There are now over 400 ETFs listed in Australia. New themes appear every week: hydrogen, defence, robotics, even water scarcity. Choice is great, until it becomes overwhelming. More choice often leads to second guessing, and second guessing usually hurts long term results.

This guide cuts through the noise and shows how to pick good ETFs on the ASX, focusing on low cost, broadly diversified, transparent ETFs, you can hold for the long term.

Why simplicity works for ETF investors

Simple portfolios built from broad, low-cost ETFs give investors the best chance of long-term success. This is our message at Stockspot, and it has stayed the same since the day we opened 12 years ago. You don’t need to chase every new launch or theme. The core benefits of a focused ETF approach are:

- Low cost: Fees (MERs) compound against returns – keep them low.

- Diversification: Broad ETFs spread risk across markets and sectors.

- Transparency: Index rules are clear and trackable.

- Scale: Larger funds typically have tighter spreads and more liquidity.

Traits of good ETFs

Good ETFs are also far easier to recognise than people think. They share clear traits, when assessing any ETF, ask:

Cost and fees

Look at the MER (management expense ratio) and trading spreads. Lower is usually better for long-term investors.

Index coverage

Does the ETF track a broad, well-constructed index (e.g., ASX 200, MSCI World, Bloomberg Global Aggregate)? Broad coverage reduces single-name and single-sector risk.

Liquidity and scale

Funds with more assets under management (AUM) tend to have smaller bid/ask spreads and better execution.

Transparency and tracking error

How closely does the ETF track its index (tracking error)? Look at historical tracking performance and how they implement the index (physical, synthetic).

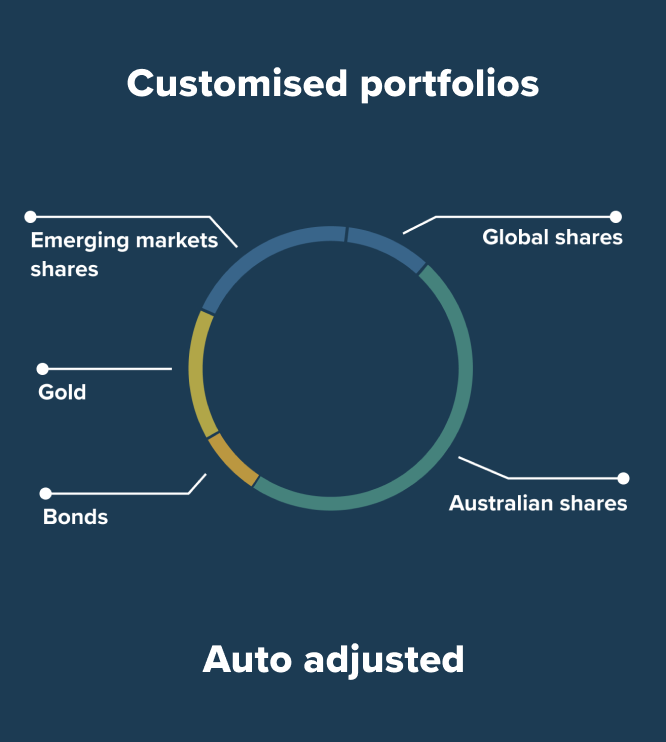

How to build a simple five-ETF core portfolio

We recommend a small set of core ETFs that cover major asset classes. The idea: own broad exposures, weight them by risk profile, and rebalance periodically.

Example core building blocks (by exposure)

The 5 core ETFs we recommend haven’t changed in years. They have survived bull markets and shocks. COVID. Inflation spikes. Currency swings. Tech booms. Gold rallies. And the slow grind of bear markets. They have done what they were built to do and have helped our five core model portfolios outperform all diversified funds in Australia over the last decade, based on the comparison group we have tracked since 2015.

| Exposure | ETF Example (type) | Why it belongs in a core portfolio |

| Australian shares | ASX: VAS – Vanguard Australian Shares Index ETF | Home bias, dividends, local market exposure |

| Global shares (ex Australia) | ASX: IOO – iShares Global 100 ETF | Access to global growth and diversification |

| Emerging markets | ASX: IEM – iShares MSCI Emerging Markets ETF | Higher growth potential, higher volatility |

| Fixed income / bonds | ASX: IAF – iShares Core Composite Bond ETF | Reduce portfolio volatility and provide income |

| Gold or defensive exposure | ASX: GOLD – Global X Physical Gold | Inflation hedge / uncorrelated asset |

How many ETFs do you really need?

For most investors a compact “core” of 3–7 ETFs is enough. The goal is to capture the major drivers of returns: equities, bonds, and perhaps a small defensive allocation such as gold, rather than dozens of niche themes.

Holding through volatility: the real challenge

Buying a sensible ETF is easy. Keeping it during market downturns is hard. Discipline matters: stick to your allocation, rebalance systematically, and add savings regularly. Avoid chasing thematic ETFs simply because of short-term headlines or “hot” performance.

Practical checklist when choosing ETFs

- Confirm the ETFs investment objective and index methodology.

- Compare MERs and total cost of ownership (fees + trading spreads).

- Check AUM and daily trading liquidity.

- Look for transparent holdings and reasonable tracking error history.

- Decide whether the ETF fills a unique role that your core portfolio needs.

Mistakes to avoid

- Chasing hot thematic ETFs without understanding rebalancing and fees.

- Over-concentration in a single sector or small number of holdings.

- Neglecting the effect of fees and turnover on long-term returns.

- Frequent trading that converts a buy-and-hold plan into speculation.

Keep the core, ignore the noise

Investing is already emotional. Markets wobble. Media commentary gets loud. Someone at work shares a tip. In those moments, having simple rules matters. You take the noise away. You stay focused on saving more. Keeping costs low and letting time and compound growth do the heavy lifting. Over decades, simplicity tends to beat gimmicks.

The rise in ETF listings doesn’t mean you must constantly upgrade. New products might be interesting – and some might even be useful around the edges. But broad ETFs that track major share markets, bonds and gold should remain the backbone. They capture global growth. They cushion downturns. They are reliable building blocks. They’re also the reason our portfolios have delivered for clients over many years.

Next steps: choose 3–7 core ETFs, set target weights, set a rebalancing rule, and automate contributions. This small amount of structure protects you from the biggest threat to returns: your own reaction to headlines.

Want help building a portfolio? Stockspot can help build and manage an ETF investment portfolio for you.

This article is adapted from my contribution to Livewire Markets Oulook Series originally published on 16 January 2026.