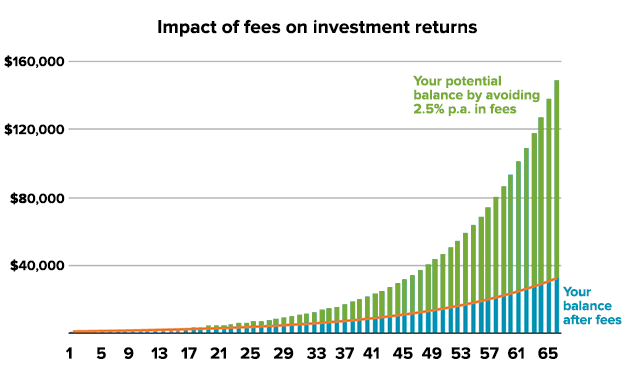

Compounding also works against you when you invest in something with high fees. If you invest $1,000 over 65 years in a portfolio returning 8% per year you would end up with $148,780.

By paying just 2.5% per year in fees (e.g. brokerage, subscriptions, fund manager fees), your final balance would be reduced by 75%! Avoiding high fees is crucial to benefit from the power of compound growth.

5. Superannuation

Superannuation is an investment fund for your retirement that is compulsory for all working Australians. The money you accumulate in super can’t be touched until you reach retirement age.

Each time you’re paid your employer contributes a percentage of your pay (currently 9.5%) to this account (you can also top-up with extra money if you choose to).

There are lots of options when choosing a superannuation fund, so it’s important to know what to what to look for to find the right one for you. There are two key areas to focus on:

Step 1: Find the right type of fund based on your capacity to take risk

The balance between risk and return should be the main consideration when working out the right the mix of different investments in your super fund. The younger you are, the greater amount of market risk you can take so the more shares and property you can own.

Growth assets (typically shares and property) have the potential for higher returns over the long-run, however they come with a higher risk of negative returns in the short run.

Defensive assets (bonds and cash) provide more steady returns and help to cushion periods of negative share market returns when share markets dip.

Step 2: Choose the fund with the lowest costs

You can’t control how markets perform, but you can control how much you pay for the management of your money.

The smaller that cost, the greater your share of the investment’s return. We find in our Fat Cat Funds Report that many Millennials paying 1.5% per year or more in super fund fees are likely to lose over $200,000 in their lifetime due to unnecessarily high fees – that’s the equivalent of the latest Tesla Roadster.

Our research over the last six years shows funds that charge less than 0.75% p.a. perform better in the long-term.

Stockspot makes it easy to grow your wealth and invest in your future.