Australia’s small but passionate exchange-traded fund (ETF) community was in raptures last month as a big name from the investing industry was visiting from the United States.

Eric Balchunas, one of the best-regarded ETF analysts in the world, was visiting from his hometown of Philadelphia. And the Stockspot team had the honour of meeting him.

Eric is a senior ETF analyst at Bloomberg and the author of The Bogle Effect. The book is on businessman Jack Bogle, how he built the investment management company Vanguard into the behemoth it is today and the impact he had on the investment industry. Eric is also the co-creator of the Bloomberg podcast Trillions, a favourite amongst the Stockspot team.

Eric was in Australia as the keynote speaker at the Women in ETFs forum and panel discussion, The Bogle Effect: How the Rise of Passive is Changing Active. Stockspot’s very own Enid Lal joined the panel with other leading industry experts, discussing trends in the investment industry.

The Stockspot team had the privilege to sit down with Eric for a couple of hours over lunch. A gifted and charming speaker, here are the key lessons we learned from the ETF guru.

Vanguard’s push from high-cost to low-cost has saved investors trillions of dollars

John Bogle founded Vanguard in 1975 and was also credited with creating one of the first index funds. Today, Vanguard manages more than $10 trillion dollars and is considered a titan in the finance industry.

Eric explained how it wasn’t necessarily the movement from active to passive that caused the huge movement into index funds, but rather the shift from high-cost fees to low-cost fees pioneered by Vanguard. Eric explained, as recounted to him by Bogle, that the root of all problems for active funds is high fees, which are like termites that eat into your returns. Since Vanguard’s launch, fund fees across the industry have fallen. This has become known as The Bogle Effect.

I found this quote by Jack Bogle fascinating in summing up his quest to for low-cost index investing to become mainstream:

“The first sign that Vanguard’s mission has created a better world for the investor will be when our market share begins to erode.”

The majority of investors can beat professional investors by just investing in low-cost index funds, as evidenced by industry research such as S&P showing that over 80% of professional funds underperform an index. Stockspot’s low-cost portfolios mirror this research, outperforming more than 90% of fund managers.

In his book, Eric estimated that Vanguard’s low-cost model has created an industry that has saved investors trillions of dollars. He likens ETFs to MP3s. MP3s have revolutionised the music industry away from CDs. Similarly, ETFs have moved investors away from actively managed mutual funds.

ETFs are not slowing down anytime soon

Eric started covering ETFs in the early 2000s when the ETF industry only had a couple hundred million in assets. Today, the global ETF market has amassed more than $13 trillion in size.

Even though Eric was one of the sole analysts covering ETFs at the time, he strongly believed that the ETF structure would find its way into investors’ portfolios due to their low cost, tax efficiency and liquidity. This was the same vision our CEO, Chris Brycki, had when building Stockspot in 2013.

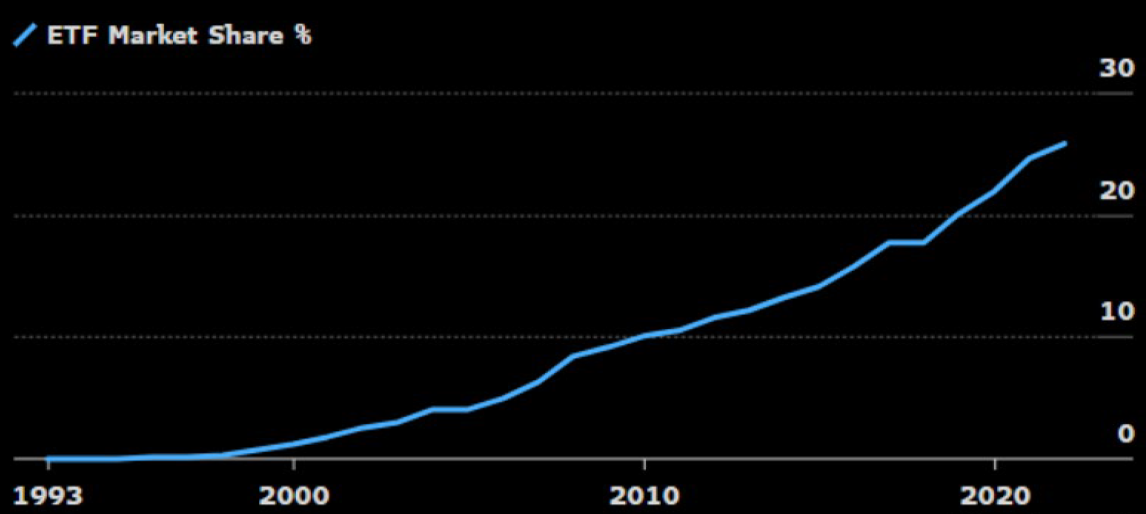

Eric was prescient about the explosive growth of ETFs. ETFs accounted for less than 2% of the total U.S. funds market in the early 2000s. Today, ETFs are more than 25%! He believes that ETFs will be more than 50% in the years ahead.

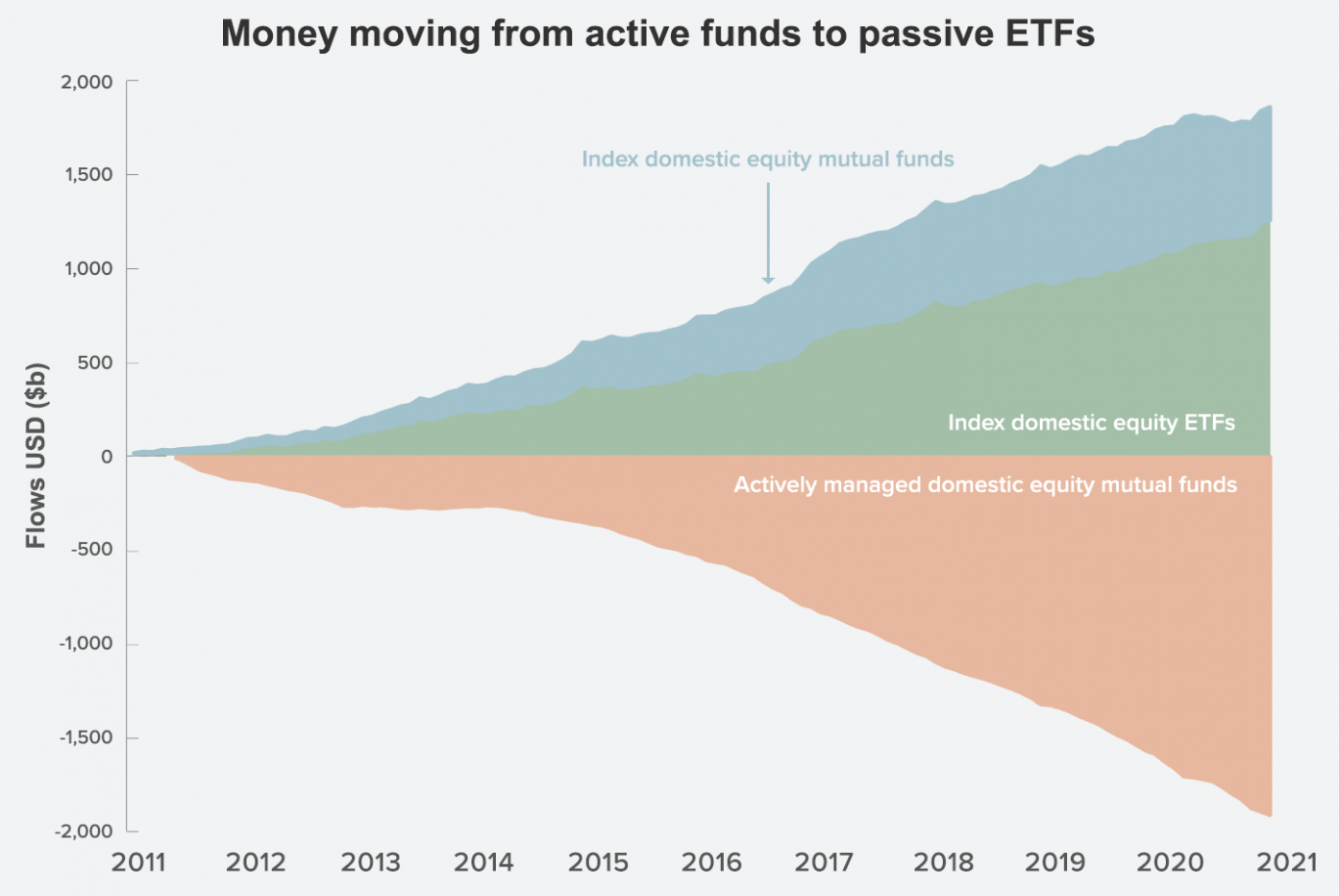

Our Stockspot ETF Research Report showed that ETF penetration was only at 4% in Australia in 2021, but is likely to follow the trajectory ETFs have experienced in the U.S. and Europe. Money continues to pour into low-cost funds such as ETFs, while many mutual and active funds continue to see strong outflows.

Eric highlighted that ETF growth accelerates during bear markets as investors will focus more on fees (given the lower market returns) and prioritise the ability to get in and out on a daily basis. Eric showed that even though the market was down, 2022 is on track for one of the biggest years in ETF flows and the highest year on record for ETF trading volume.

The art of doing nothing

Eric said that the modern-day investor portfolio is made up of 85% boring and passive low-cost funds and 15% of portfolios are in “hot sauce” assets (a metaphor he used to describe exciting and riskier investment options).

He emphasised that it’s okay to have a boring portfolio. This aligned nicely with Stockspot’s philosophy of “boring is brilliant”. Eric recounted stories of how Jack Bogle was surprised when he got invited back to investment conferences, despite him always exercising intellectual humility and responding to market prediction questions with “I don’t know”.

The ETF market has everything from the simple and vanilla products that Eric equates to being “safe for grandma” to all the shiny and riskier products like crypto ETFs. He acknowledged that humans will always want to chase exciting things, so he suggested a clever behavioural hack. If allocating a small part of your portfolio to riskier investments distracts you from touching the boring part of your portfolio, then it’s doing you a service to let the power of compounding work its magic.

Eric did acknowledge that some “hot sauce” ETFs are dangerous and investors should stay well clear. Our research has shown that many thematic ETFs either shut down or underperform after being launched. Investment themes go through phases, as Eric showed last year’s favourite – technology ETFs – have been overthrown this year by natural resources and energy ETFs.

The changing of the baton in investment themes also happens with investor psychology. Eric explained that the biggest issue facing investors in 2020/2021 was COVID-19. Now it’s inflation. Every year there’s a new issue faced or a new and exciting theme. Eric reiterated Stockspot’s message of the value of staying diversified and tuning out the noise in order to achieve good financial outcomes. As Eric said, the most disciplined investors are passive investors.

It was an honour to meet Eric. His visit strengthened Stockspot’s excitement about the future of the ETF market in Australia. We believe that ETFs are the perfect building blocks for our clients, allowing them to benefit from the power of low fees, tax efficiency, and consistent long-term returns.