It’s something we’ve all done before… set New Year’s resolutions that only last a few days. Or, if you’re particularly dedicated, until 15 January.

Although we set goals with good intentions of following them through, we often don’t.

Why is it so challenging to stick to our goals?

The answer is actually hardwired in our habits.

Effective goal setting

If you’re looking to set a goal, timing is usually everything, as with most goals the sooner you start the better.

Even so, there can still be resistance. The goal is too big or perhaps a bit overwhelming, so you put it off.

This is where habits come into the mix. Effective goals (that actually last) come through small, incremental changes to our habits, chipping away, day by day so that it becomes routine and a normal part of our lives.

An excellent book on this subject is Atomic Habits by James Clear.

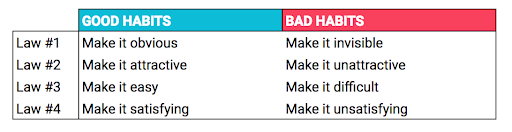

The book dives into the four laws of setting good habits (and breaking bad ones) which are 100% worth applying to any goal you set for yourself or others.

When it comes to money and good money habits, it’s all about making them easy – so you can take advantage of the enormous value of compounding returns. Which is both satisfying and attractive!

What’s one financial goal you want to work towards this year?

With the silly season over, and life somewhat normalised (COVID aside), it’s a good time of the year to map out at least one financial goal you want to work towards this year, and the habits that will support you getting there.

Some example goals are:

- Starting to invest and get your money growing

- Doubling down to save for a home deposit and spending less

- Smashing your credit card (or buy now pay later) debt

- Increasing your superannuation contributions and having more money for your retirement

- Negotiating a pay rise and knowing your worth

No matter your goal, break it down and focus on what habits you can use today, tomorrow, and consistently to get you there.

Looking for more tips to get ahead in 2022? Join this free live Masterclass next week with Meggie and myself. Register now.

Investing in 2022

With cost of living continuing to rise and interest rates still at rock bottom, investing some of your savings could be one of the most important goals you set for yourself this year, ensuring your money is growing ahead of inflation over the long-term.

Using an online adviser is the safe and sensible way to invest your money, ensuring you are well diversified, will stick to your investment plan, and pay low fees.

Investing habits setting you up for success

Once you start investing, there’s a few good habits that will help set you up for success.

Powering-up with top-ups

Regularly topping-up your portfolio is a simple, yet powerful, habit to boost your portfolio’s growth.

The chart below shows the benefit of topping a $20,000 diversified portfolio with $50 per week over 20 years, earning a 9% p.a. after fees, compared to not topping-up at all!

The difference is significant. You almost double your money through these small, consistent $50 top-ups over time.

Tip: Use the Stockspot Investment Calculator to see the power of top-ups and time in the market.

Automate whatever you can

Life is busy. So automate what you can.

Automation is the best way to help you manage your investing behaviour because you don’t need to think.

If you don’t have the discipline to manually manage top-ups, or you’re not likely to top-up when markets fall to take advantage of cheaper prices, automating top-ups is the best thing you can do.

Set your top-ups to auto-pilot and drip-feed money into your portfolio regularly.

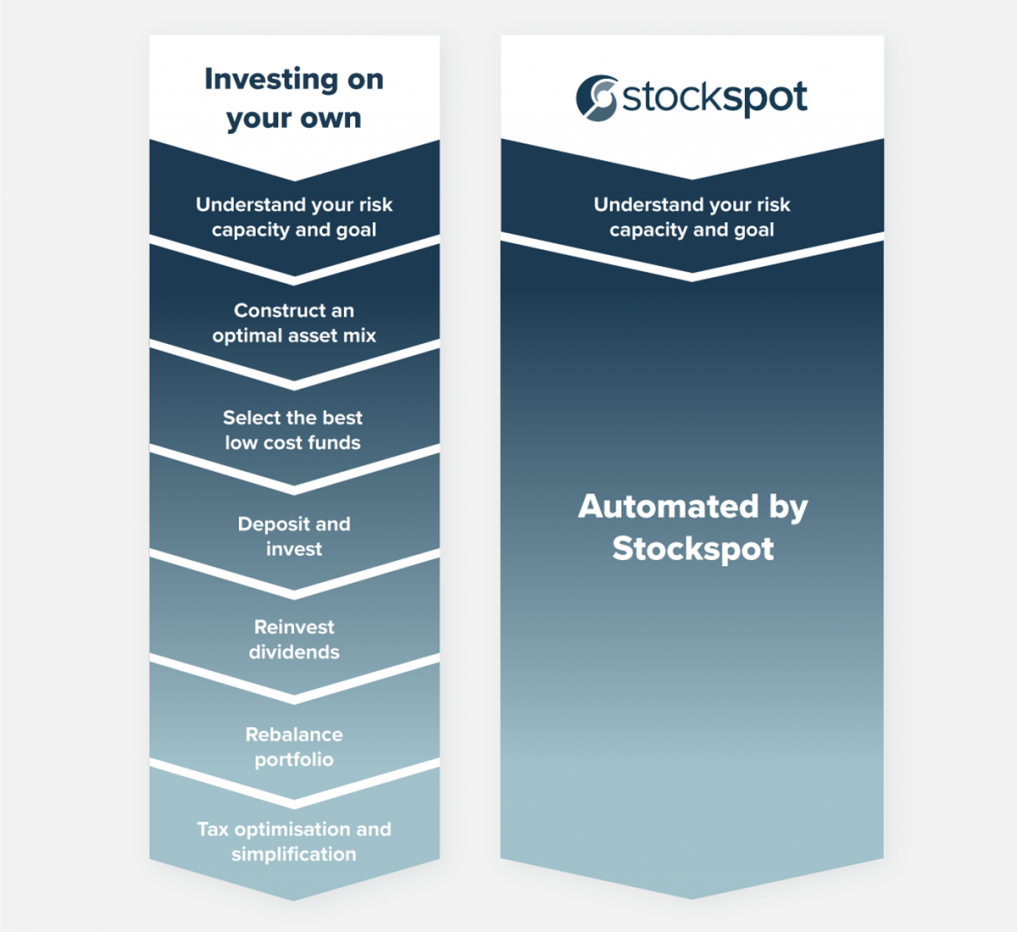

Stockspot also helps clients by automating everything, saving them time, money, effort, and stress, compared to a DIY (do-it-yourself) investment approach:

Keeping a long term mindset (for compound’s sake)

Maintaining a long-term mindset when you invest is essential. It’s healthy to remind yourself at the start of each year why you’re investing in the first place: what’s your goal?

It might be a home deposit, funds for your retirement, or money for your kids’ future.

The best thing you can do is stay invested for as long as possible to enjoy the benefit of compounding returns.

The examples below show the impact of compounding over longer periods of time. Showing the growth of $50,000 invested for five years, 10 years and 20 years earning 9% p.a. after fees.

The longer you stay invested the more powerful the compounding becomes, boosting the portfolio’s from $122,568 after 10 years (over double the initial investment) to $300,458 after 20 years (five times the initial investment).

When things get bumpy, sit tight and keep your eye on the prize.

Now that you know this, what’s one small thing you’ll do tomorrow to help you work towards your financial goals?

Talk with us

Our qualified investment advisers are here to help. If you have questions and would like to speak to an adviser, please get in touch.

All the best for 2022!