Search the internet for “World’s most successful investors” and you’ll quickly notice a clear trend – very few women mentioned. But a growing body of research has found that women are in fact better suited to becoming successful long-term investors than men.

In 2013, a study found that hedge funds run by women returned 9.8% compared to 6.1% by men that year. A different US study of 750,000 portfolios in 2014 also found women earned higher median returns than men.

Plenty of stereotypes are used to explain this trend of superior performance by women – from men’s testosterone clouding their judgement to women being more calm under pressure.

To get to the bottom of this, we looked at our data to work out why women and men really invest their money differently and how this could lead to different results.

Women accept lower returns to avoid risk

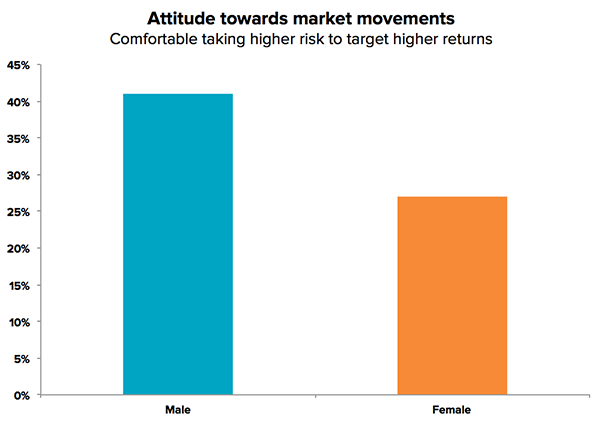

The first clear trend we noticed is that that our male clients are comfortable taking more risk. On the other hand, female clients prefer to be less exposed to market movements. Only 27% of our female clients are comfortable taking on more risk to target higher returns compared with 41% of our male clients.

On its own this would suggest that men should perform better over the long-term since they are more willing to make more risky and higher yielding investments. However since the data suggests this is not the case, there is probably a more important factor at play: confidence.

Men are overconfident

Confidence can be a good thing as it helps push you to act and make decisions that can help improve your investment outcomes. However, having too much confidence can mean you end up believing you have more control over short-term investment returns that you actually do.

In retrain our investment brain, we looked at how overconfidence in your own skills often means you end up chasing returns and over-trading. Our data suggests that overconfidence does impact men more than women when it comes to investing because men tend to act more often.

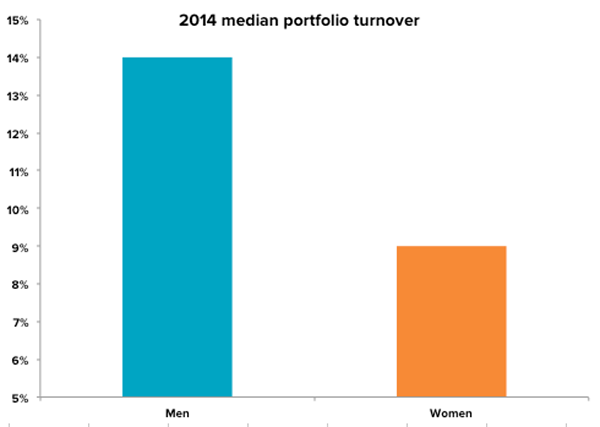

The US study that found women earn higher returns than men also identified a significant difference in portfolio turnover (how often investments in a portfolio are purchased and sold) between men and women. The median portfolio turnover for women was 9% per year compared to 14% for men.

Source: SigFig

Higher turnover means men incur extra costs and are more likely to be buying and selling at the wrong times because they are chasing returns. Both of these lead to worse performance than women.

Women underestimate themselves

Where men are too confident, many women lack investment confidence so avoid even sensible risk. A Merrill Lynch survey based on data from 11,500 personality quizzes found that 55% of the women questioned agreed or strongly agreed with the statement, “I know less than the average investor about financial markets and investing” compared with just 27% of the men.

As a result of feeling like they don’t know enough, women end up having a lower risk appetite and in many cases just leaving their savings in a cash account rather than investing.

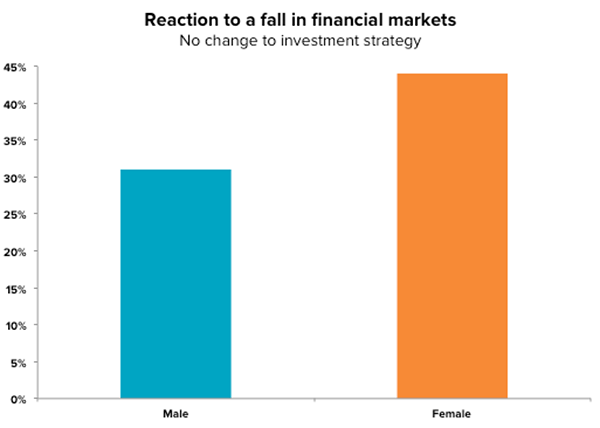

This is unfortunate because women who do invest tend to stick with their strategy and achieve good results. 44% of our female clients said they would stick to their investment plan if markets fell compared to 31% of men. Women are more disciplined long-term investors.

What men and women can learn from each-other

The good news is that by learning from each other’s good and bad habits, investors of both sexes can benefit. Men can learn from the discipline women have in not being tempted to change course, whereas women can take some investing confidence from men.

Both men and women can become great investors by sticking with a long-term strategy and having the right mix of investments based on their investment horizon and personal profile.

Automated investment services like ours help women be confident in taking a sensible level of risk, while at the same time preventing our male clients from the costly mistakes of trying to time the market or select individual stocks.

Find out how Stockspot makes it easy to grow your wealth and invest in your future.