Meet Rosie Wilson

Hi, I am Rosie, I’m from Adelaide, South Australia. I am an advanced behaviour support consultant and I specialise in working with young people who have experienced trauma and have a disability. I also run my own business (Make Life Rosie) where I provide clinical supervision for behaviour support consultants and develop mental health resources.

I love to travel and experience all the world has to offer and my daily workouts, long walks and pilates are my self-care.

Why I decided to trust Stockspot with my investment portfolio

I decided to trust Stockspot with my investment portfolio after a lot of research. It was important to me to find a platform that was simple, ethical and easy-to-use.

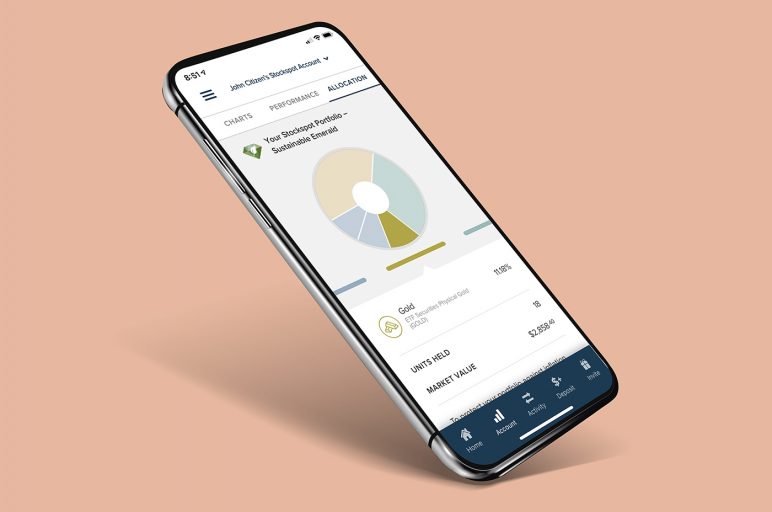

Stockspot ticked all those boxes and more – I loved the easy viewing education components on the platform and found the user system was both aesthetically pleasing, simple and explanatory. I loved that I could view my investments across my technology platforms, in a quick and efficient manner.

I am a ‘set and forget’ investor and so I love that Stockspot takes care of the diversification in my portfolio, with a long-term goal, as this allows me to completely forget about my investments – so long as I ensure there are recurring and consistent deposits – Stockspot does the rest.

The Stockspot sign up process

The sign up process was so simple and stress free.

I loved the way it helped me understand what my investing goals should be, whilst also explaining my options to me.

“I decided to trust Stockspot with my investment portfolio after a lot of research. It was important to me to find a platform that was simple, ethical and easy-to-use. Stockspot ticked all those boxes and more

My investing experience with Stockspot

My investing journey has been great so far and my goals are well and truly underway.

I initially started with a lump sum and I scheduled consistent and ongoing deposits every fortnight to ensure that I am setting myself up for the best compounding interest opportunities available to me.

My goals are long-term and early retirement – with the diversification of my Stockspot portfolio, I can see that my money is growing and safe and this was particularly evident throughout the COVID-19 recession.

What I like about Stockspot

There are a few things I like about Stockspot.

It truly couldn’t be easier and has been one of the best financial decisions I have made.

Other things I like are:

– The ease and simplicity

– The phone app and desktop access

– The ongoing communication and thorough education

– The diversification and the way I can simply ‘set and forget’.

My money tips for those thinking of investing

If you have savings and are hoping to grow those savings over the long-term, over time, then there is no worse time to do so in a savings account, than during this current climate.

Get educated around the interest rates in savings accounts versus diversified investment portfolios, look at the statistics that are available to you and get investing!

It will change the course of your life and the options available to you as you get older and want to retire.

My final words about investing

Just start. Start with whatever you have and continue with whatever you can, consistently, over time and automate it.