The major party leaders in Australia and the US all adopt very different investment strategies for their own personal wealth.

We’ve analysed the investment strategies of Malcolm Turnbull, Bill Shorten, Hillary Clinton and Donald Trump to reveal whose approach is best suited to everyday investors.

Australia

Malcolm Turnbull

Estimated net worth: $186 million

Investment strategy: ETFs, thematic investments

Mr Turnbull proved his money making prowess and penchant for technology investments several decades ago. His significant wealth stems from smart investments made in the 1990s and early 2000s, including a $450,000 investment in OzEmail that turned into $59 million and the sale of his boutique investment bank Turnbull & Partners to Goldman Sachs in 1997.

After some big successes, Turnbull has focused on spreading his risk across different investments which now include Potts Point property, shares, ETFs (exchange traded funds) and a select number of managed funds.

In 2013, Mr Turnbull exited most of his direct share investments, preferring to keep a core portfolios of ETFs. The PM’s portfolio is now focused in on diversified ETFs with global stocks and corporate bonds.

Mr Turnbull has also added ETF exposure to Japanese shares, dividend shares and tech stocks – a view on the countries and sectors he expects to perform well over the coming years.

Stockspot’s view

We reckon the PM has it sorted. ETFs passively track index like the ASX, freeing up his time to run the country. There’s little to fault about Mr Turnbull’s portfolio from an investment perspective. It’s broadly diversified, relatively low cost and provides him with exposure to market themes like dividend shares.

Pros

Turnbull’s portfolio resembles a core-satellite approach – consisting of majority broad ETFs along with some thematic ETFs and boutique fund managers. The ETFs save the PM time so he’s not sitting at home picking stocks when he should be watching over the country.

The ETFs also remove (real or perceived) conflicts of interest which is helpful for a PM under public scrutiny. They give him exposure to thousands of shares and bonds from Australia and around the world to help keep building his wealth.

Cons

Turnbull employs a US financial adviser, so not only is he is sending jobs overseas, but is probably paying hundreds of thousands (if not millions) of dollars each year for advice on his portfolio.

Considering he’s very keen on jobs and growth we think he should set an example and keep the financial advice jobs in Australia. We would be very happy to manage his ETF portfolio for a fraction of the cost of his adviser.

Bill Shorten

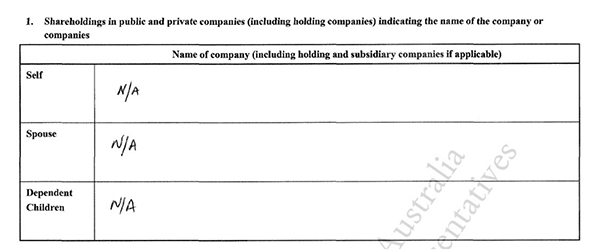

Estimated net worth: Less than $2 million

Investment strategy: none

Mr Shorten’s approach is similar to many Australians who chose to not invest at all outside of their super. Apart from cash, some Westpac shares owned by his wife, and his family home in Moonee Ponds, his investment strategy is notably bare. Being time poor he has preferred to leave his savings in cash and his family home rather than invest in a portfolio of shares and bonds.

Stockspot’s view

Perhaps he’s strategically not invested so he’ll never be called out on conflicts of interest. However since 28 of Shortens 100 Positive Policies are related to investing in healthcare – he could start ticking them off by investing in the Healthcare ETF (IXJ).

In a single trade he would be throwing his support behind 100 healthcare businesses including CSL, Ramsay Healthcare and Cochlear. It would also help him tax-deduct all of those laboratory photo-opp visits.

Pros

With no investments, he’ll never need to worry being called the Member for Net Worth.

Cons

Mr Shorten’s savings are going backwards. Without an investment portfolio it’s likely his savings are growing slower than inflation – so he’ll need to hope that the parliamentary pension keeps rising.

United States

Hillary Clinton

Estimated net worth: US$31 million (US$111 million including Bill Clinton’s estimated $80 million)

Investment strategy: Low cost index funds, US focus

Like Malcolm Turnbull, Clinton has chosen the diversified, low-cost option. Her only reported investment in 2016 is a Vanguard index fund which tracks the S&P 500 Index. She and Bill Clinton have approximately US$5 million invested in the fund and otherwise only hold cash and life insurance policies.

Stockspot’s view

Clinton gets top marks for a diversified, relatively low risk long-term approach, but she lacks diversity. She has faith in US shares performing well (maybe she knows something about the US economy we don’t?) but if they go into a period of underperformance her portfolio will suffer.

Pros

Clinton ticks the box for having a low-cost portfolio, and she’s follows the strategy that her good friend Warren Buffett recommends.

Cons

Clinton’s portfolio lacks diversification. Where are the international shares or bonds? As a result of being US focused, her portfolio also generates relatively little income – about 2% or US$100,000 per year. We’re not sure that’s enough to support her and Bill’s lifestyle should she not win office in November.

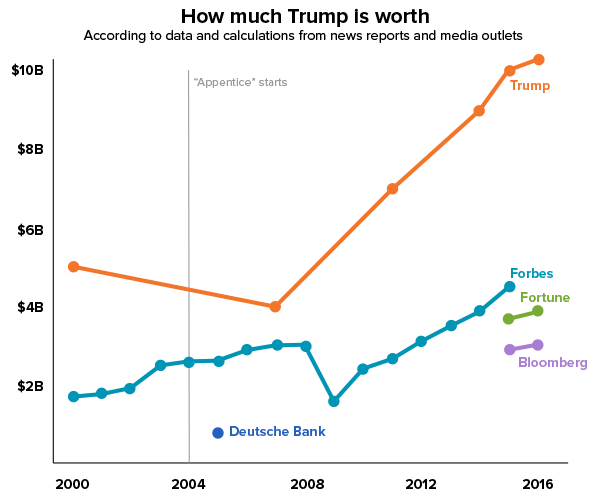

Donald Trump

Estimated net worth: US$3 billion (Bloomberg) to US$10 billion (Trump’s own estimate*)

Investment strategy: Leveraged property

Mr Trump’s net worth has been debated for decades, although the one constant is that his own estimate has always been higher than everybody else’s.

Since becoming a presidential candidate, he has repeated his assertion that he’s worth more than $10 billion, which he claims is proof of his business prowess. In his estimate he includes a US$3 billion value that he has put on the value of his own name as a brand.

Source: Washington Post

Trump’s investment strategy stands in stark contrast to Clinton’s. His last financial report from July of 2015, showed that he had US$27.6 million in a Blackrock hedge fund. This fund charges a 1% annual fee plus 20% of the profits, compared to the tiny 0.05% charged by Hillary’s Vanguard’s fund. His other holdings include $1-5 million in three other small hedge funds.

All up however, Trump’s managed funds make up less than 3% of his net worth. The much larger majority of his money is tied up in US real estate and resorts, which carry about $630 million worth of debt. Any fall in his property values would have a significant impact on his net worth due to financial leverage.

Stockspot’s view

Trump’s penchant for bricks and mortar investments may explain why he wants to build a very big wall… but regardless of what you think of his politics, you probably don’t want to follow his lead in investing unless you have the luxury of very deep pockets and a very long term time horizon.

He has probably been lucky to not have more troubles given he’s highly leveraged (lots of debt) and highly concentrated in US property.

Pros

Trump has done well to stay solvent (avoid bankruptcy) while taking huge, concentrated bets on property using debt. Australian homeowners have more in common with Trump than perhaps they’d like to admit.

Many have followed a similar strategy over the past 30 years and owe most of the growth in their personal wealth to long-term property price growth.

Cons

Ironically, if Trump was more like Hillary Clinton and followed her strategy he would have even more money! Trump’s net worth has grown about 250% since 1987 but if he’d invested in a single index fund in 1988, his net worth would be as much as $13 billion.

It shows how difficult it is to outperform the market over the long-term, regardless of how great a businessperson you claim to be.

Verdict

Politician’s public personalities clearly translate into their investment decisions. Trump’s approach is very high-risk and insists on being noticed whether you want to or not.

Hillary Clinton’s is simple and sensible. Bill Shorten has taken a different approach altogether – preferring, like a lot of people, not to invest at all. Whereas Malcolm Turnbull is tactical with his portfolio and he uses it to express views views on different sectors of the economy.

We think Mr Turnbull’s style of investing in passive ETFs combined with Hillary Clinton’s focus on keeping fees low is the approach most Australian’s would do well to follow. But, of course, we’re biased since all of our clients follow a similar strategy.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.

Malcolm Turnbull image: Ash Carter via Flickr

Bill Shorten image: Takver via Flickr

Hillary Clinton and Donald Trump images: Marc Nozell via Flickr